Balance Sheet Trends of Illinois and Wisconsin Community Banks

August 18, 2021

The U.S. economy surged to life over the summer, but uncertainty looms again with new strains of the COVID-19 virus. We want to provide analysis around the trends that have emerged through the first half of another unusual year by breaking down banking activity we have seen from our members in Illinois and Wisconsin. All statistics included relate to commercial banks, savings banks, and thrifts with less than $10 billion in total assets as of their Q2 2021 call, unless otherwise stated.

Loan and Deposit Behavior

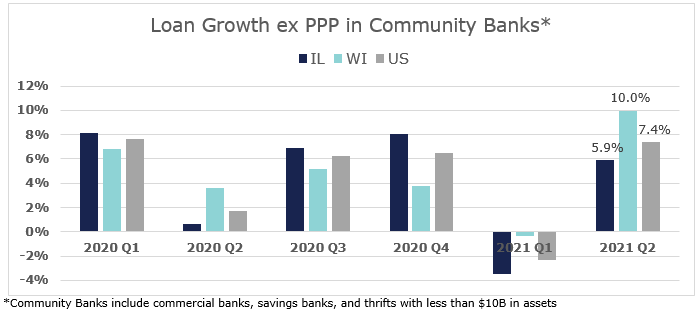

18 months into the COVID-19 pandemic, a flood of liquidity remains; driven by fiscal stimulus and easy money policy. Loan growth has been scarce while deposits have overwhelmed banks of all sizes, and community banks are no exception. The median Wisconsin bank carries a higher loan to deposit ratio than the median Illinois bank, a trend that has persisted. However, in the absence of stimulus checks or Paycheck Protection Program (PPP) funding, loan and deposit growth slowed in Q2. While top line loan growth remained muted, excluding the impact of PPP loan forgiveness, loan growth proved to be robust in Q2 as the economy opened, particularly in Wisconsin where the annualized loan growth grew to 10%.

Maintaining Margins

Deploying Excess Liquidity

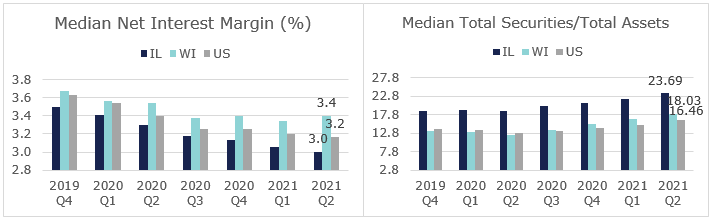

Excessive cash balances and low interest rates have strained margins at banks throughout the country. As deposits continue to grow, albeit at a slower pace in the second quarter, banks must remain diligent in deploying their excess liquidity. As seen below, the median Wisconsin member was able to expand margins in Q2, bucking the trend of compressing margins both nationally and for Illinois community banks. At the median, Wisconsin banks were able to keep cash balances relatively stable in 2021 even as deposits continue to grow. We can see that excess liquidity has been deployed into investment securities. The median bank in Illinois and Wisconsin each hold more securities as a percent of total assets than the median bank nationally. Q2 2021 is the high water mark for securities holdings for the median Illinois, Wisconsin, and U.S. bank, respectively.

Optimize Wholesale Funding

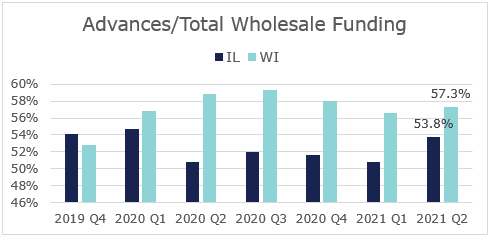

While wholesale funding continues to reduce at most banks, our members continue to find value in the flexibility, structure, and cost of advances. Advances as a percentage of wholesale funding grew in both Illinois and Wisconsin. Among community banks, aggregate advances were flat in Illinois and increased slightly in Wisconsin for the first time since Q2 2020. Members have found value in restructuring advances to reduce their cost of funds and negative all-in rate funding on short-term and putable advances when including the benefit of the Federal Home Loan Bank of Chicago’s (FHLBank Chicago’s) 5% dividend on activity stock.

Questions?

Please don’t hesitate to reach out to your Sales Director with any questions. Our FHLBank Chicago team is here to provide you and your organization the support and solutions you need in any economic environment.