Consumer Lending: Auto Lending Solutions: Q1 2020

Overview

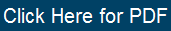

According to the New York Fed’s Q4 2019 Household Debt and Credit Report, household debt increased by $193 billion in Q4, finally topping $14 trillion and marking the twenty-second consecutive quarterly increase in debt. Total debt now stands at $14.15 trillion, $1.5 trillion higher than the previous peak of $12.68 trillion in Q3 2008. As household debt continues to grow across the U.S., mortgages and student loans continue to climb as the largest portions of total debt. However, auto loan originations have been strong, most recently increasing $16 billion in the fourth quarter. HELOCs, on the other hand, have been steadily declining since 2009 and currently only constitute 2.7% of total debt. In the past five years, auto loan debt has grown to $1.33 trillion, compared to $0.96 trillion in Q4, 2014, while HELOCs have declined to $0.39 trillion, compared to $0.51 trillion in Q4 2014. As household debt continues to rise, there is the possibility that households may continue their auto purchase trends or reverse prior trends and tap into unutilized home equity. Although auto loans and HELOC loans are not the largest loan origination markets for consumers, it is important for institutions to prepare to handle these potential portfolio fluctuations. The strategy described in this paper is a common approach the FHLBank Chicago Solutions Team has seen members utilize given today’s low long-term interest rates and uncertainty regarding the path of interest rates.

Using a Blended Strategy to Hedge an Auto Loan Portfolio

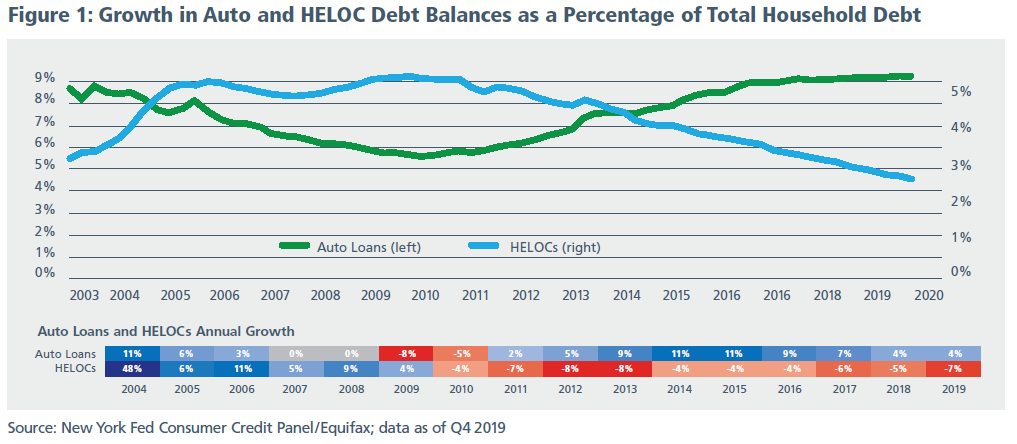

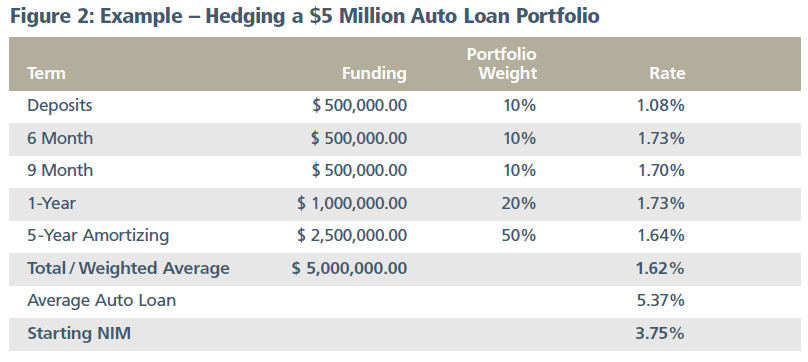

According to the TransUnion 2020 Consumer Credit Forecast, auto loan performance and originations are expected to remain strong through 2020, despite challenges to consumers in the way of higher gas prices, threats of auto tariffs, and rising vehicle prices. To offset these challenges, consumers may increasingly be looking for extended loan terms, creating potential opportunities for lenders. Your institution can hedge its auto loan portfolio by funding your portfolio with a combination of deposits and a ladder of longer-term advances to lock in low loan rates today. You can utilize more liquid, shorter-term funding options such as a mixture of deposits and short term advances, but then add a longer-term amortizing advance to the mix to lock in low cost, longer-term funding. When the amortizing advances pay down on schedule, you can meet any gaps in your funding needs with the short-term advances or deposits. For example (see Figure 2), a $5 million auto loan portfolio can be hedged with a combination of deposits, a 6-month fixed-rate advance at 1.73%, a 9-month fixed-rate advance at 1.70%, a 1-year fixed-rate advance at 1.73%, and a 5-year fully amortizing advance at 1.63% to mitigate interest-rate risk and maintain a starting NIM of 3.54%, assuming an auto loan rate of 5.37% (Federal Reserve’s Q3 2019 Consumer Credit report).*

HELOC Lending Solution

Outstanding balances on HELOCs have steadily declined since 2008, even as households continue to sit on record levels of untapped home equity. Based on a report from Black Knight, low interest rates and home-price gains continue to make real estate more valuable and as of Q3 2019, untapped equity has reached yet another all-time high at $6.3 trillion. According to the Black Knight report, nearly half of the 45 million homeowners with tappable equity have 1st lien interest rates at or above 4.25%, making refinancing the more attractive option. As untapped equity continues to grow and the Fed signals a low, stable rate outlook for 2020 however, there is the possibility that homeowners could swing back toward HELOCs, despite declining popularity and tighter lending conditions since 2008. The rates on HELOCs are variable and contain periodic caps, lifetime caps, and floors, and are typically correlated to a variable rate index—such as LIBOR or Prime. Institutions that offer lines of credit to customers can fund and hedge volatile notional balances of HELOCs or any other lines of credit with a discount note indexed advance or a SOFR-Indexed Advance, where the interest rate commonly resets daily, monthly, or quarterly. Discount note indexed advances can have the additional benefit of being prepaid on reset dates without a fee.To Learn More

Contact your Sales Director at membership@fhlbc.com to find out more about the products, strategies, and tools you can use to develop competitive lending solutions for your consumer loan customers.

Contributors

Danny Magdaleno

Membership Solutions Analyst, Sales, Strategy, and Solutions

Erin Hunter

Director, Sales, Strategy, and Solutions

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to

any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | March 2020