Supporting the LIBOR Transition - Product Offerings

August 11, 2022

Key Takeaways

- The impact of a post-LIBOR environment

- Operational considerations for members

- Product offering supporting a post-LIBOR funding environment

The Impact of a Post-LIBOR Environment

The sunset of

the London Interbank Offered Rate (LIBOR) benchmark has introduced a unique

challenge and opportunity for our members as markets migrate to the preferred alternative

reference rate, the Secured Overnight Financing Rate (SOFR). The LIBOR

benchmark was linked to trillions of U.S. dollar denominated financial products

including loans, derivatives, interest rate swaps, and investments. While

banking institutions have stopped making new LIBOR-referenced loans at the start

of this year, the three-month, six-month, and one-year tenured LIBORs will

continue to be published. The swiftly arriving transition from LIBOR to SOFR reinforces

the need to orchestrate a significant operational and technological transformation

that is most certainly at the forefront of our members’ minds.

Operational Considerations

Our members

have prudently embarked on a significant planning process for the LIBOR

transition. Each transition plan has had to incorporate the unique

characteristics of their product offerings, portfolios, businesses and hedging

strategies, customers’ priorities, and industry sectors. In general, we have

found some key elements that are common to successful LIBOR transition

planning:

- Program structure and governance

- Assessment of impact and exposure

- Choice of new benchmark rates and product transition

- Contract remediation: legal review and fallbacks

- Client strategy and communications

- Systems and process changes

- Risk and valuation model changes

- New financial reporting, accounting, and tax implications

FHLBank Chicago’s Commitment to Supporting Members

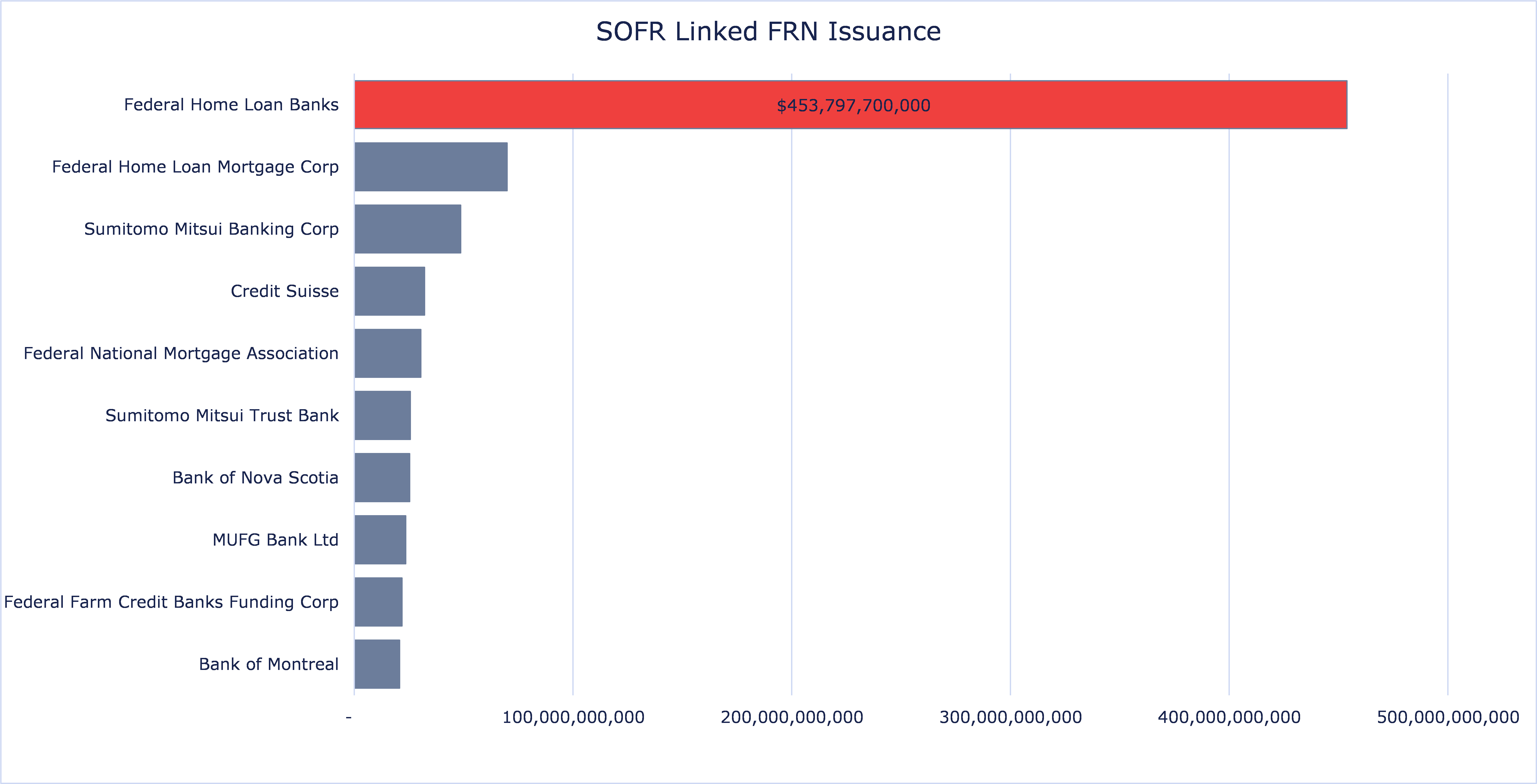

The FHLBank system is the largest issuer of SOFR-linked debt in the world, with this level of volume also comes knowledge as a trusted advisor to help support members in their transition from LIBOR to SOFR. Below is a visualization of the issuance of

SOFR-linked Floating Rate Notes (FRNs). The Federal Home Loan Bank System (FHLBank) has issued $453 billion or 60% of all SOFR-linked FRNs through July 2022.

FHLBank Chicago remains committed to helping members navigate the post-LIBOR environment and has been hard at work ensuring that our products support our members’ transition from LIBOR in a less than predictable rate environment. We will continue to serve member needs by providing solutions that are linked to SOFR, Fed Funds, or Overnight Indexed Swaps (OIS), while monitoring the market for key developments and trends ensuring that product development aligns with market conventions.

Product Offering Supporting a Post-LIBOR Funding Environment

Advance products linked to LIBOR were incorporated into a wide variety of financial strategies by our members. These floating rate advances have been used to fund floating rate loans, other assets, or to act as a balance sheet hedge. They are also used for liquidity needs and for asset sensitive balance sheets. Lastly, the optionality that FHLBank Chicago advances offer can be embedded via derivatives such as caps and floors can be used to hedge interest rate risk of various portfolios on member balance sheets.

- LIBOR-based advances have been replaced with Discount Note Floating Rate advances and SOFR floating rate advances.

- Prepayable LIBOR Floating Rate Advances have now been replaced by Callable SOFR advances and prepayable Discount Note Floating Rate Advances.

- FHLBank Chicago also transitioned the structure of the hedge from LIBOR to SOFR for Putable Fixed Rate advances and Floating to Fixed Putable advances to continue offering those products.

Coming soon, we plan to offer the Floating to Fixed Putable advance with an initial floating rate indexed to SOFR (currently available in OIS only), compound interest on the Callable SOFR Floating Rate advance, and reintroduce the Net Interest Margin (NIM) Protection advance, which allows for various caps and floors to be embedded within the advance. We continue to monitor the term SOFR markets and may plan to offer term SOFR products in the future based on member needs.

While in 2019, FHLBank Chicago stopped offering new LIBOR-linked advance products that matured after 2021, we have been hard at work converting LIBOR based products to SOFR based products as quickly as the nascent SOFR market allows. Below is a summary of our current and planned offerings. Current rate indications are available on the FHLBank Chicago Daily Rates sheet.

| Advance Product | Features | Current Status | Uses | |

|---|---|---|---|---|

| A123 Putable Fixed Rate | - Maturities of 2-days to 10-years - Lockout periods of 1 day or greater - European and Bermudan options | Available | - Fixed rate funding at lower cost | |

| A382 Discount Note Floater | - 4-week maturities: 28-days to 5-years - 13-week maturities: 91-days to 10-years - 26-week maturities: 182-days to 10-years - Index determined by weighted average discount note (DN) issuance to auction | Available | - Fund floating rate assets - Fund asset sensitive balance sheers and liquidity needs | |

| A300 SOFR Floater | - Maturities of 28-days to 10-years - Rate set at fixed spread to SOFR - One-time prepay option | Available | - Fund floating rate assets - Fund asset sensitive balance sheets and liquidity needs | |

| A370 Floating to Fixed Convertible | - Maturities of 1 to 10-years - Indexed to OIS - European and Bermudan options | Available | - Improving current NIM - Hedging against rising rates | |

| A380 Callable SOFR Floater | - Maturities of 28-days to 10-years - Rate set at fixed spread to SOFR - European and Bermudan options - Simple average interest | Available | - Fund floating rate assets - Fund asset sensitive balance sheers and liquidity needs | |

| A370 Floating to Fixed Convertible (SOFR) | - Maturities of 1 to 10-years - Indexed to SOFR - European and Bermudan options | 2022 | - Improving current NIM hedging against rising rates | |

| A380 Callable SOFR Floater w/ Compounding Interest | - Maturities of 28-days to 10-years - Rate set at fixed spread to SOFR - European and Bermudan options - Compounding interest | 2022 | - Fund floating rate assets - Fund asset sensitive balance sheers and liquidity needs | |

| SOFR Caps and Floor Options | - Options for SOFR Floating Rate advances - Market is currently developing | 2023 | - Hedge interest rate risk exposures | |

| A420 NIM Protection | - Currently in development | 2022 | - Hedge interest rate risk exposures without derivatives | |

| Term SOFR Advance | - Indexed to term SOFR | 2023 | - Fund floating rate assets fund asset sensitive balance sheets |

To Learn More

Contact your Sales Director or email membership@fhlbc.com if you want to learn more about advance strategies using alternative reference rates to lower your all-in cost of borrowing.

Contributors

| Cathy Kiriakos |

Looking for a printable version of this white paper? Download the PDF.

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis.

The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute

legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other

advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included,

and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which

are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s

periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked

sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content

and offerings presented on its website.

There are associated risks with options. Because the FHLBank Chicago owns the option to terminate the advance prior to final maturity, the actual duration of the advance may be significantly lower than the stated maturity of the advance. Likewise, the

FHLBank Chicago may not execute the put option, and the advance will be held to maturity in the case of falling interest rates. Contact your own accountants and attorneys before executing an A123 Putable Fixed Rate Advance.

Not all advance types are suitable for all members. Members must be aware of and understand the market and operational risks that are associated with advances with embedded options. Contact your accountants and attorneys before executing an advance with

embedded options. Certain advances such as those that contain call or put options, interest rate caps, collars or floors, or other rate, term, or payment variations may require the acknowledgement of or execution of disclosure statements in which

a member represents that it understands the risks associated with a particular advance.