Downpayment Plus and Downpayment Plus Advantage Program Benefits

February 9, 2022

Overview

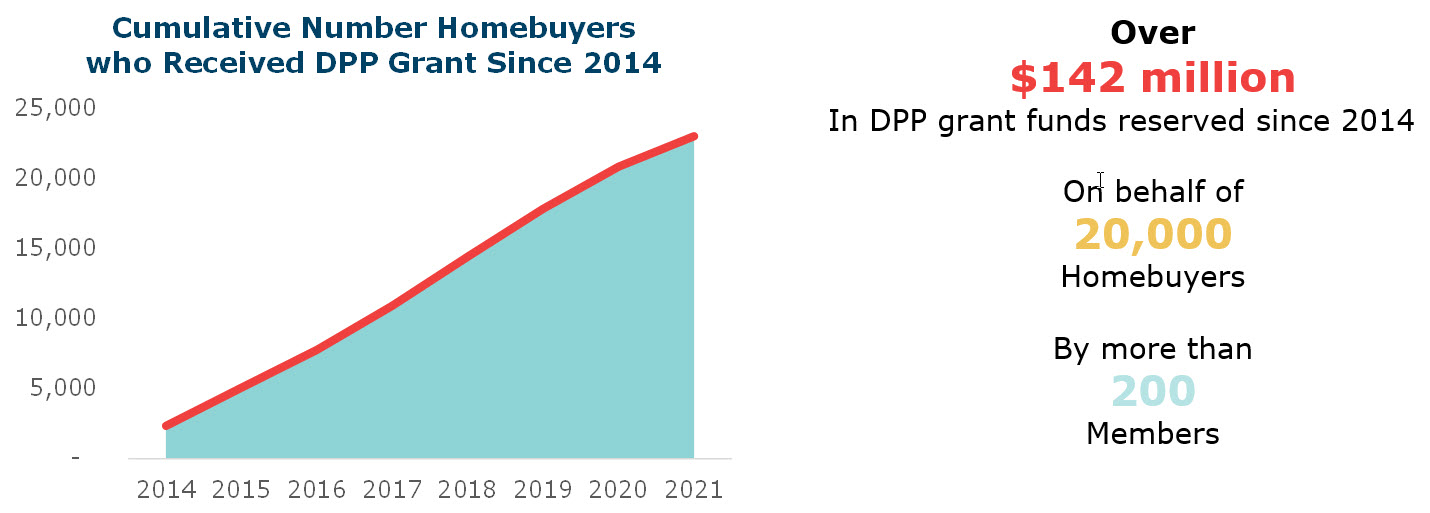

The Downpayment Plus® (DPP®) program offers Federal Home Loan Bank of Chicago (FHLBank Chicago) members forgivable grants for down payment and closing cost assistance, up to $6,000 on behalf of their income-eligible customers. These easy-to access grants are paid by the member on behalf of its borrowers at the time the borrower closes on their mortgage financing. The member is then reimbursed post-closing by FHLBank Chicago.

The Downpayment Plus Advantage® (DPP Advantage®) is a similar program that assists income eligible homebuyers participating in homeownership programs offered by non-profit organizations that provide mortgage financing directly to the homebuyer. Nonprofit organizations providing direct first-mortgage financing, such as Habitat for Humanity or Neighborhood Housing Services, must partner with an FHLBank Chicago member financial institution to access DPP Advantage funds. Grants are forgiven on a monthly basis over a five-year retention period.

These programs are a great way to attract new customers to your mortgage business, develop repeat customers, and cross-sell customers into deposit products and other lines of business. Additionally, partnering with non-profit organizations through the DPP Advantage® program will help your organization grow by improving the wellbeing of the communities you serve.

In 2021, 261 members enrolled and 176 of those members disbursed $18 million in DPP grants on behalf of more than 3,000 homebuyers!

The 2022 program opened on January 18, and program agreements can be established at no cost and zero obligation. Sign-up now and prepare for the busy spring home buying season! Read below for more information on the program and the benefits to be gained through participation.

Key Takeaways

Overview of DPP and DPP Advantage Programs

DPP is a program funded by FHLBank Chicago that provides down payment and closing cost assistance for income-eligible homebuyers. The assistance provided is in the form of a forgivable grant (subsidy) paid on behalf of the borrower at the time the borrower closes on the first mortgage financed by your financial institution.

DPP Advantage assists income eligible homebuyers participating in homeownership programs offered by nonprofit organizations in Illinois or Wisconsin that provide mortgage financing directly to the homebuyer. Nonprofit organizations providing direct first mortgage financing must partner with a member financial institution in order to access DPP Advantage funds.

| DPP | DPP Advantage |

|---|---|

| Income Guidelines | |

| Households must have a projected annual income at or below 80% of area median income. Income requirements are adjusted for household size and locations determined by HUD. Applications are subject to the most recent guidelines published. Annual updates are typically published in April by HUD. | |

| Homebuyer Contribution | |

Homebuyer must contribute a minimum of $1,000 to their home purchase transaction to be eligible for DPP. Contribution minimum is calculated as gross contribution less any cash back at closing. Cash back cannot exceed $250 per regulation.

| No required homebuyer contribution.

|

| Borrower Education and Counseling | |

Borrowers are required to complete Pre-Purchase Education and Counseling, which must be provided by one of the following:

| |

| DPP | DPP Advantage |

| 5-Year Retention | |

| Grants are forgiven to the member in equal parts monthly over a 5-year period (60 months). If the borrower sells or refinances their home prior to the end of the retention period, they may owe a portion of the grant in repayment; however, there are many situations in which repayment is waived, resulting in very few borrowers owing repayment on their grant. | |

| Use of Proceeds | |

Eligible use of grant proceeds include:

| |

| Member Limits | |

| $420,000 annually | No limit |

Best Practices and Common Misconceptions

Best Practices

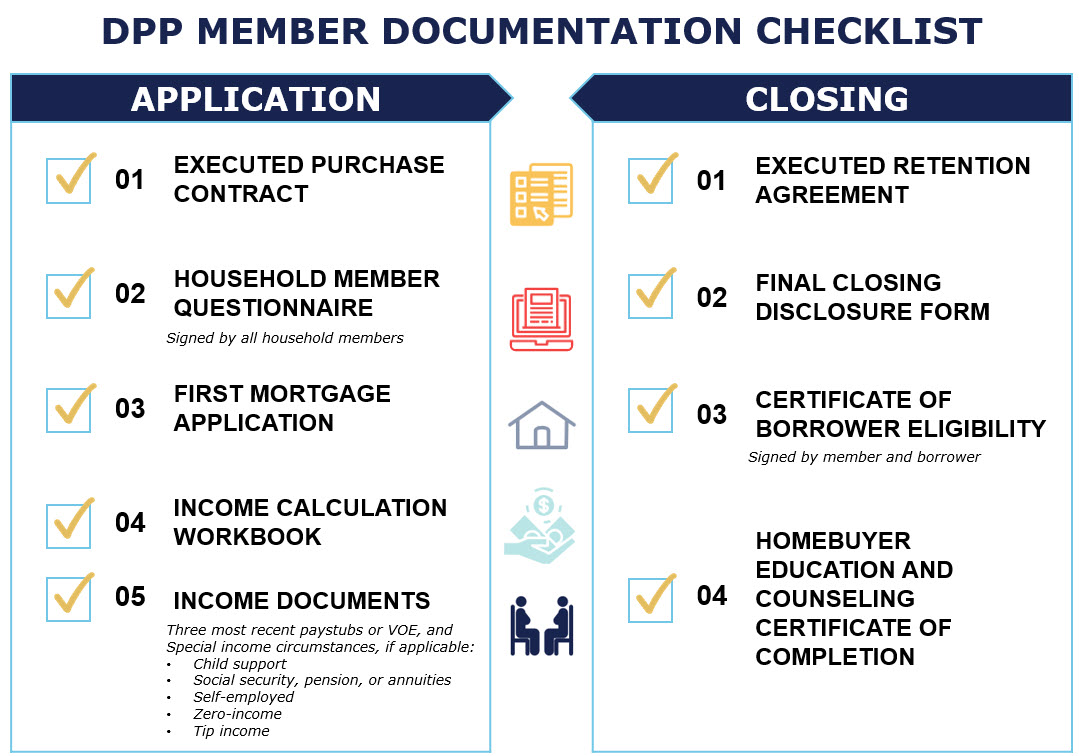

Our most successful DPP program users have educated loan officers on DPP and incorporated DPP into the institution’s loan origination process. By familiarizing loan officers with qualifying income limits in your area, employees can identify DPP income-eligible borrowers as soon as a prospective customer engages with an officer. Further, loan officers that are well-versed in the DPP participation and documentation requirements for the homebuyer can clearly communicate these directly to the homebuyer at the beginning of the process.

Some members have further implemented a process to gather the required homebuyer documentation up front to facilitate the DPP reservation and the subsequent closing, reducing back and forth correspondence with the borrower. When borrowers come with the appropriate documentation, it simplifies the approval process. The below checklist summarizes the documentation required when reserving a DPP grant:

Common Misconceptions

One common misconception is that originating a loan while utilizing a DPP grant can limit the originator’s loan options. However, this grant is very flexible and can be paired with almost any loan program. DPP-paired loans can be used in conjunction

with many different loan programs including but not limited to Section 184, FHA, VA, Rural development, or state agency first mortgage programs. The grant may also be paired with federal, state, or local grant programs. The originator is not required

to hold the first mortgage and can sell it through the secondary market to investors such as FNMA, FHLMC, or through FHLBank Chicago’s Mortgage Partnership Finance® (MPF®) program. DPP does carry some restrictions

on the terms of the first mortgage. The loan term and initial interest rate lock period must be at least five years, the loan cannot be interest-only, and the mortgage must be recorded with a retention agreement for the 5-year retention period.

Another common misconception is that DPP is only for first-time homebuyers. While first-time homebuyers make up a substantial portion DPP recipients, all income-qualifying borrowers are eligible to receive DPP funds when securing a first mortgage. Members

have used funds to assist seniors and other fixed income applicants.

A final misconception is that engaging with the DPP programs comes at a cost, or requires a member to be a participating financial institution (PFI). These programs are part of our commitment to community investment and come with no obligation to FHLBank

Chicago. There are no associated fees with engaging in the DPP programs and members do not need to be a PFI or engage with the Bank in any capacity to access the benefit of these programs.

Value Add for Your Business

By participating in DPP and marketing a grant opportunity to existing and prospective customers, members can attract and retain more lending business, potentially increasing market share in existing markets or penetrating new markets. As mortgage rates begin to trend upward, many first-time homebuyers may want to enter the market and take advantage of lower rates. By offering this program to eligible households, you may be able to attract these new customers (or a new demographic of customers) and build a lasting relationship with them. Further, when making these loans in conjunction with a grant, you are improving the loan-to-value of your borrower, making the origination sounder. There are no fees associated with participation in the DPP program.

DPP Advantage

A top trend for financial institutions in 2022 is to give back to the communities that you serve. As local communities rebuild following the impact of the pandemic, increasing community outreach shows your investment and commitment to community growth. By assisting prospective homeowners in realizing their homeownership goals through a grant and a loan, your institution directly supports the people and the communities you serve. Members have made loans in the past that would not have been possible without a DPP grant, directly facilitating affordable lending in their communities. By partnering with non-profit organizations through the DPP Advantage program, your organization can lead with purpose by supporting growth and improving well-being within the communities that you serve.

To Learn More

Contact your Sales Director or email dpp@fhlbc.com to learn more about the benefits of the DPP program and how to get started.

Other key resources are linked below for your convenience:

- DPP Program Page

- 2022 DPP Video Guides

- 2022 DPP Program Guide

- HUD Income Guidelines

- Income Calculation Guidelines

Contributors

| Cathy Kiriakos Senior Analyst Sales, Strategy, and Solutions | |

| Raj Misra Senior Director, Institutional Sales Sales, Strategy, and Solutions |

Looking for a printable version of this White Paper? Download the PDF.

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content and offerings presented on its website. Mortgage Partnership Finance,” “MPF,” “MPF Xtra,” and “eMPF” are registered trademarks of the Federal Home Loan Bank of Chicago.