FHLBank Chicago Invests $2.5 Million to Expand Housing Counseling Across Wisconsin

The Federal Home Loan Bank of Chicago (FHLBank Chicago) has awarded $2.5 million to the Wisconsin Housing and Economic Development Authority (WHEDA) for 2025 through its Community First® Housing Counseling Resource Program. The increased funding compared to last year allows WHEDA to expand its network of U.S. Department of Housing and Urban Development (HUD)-certified counseling agencies, helping more Wisconsin families prepare for sustainable homeownership.

“Together with WHEDA, we’re expanding pathways to successful and sustainable homeownership across Wisconsin,” said Katie Naftzger, Senior Vice President and Community Investment Officer at FHLBank Chicago. “Housing counseling provides families with the knowledge and confidence to make informed decisions and create stability that lasts.”

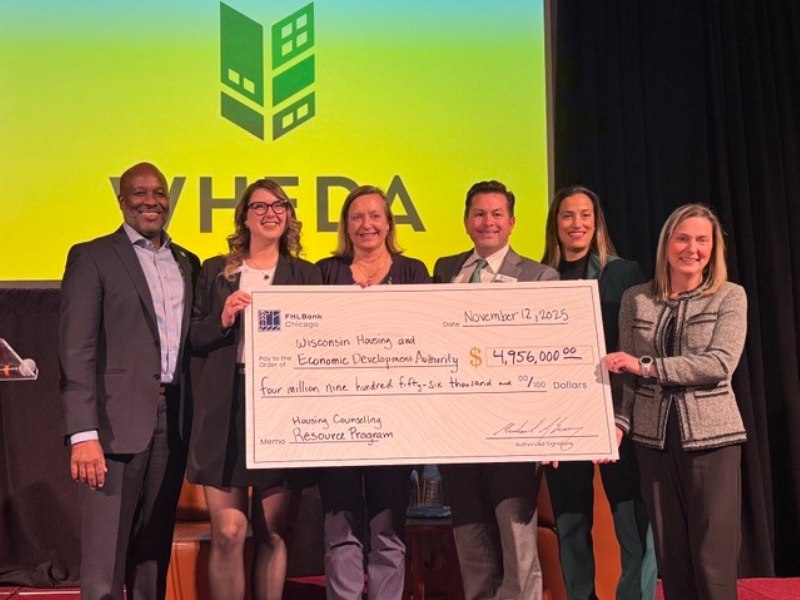

Photo caption: Members of the FHLBank Chicago and WHEDA teams gather for a Housing Counseling Resource Program check presentation to celebrate funding that will support homebuyers across Wisconsin. This represents a $2.5 million investment for 2025 and 2026, totaling $5 million in support over the two-year period.

Launched in 2022, the Housing Counseling Resource Program expands access to financial education, credit preparation, and homebuyer support services for people working toward long-term housing stability. The program also empowers current homeowners in the maintenance of their homes through post-purchase education and, should they incur financial instability, foreclosure prevention counseling.

With WHEDA leading Wisconsin's efforts and the Illinois Housing Development Authority managing Illinois services, FHLBank Chicago has invested $13 million in strengthening housing counseling access across both states.

“Housing counseling gives people the knowledge they need to navigate the path to homeownership and make informed decisions. The Federal Home Loan Bank of Chicago’s investment ensures current homeowners and first-time buyers have the support to secure a stable home,” said Elmer Moore Jr., Executive Director and CEO of WHEDA. “Homeownership provides working families with stability and strengthens community connections. This partnership is a game-changer, and we are so very grateful.”

In 2023 and 2024, HUD-certified housing counseling agencies receiving funding through the Housing Counseling Resource Program have served more than 14,000 Wisconsin households, with over 1,600 achieving their goal of homeownership. This individualized support equips families with the knowledge and resources needed to make informed decisions and establish lasting financial stability.

One success story: Kathryn Hazleton, a first-time homebuyer, worked with La Casa de Esperanza, to become mortgage-ready with Waukesha State Bank and secure a $10,000 grant through FHLBank Chicago’s Downpayment Plus® (DPP®) Program.

“La Casa de Esperanza’s homebuyer program helped me understand what I needed to do to buy a home,” said Hazleton. “The grant I secured through the DPP Program was extremely helpful, and I didn’t need to spend all my savings on the down payment. I had been saving for years, and I finally did it. Now I can afford to update my home and make it my own. Being a homeowner makes me feel free, and it’s relaxing to know I have my own place and my payments are controlled.”

FHLBank Chicago remains committed to strengthening housing counseling resources and creating pathways to homeownership for families across Wisconsin and Illinois. Photo caption: First-time homebuyer Kathryn Hazleton celebrates achieving homeownership with housing counseling support from La Casa de Esperanza and $10,000 in down payment assistance through FHLBank Chicago’s Downpayment Plus® Program.