Customized Mortgage Funding/Hedging Strategies

April 20, 2022

Overview

As the U.S. economy's recovery

gained ground in 2021, the impact of coronavirus is gradually reducing with economic

growth in 2022 expected to transition to a more normal but still strong growth of

approximately 3.1%. Inflation rose sharply in 2021, with the Consumer Price

Index (CPI) recording a high of 7.9% in February 2022 and is expected to remain

elevated in 2022. From the backdrop of high inflationary pressures coupled with

rising interest rates as the Federal Reserve Bank (Fed) tightens monetary

policy, mortgage rates are projected to drift upward.

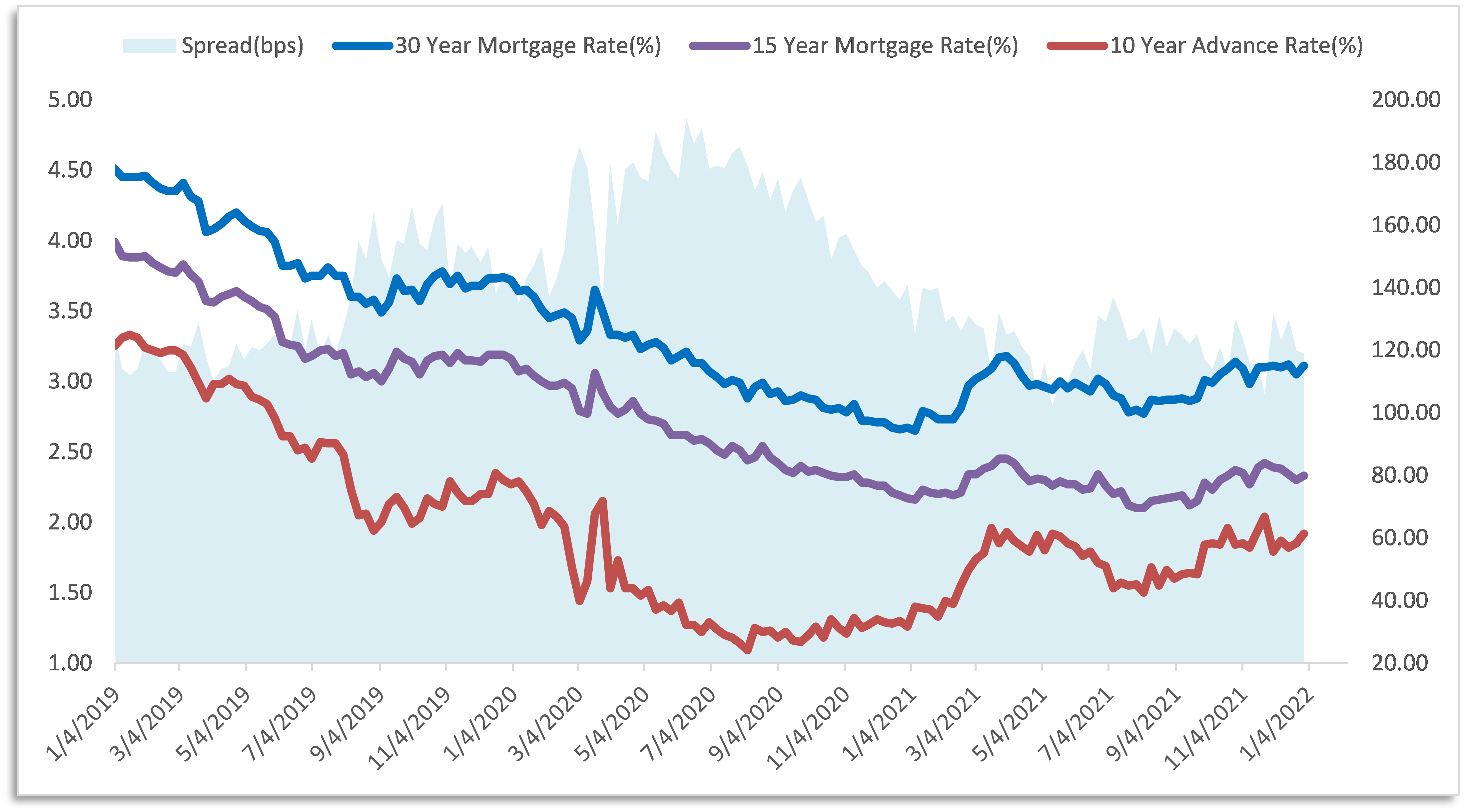

Purchase originations are anticipated to lead all originations as refinances wane with mortgage rates climbing higher. Since the pandemic started, the 30-year mortgage rate from Freddie Mac has steadily retreated from its high in Q3 2019 along with FHLBank Chicago's 10-year advance rate. However, with the Fed expected to increase the pace of monetary policy tightening to curb the surge in inflation, rates have moved higher and are likely to continue to do so. The spread between the 30-year mortgage rate to 10-year advance rate (see below graph) is poised to moderately widen. As market conditions change, keeping mortgages on the balance sheet is becoming a more attractive prospect.

Holding Mortgages on the Balance Sheet

Financial institutions often choose

between selling or holding originated mortgage loans on their balance sheet

based on the overall macroeconomic environment coupled with other factors such

as term of the loan, type of loan (i.e. conforming loans, non-conforming loans),

level of deposit rates, and amount of liquidity on hand. Retaining mortgage

loans exposes financial institutions to credit risk, which is interest rate

risk impacting risk-based capital ratios from regulatory capital held against

these loans but also improves net interest margin (NIM).

FHLBank Chicago has a myriad of

customized solutions for our members if you intend holding originated loans on your

balance sheet. In this White Paper, we analyze hedging a 15-year and 30-year mortgage

portfolio with a mix of advances and its resulting impact on NIM using forward

rates as of February 28, 2022. We assumed an average deposit rate of 0.16%,

cost of funds of 1% adjusted by the forward one month LIBOR, deposit beta of

0.3, and a lag of nine months in each rate shock scenario.

30-Year Mortgages Funding

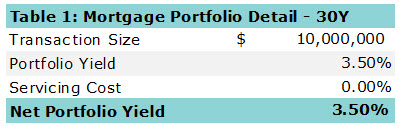

Table 1 below shows the funding

of a portfolio of 30-year mortgage loans at a rate of 3.50%, Table 2 shows the

mortgage portfolio funding is with a ladder/mix of fixed rate and callable

advances as well as use of deposits to make up for any shortfall in funding. In

this scenario, the fixed-rate callable advances gives the FHLBank Chicago

member the right to prepay the advances without a prepay fee on specific dates

following a lockout period. For example, the 10-year no-call five-year Bermudan

callable advance (10NC5Y BERM) is a ten-year fixed advance that may not be

called for five years but then is callable every three months thereafter. This

funding stack provides a nice mix of interest rate protection and flexibility

to decrease some of the funding if the assets prepay quicker than planned.

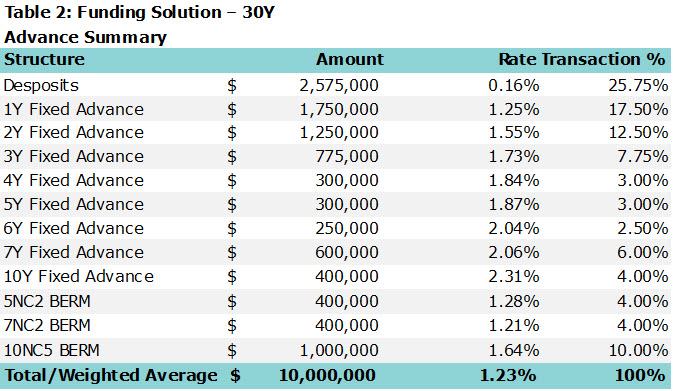

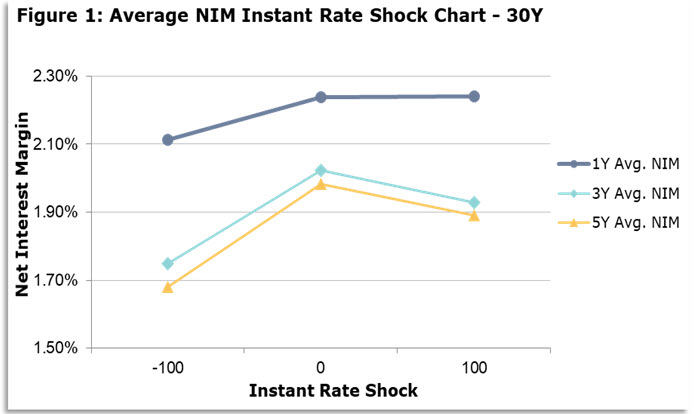

We show in Table 3 and Figure 1

below that the FHLBank Chicago member using the above strategy stands to earn a

projected starting NIM of 227 basis points (bps). Over a five year horizon,

assuming interest rates remain unchanged, the member could also earn 198 bps. NIM

compression is also likely as a result of contraction risk where loan

prepayments increase amid the backdrop of falling interest rates.

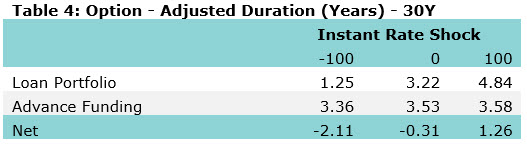

Table 4 indicates that in a

falling rate scenario, the option-adjusted duration of the loan portfolio would

fall to 1.25 years while the advance funding would be 3.36 years. The

option-adjusted duration of the advance funding would increase in a rising-rate

scenario, as the probability of exercising the option for the callable advances

decreases.

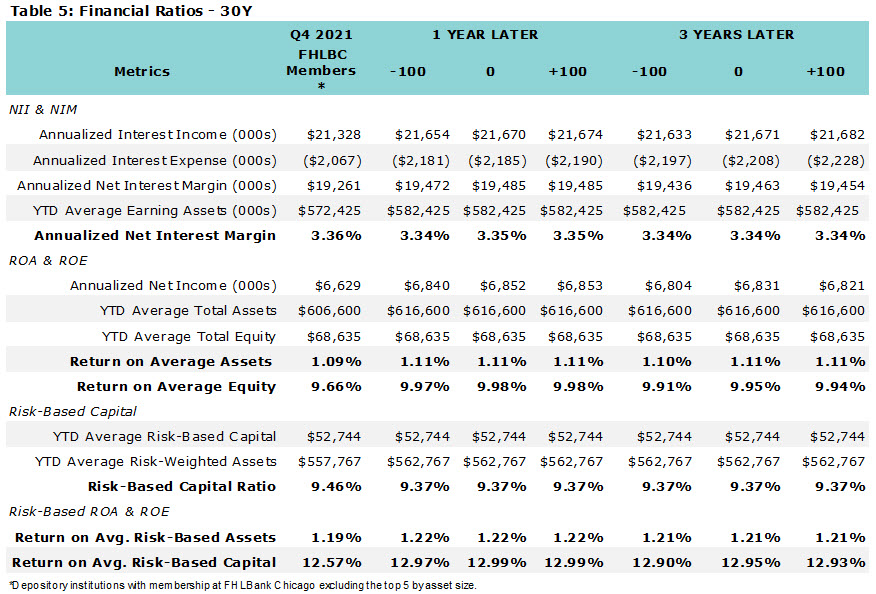

Another important thing to consider is how holding 30-year mortgages on your balance sheet coupled with the funding strategy above may affect your financial ratios such as return on average equity (ROAE), return on average assets (ROAA), and return on risk-based capital. Table 5 displays the impact on the balance sheet after the mortgage portfolio is added. FHLBank Chicago depository members had an average of $607 million in total assets as of Q4 2021, excluding the top five largest banks by asset size. The $10 million portfolio strategy proposed in this paper represents only approximately 2% of those average assets albeit providing significant value to your institution.

From Table 5, the sampled FHLBank Chicago members have an ROAA ratio of 1.09% and a ROAE of 9.66%. The 30-year mortgage loan strategy would add an estimated approximately 32 bps of ROAE after one year and approximately 29 bps over the three year period assuming all else remain unchanged. Mortgages must be held at 50% weights for risk-based capital purposes, according to Basel III guidelines. We can infer the institution’s total risk-based capital ratio reduces by 9 bps. However, after one year, the return on risk-based capital is projected to improve by 42 bps in the base case scenario.

15-Year Mortgage Funding

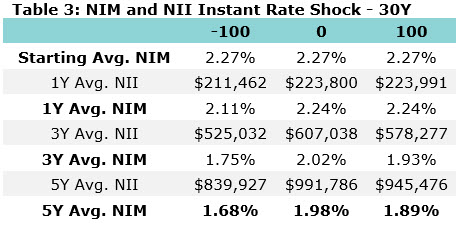

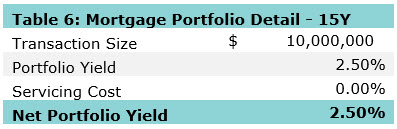

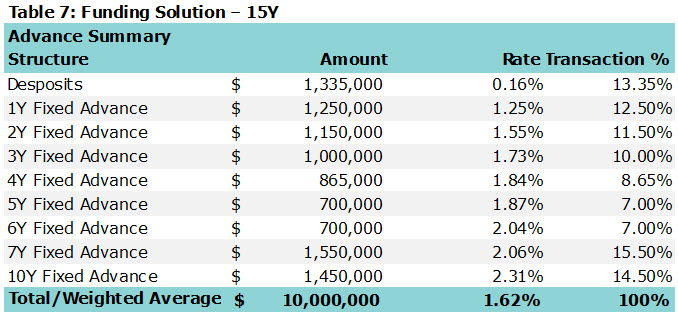

Table 6 below shows the funding a

15-year mortgage loan pool at a rate of 2.50%. Table 7 shows the mortgage

portfolio funding solution is a ladder/mix of fixed rate and callable advances

as well as use of deposits to make up for any shortfall in funding.

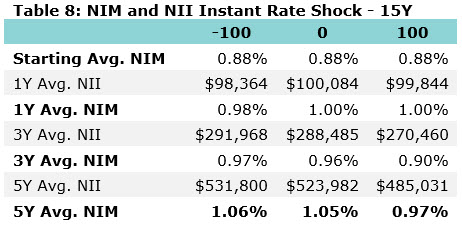

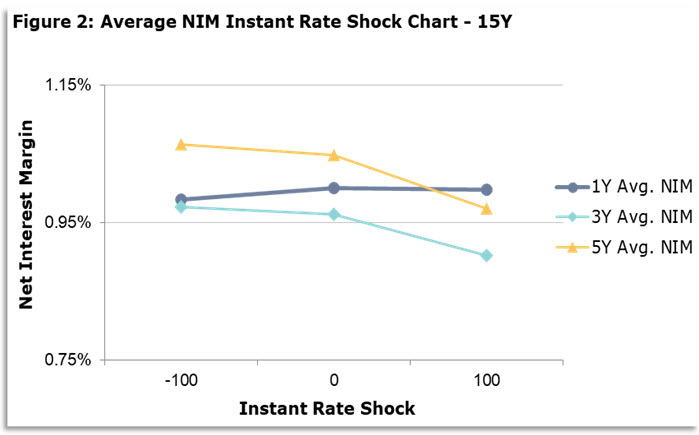

We show in Table 8 and Figure 2 below that the FHLBank Chicago member using above strategy stands to earn a projected starting NIM of 88 bps. Over a five year horizon, assuming interest rates remain unchanged, the member could also earn 105 bps.

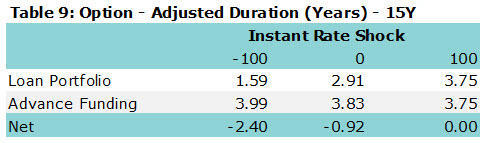

Table 9 shows that in a down 100

basis point, parallel instantaneous rate shock, the option-adjusted duration of

the loan portfolio would fall to 1.59 years, while the advance funding would be

3.99 years. In this scenario, new loans adjusted to a lower yield are assumed to

replace the paid-down balances.

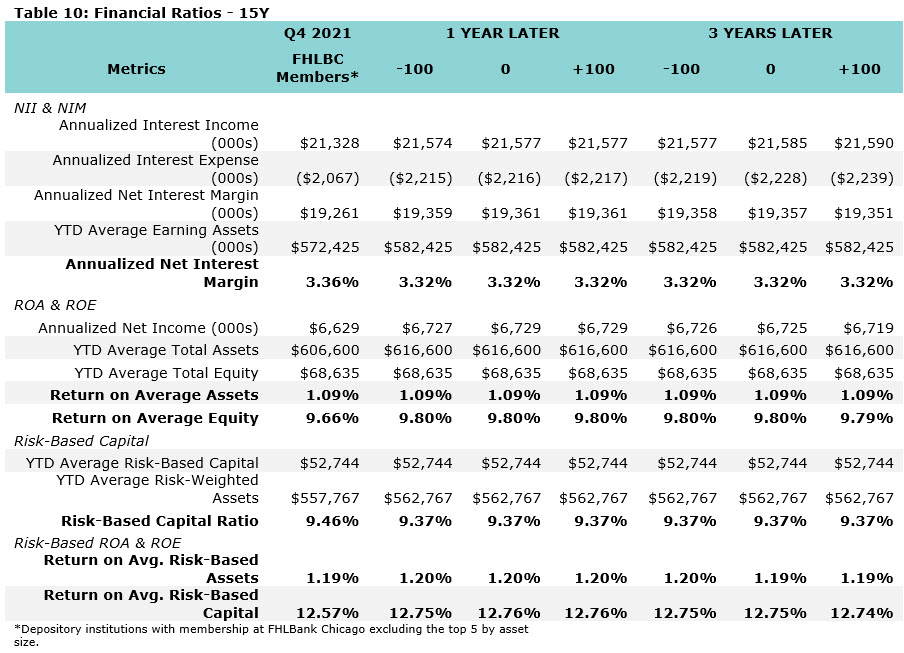

Similarly, we look at how holding

15-year mortgage portfolio on your balance sheet coupled with the funding

strategy utilized may affect your financial ratios such as ROAE, ROAA, and

return on risk-based capital. Table 10 displays the impact on the balance sheet

after the mortgage portfolio is added.

As shown in Table 10, the hedging strategy for a $10 million portfolio of 15-year mortgage loans would add an estimated 14 bps of ROAE after one year, assuming all else remains constant. Similarly, the institution’s total risk-based capital ratio is projected to be reduced 11 bps but after one year the return on risk-based capital would have improved by 19 bps in the base case.

While fixed rate mortgage loans are used in this strategy, members could use a variety of different assets, such as hybrid adjustable rate mortgages, commercial and industrial loans, commercial real estate loans, and consumer loans.

By using aforementioned mix of advances to fund/hedge your mortgage portfolio coupled with filling the shortfall with deposits, you can increase income, ROA without heavily impacting your interest rate risk or risk-based capital levels. This reflects an inherent tradeoff made to increase the net portfolio spread at the expense of a slight increase in interest rate risk exposure.

Our Solutions and Sales teams can customize these strategies for you to fit your own institution’s risk/return tolerances – feel free to put us to work to meet your objectives!

To Learn More

To learn more about the strategies discussed here, or to have your mortgage portfolio run through our model, please reach out to your Sales Director.

Contributors

| Kwabena Osei-Yeboah, CFA, FRM Senior Fixed Income Analyst Sales, Strategy, and Solutions | |

| Chris Milne Managing Director, Institutional Sales Sales, Strategy, and Solutions |

Looking for a printable version of this White Paper? Download the PDF.

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content and offerings presented on its website. Mortgage Partnership Finance,” “MPF,” “MPF Xtra,” and “eMPF” are registered trademarks of the Federal Home Loan Bank of Chicago.