Commercial Lending: Q1 2020

Overview

Commercial lending volume has continued to fall from its post-recession highs. However, according to data from the Federal Reserve Bank of St. Louis, commercial and industrial (C&I) balances, as well as commercial real estate (CRE) balances, increased from 2018 to 2019. C&I balances grew at a rate of 2.23%, while CRE balances rose at a rate of 5.34%. Data from the Senior Loan Officer Survey, as well as the Small Business Lending Survey, indicate that challenges remain, with reports of weakening loan demand and tightening lending standards. The Federal Home Loan Bank of Chicago (FHLBank Chicago) offers a range of solutions to help our members thrive in this ever-changing environment.Commercial and Industrial Lending Solutions

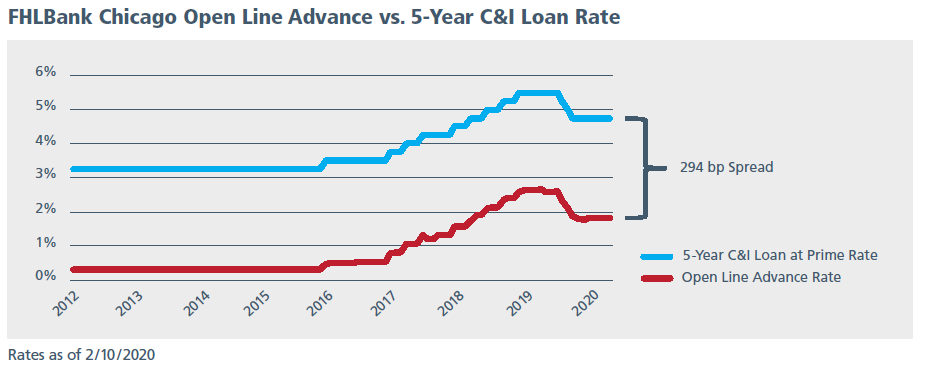

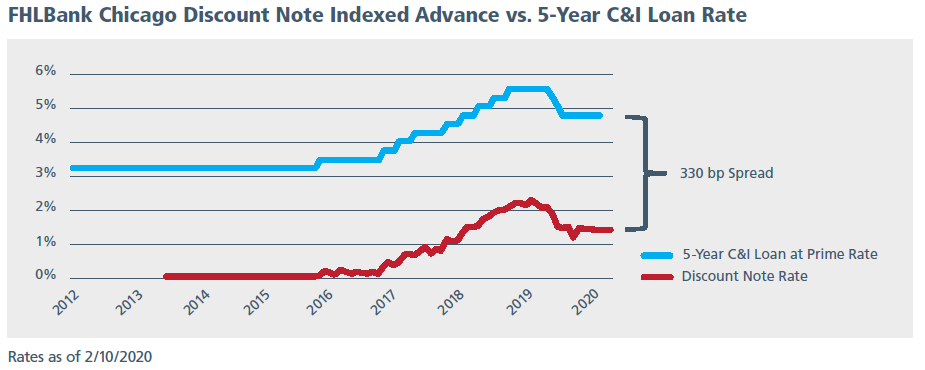

Since most C&I loans have floating interest rates, it is best to fund with floating rate advances. For example, you could use either an open line advance or discount note indexed advance to hedge individual loans or the entire portfolio. Hedging with a discount note indexed advance can more closely match the reset periods of the loan, locking in net interest margin (NIM) across various interest rate scenarios. An open line advance will automatically roll each day until the financial institution notifies FHLBank Chicago to pay down the advance. This reduces the operational costs of rolling maturing advances, and provides additional benefits when rates fall (as the advance’s price will fall faster than the asset’s). Both strategies offer the benefit of locking in medium- to long-term funding while taking advantage of changes in market rates. Using either of these short-term, low-cost funding options is a great way to increase NIM while still providing borrowers with a competitive loan rate.

Commercial Real Estate Lending Solutions

Match-Funding Strategy

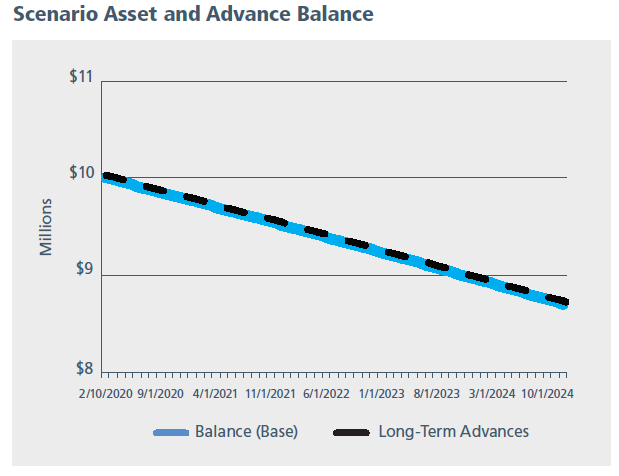

To hedge long-term fixed rate CRE loans, financial institutions have various strategies available to them. One approach is to match-fund the loan by taking out an advance with a similar term, structure, and notional amount. In the example below, we suggest match-funding a $10 million, 5-year, 30-year amortizing loan (assuming no prepayment at a rate of 5.00%) with a 5-year, 30-year amortizing advance at 1.63%. This would provide the financial institution with an initial NIM of 3.37% and would eliminate interest-rate risk on the loan across interest rate scenarios. If your loan does not have prepayment protection, consider using a callable amortizing advance for funding or hedging purposes.

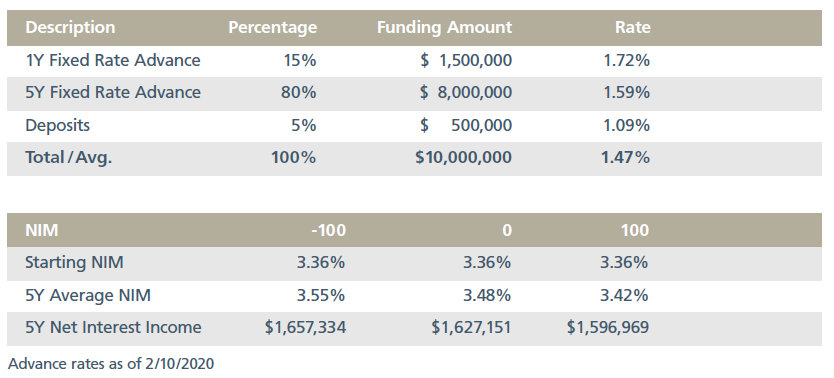

Barbell Strategy

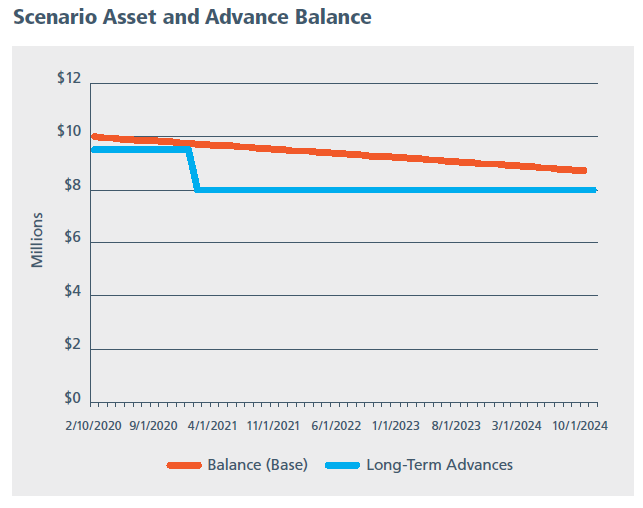

Another option would be to use a barbell funding strategy. This strategy can further improve NIM by funding portions of the loan with advances while the rest is funded with deposits. Consider the scenario illustrated below, where 80% of the loan amount is funded with a 5-year fixed rate advance at 1.59%, 15% is funded with a 1-year fixed rate advance at 1.72%, and the remaining 5% is funded with deposits. Using this strategy, your institution would receive a starting NIM of 3.36%. A financial institution could also use a ladder strategy combining fixed rate, fixed term advances and/or callable or putable advances at various terms.

Swap-Plus-Rolling Short-Term Advance

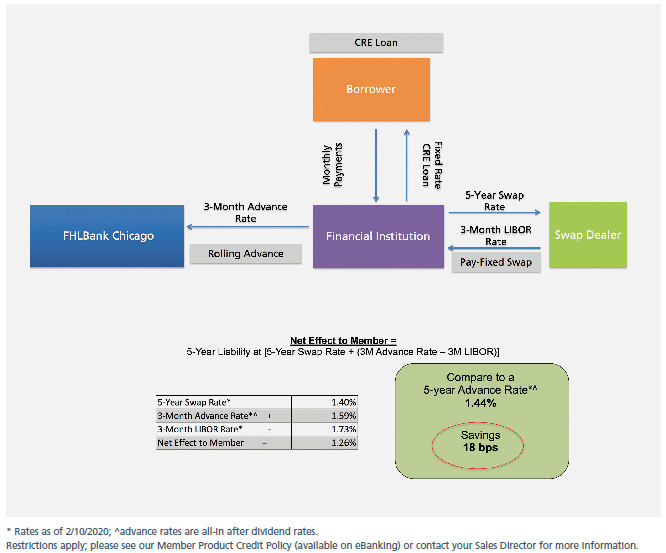

If your institution is concerned about match-funding a fixed rate CRE loan with a fixed rate, fixed term advance, you may want to consider rolling short-term advances for the term of the loan.

In this strategy, a financial institution sets up a long-term pay-fixed swap—in this case for five years—with a broker-dealer or FHLBank Chicago, and receives the 3-month LIBOR rate. It then takes out 3-month advances and rolls them, following the swap reset dates and notional amounts exactly. Because the 3-month all-in after dividend advance rate has historically been below the 3-month LIBOR rate, the financial institution is able to lock in five years of funding at a much lower rate than it would pay for a regular 5-year fixed rate, fixed term advance. The swap used in this strategy is considered a cash-flow hedge, where the changes in fair value go to “Other Comprehensive Income” on the balance sheet, not directly into income. Financial institutions should keep in mind that LIBOR transition fallback language should be incorporated into any derivative transactions using LIBOR as an index. See the illustration below for an example of the potential savings.

Back-to-Back Swaps

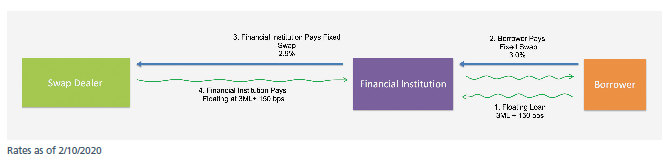

Do you have borrowers requesting long-term fixed rate commercial loans and find it difficult to meet their needs? Or would your institution rather hold floating-rate loans on its balance sheet? If duration risk is a concern, consider a back-to-back swap. In a back-to-back swap, a floating rate CRE loan is combined with two swaps. The first swap is between the borrower and the financial institution. This swap effectively converts a floating rate loan to a fixed rate loan for the borrower. The second swap is between the financial institution and the broker-dealer, and effectively converts the fixed payment the financial institution receives from the borrower to a floating rate. See the graphic below for an example:

The back-to-back swap strategy offers benefits for both the financial institution and the borrower. The borrower gets the requested fixed rate funding, and the financial institution reduces its duration risk or interest-rate risk on the fixed rate loan. In addition, any difference between the pay-fixed rates on the two swaps can be booked as fee income.

To Learn More

Contact your Sales Director at membership@fhlbc.com to find out more about the products, strategies, and tools you can use to develop competitive lending solutions for your commercial customers.

Contributors

Melissa Palumbo

Membership Solutions Analyst, Sales, Strategy, and Solutions

Erin Hunter

Director, Sales, Strategy, and Solutions

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to

any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | March 2020