Deploying Your Liquidity: Residential Lending and Investment Strategies

March 24, 2021

Overview

Most Federal Home Loan Bank of Chicago (FHLBank Chicago) depository members continue to see growing liquidity levels at their institutions. Ideally, this cash generated from the influx of deposits could be lent out to your core line of business, whether that be consumer, commercial, industrial, agriculture, real-estate or other loans. Keeping the liquidity in cash or short-term assets will generate safe and stable net interest income while putting institutions in a position to lend at a higher rate later on, if core loan demand grows to match the liquidity. However, short-term or low duration floating rate assets are typically at much lower than desired yields relatively. There is an opportunity cost with waiting to fully deploy your liquidity. Consider deploying some liquidity to holding or purchasing longer-term fixed rate assets such as jumbo residential loans, agency backed bonds, agency commercial mortgage backed securities (CMBS), municipal, or corporate bonds as a long-term income generating strategy for your institution.

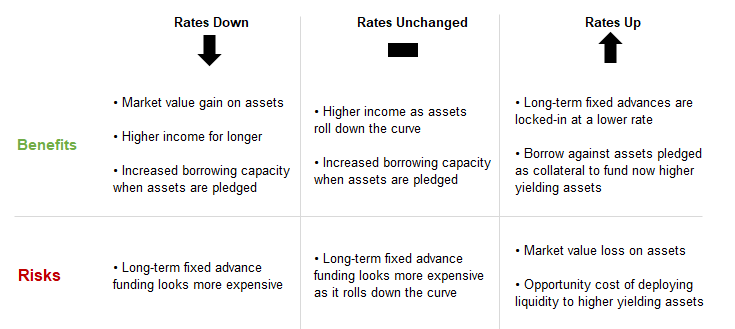

We encourage members to use a mix of deposit funding with some long-term FHLBank Chicago fixed-rate advances to hedge against interest rate risk. Further, pledge those assets with us to maximize your borrowing capacity. If deposit outflows dry up liquidity, FHLBank Chicago will be here to supplement with competitively priced advances. If rates rise, locking-in some longer-term advances at today’s rates will protect against unrealized losses associated with the price volatility on the assets. If rates remain unchanged or fall, your institution will earn above market rates as the assets roll down the curve over time.

Low Yield on Short-Term Assets

Short-term assets such as FHLBank discount notes, treasury bills, or interest earned on excess reserves (IOER) at the Fed can produce low but stable net interest income when funding costs are near 0%. Agency backed floating rate securities such as Fannie Mae’s Multifamily SOFR ARMs in Delegated Underwriting and Servicing (DUS) program is another popular investment for our members seeking more income while still positioning themselves to benefit in rates up. However, the yield on these assets relative to core lending can lower metrics such as net interest margin (NIM), return on assets (ROA), and return on equity (ROE).

Long-Term Strategies

Given the opportunity cost of staying short, we encourage our members to think about putting some liquidity to work on the long-end of the curve into fixed-rate assets where absolute yields have risen. Hedge some of the interest rate risk of higher duration assets with some longer-term advances or pay-fixed interest rate swaps.

Option 1: Jumbo Residential Loans on Balance Sheet

Many FHLBank depository members are active sellers in our Mortgage Partnership Financing® (MPF®) program. Some members prefer to sell residential mortgage loans off their balance sheet, thus eliminating the associated prepayment and extension risks. This is especially the case with larger jumbo loans which are not currently accepted within our MPF program or other traditional mortgage liquidity providers. However, some members have found value in holding them on balance sheet, hedging with some longer-term and callable advances from FHLBank Chicago.

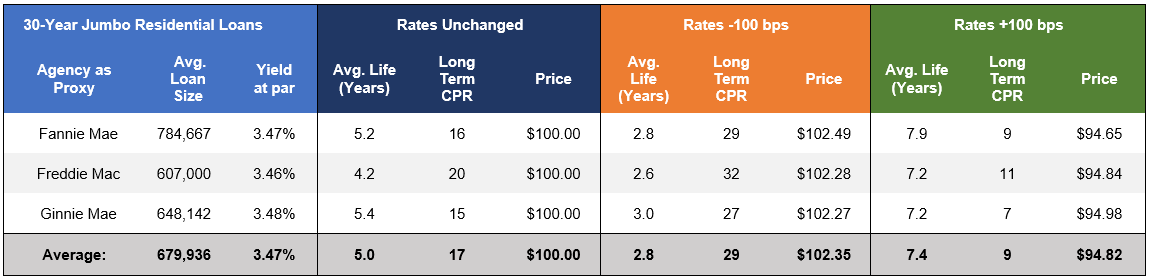

New issue 30-year jumbo residential loans are classified as being over the 2021 conforming loan limit of $548,250 by the Federal Housing Finance Authority (FHFA). Jumbo loans within new issue agency mortgage back securities from Fannie Mae, Freddie Mac, and Ginnie Mae are yielding close to 3.5% as of March 2021. See the table below:

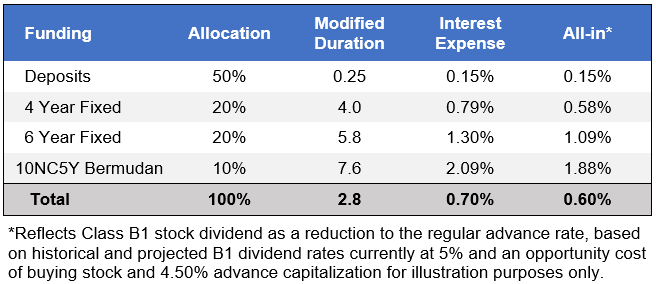

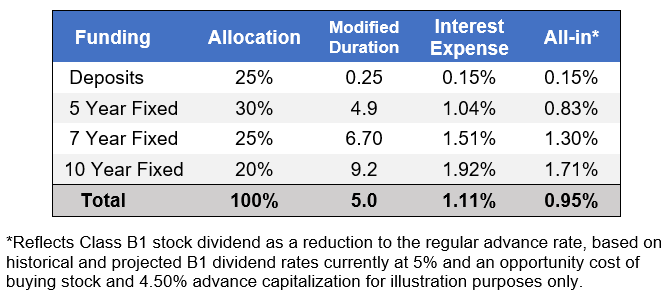

Member’s willing to take on some of the interest rate risk associated with these residential loans could fund them with a mix of deposits and FHLBank advances. Accounting for FHLBank Chicago’s Dividend Benefit*, members would pay an estimated 0.60% all-in funding cost with this strategy. See the table below:

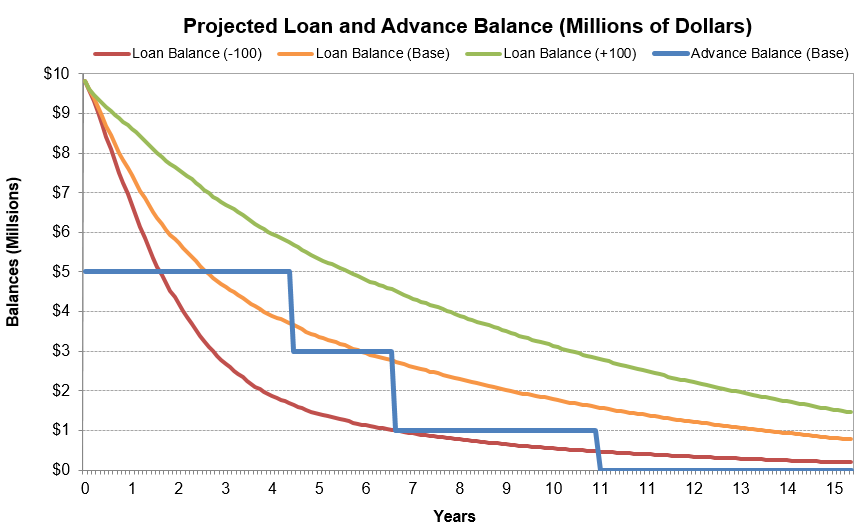

Half the strategy uses the excess liquidity from deposits while the other half is comprised of fixed-rate and callable fixed-rate advances. The advances serve as a hedge to some of the interest rate risk related to the unknown timing of cash flows from a pool of jumbo residential loans. Advances with embedded call feature(s) allows you as the member to terminate the funding after a lock-out period and quarterly thereafter when electing Bermudan callable advances. This flexibility is optimal when funding assets like mortgage loans, which can be paid back at the discretion of the borrower. The chart below illustrates the projected timing of those cash flows with the advance balance in the base case on a 10M strategy. Deposits and other sources of liquidity, such as rolling short term advances, would fill the funding gap:

With this strategy, members can earn an estimated NIM of 287 basis points (bps), subject to unknown duration risk depending on the path of rates. FHLBank Chicago can help model your specific loan portfolio and suggest various funding options based upon your own risk appetite.

Option 2: Long-Term Call Protected Securities

FHLBank Chicago members not willing to take prepayment or extension risk of mortgage loans can look to longer-term call protected securities where absolute yields have risen. Despite tight spreads over benchmark yields, deploying some of your excess liquidity to long duration assets could be an effective strategy to earn higher income in rates unchanged or rates down scenarios.

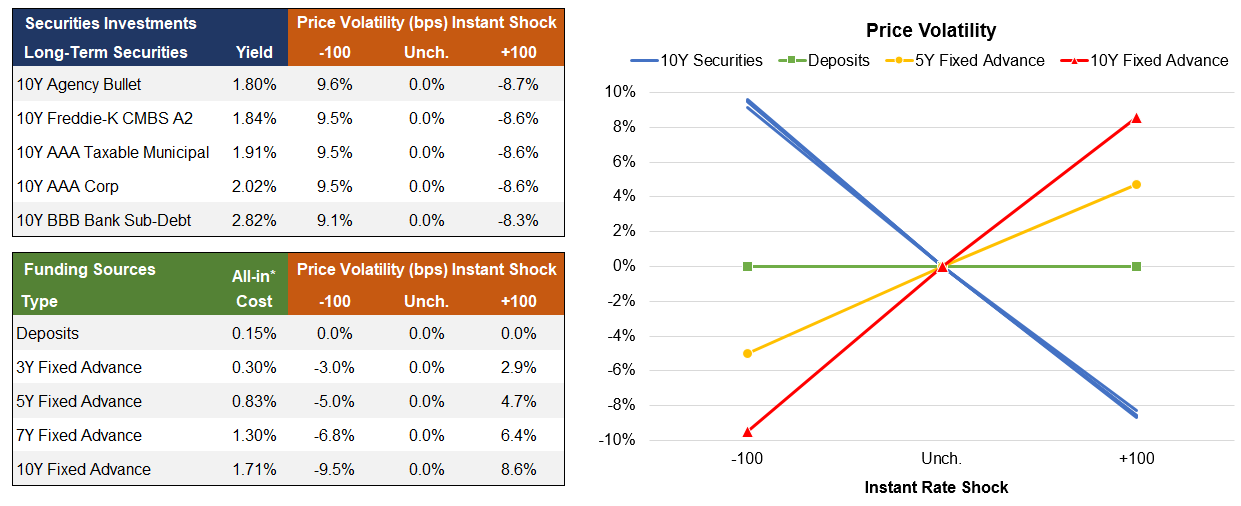

10-year fixed securities with little credit risk such as agency backed bullet bonds and call-protected CMBS from Freddie Mac offer yields over 1.8%. Members willing to take on some credit risk can look to higher yielding AAA municipal or corporate bonds yielding 1.9% to 2%. Members that are comfortable with bank-sub debt related securities can earn over 2.8% yield.

Long duration fixed-rate securities come with interest rate risk. As a result, even small movements of benchmark interest rates can lead to price volatility or market value gains and losses on the assets. This would be experienced in the form of unrealized gains or losses in other comprehensive income (OCI), if they are positioned as available for sale (AFS). FHLBank Chicago members can hedge this risk by funding with longer-term fixed rate advances or pay fixed interest rate swaps of similar duration. The price volatility of securities on the asset side of the balance sheet is offset by the inverse but symmetrical relationship of funding with longer-term advances. See the chart and table below for more details:

We encourage members to consider taking some interest rate risk with longer-term securities but hedged with a blended funding solutions. For example, the blended funding portfolio of deposits with a ladder of fixed-rate advances has an all-in funding cost below 1%. Member could earn between 85 – 187 bps funding the example securities with the blended funding strategy displayed below:

How To Learn More

FHLBank Chicago is happy to discuss these strategies or other ideas with your institution. Please reach out to your Sales Director or any member of the Sales, Strategy, and Solutions to team for customized analysis, and let’s find the right strategy for your institution.

Contributors

|

Nick Simoncelli Senior Analyst, AVP Sales, Strategy, and Solutions |

|

Chris Milne Managing Director Sales, Strategy, and Solutions |

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content and offerings presented on its website.

There are associated risks with options. Because the FHLBank Chicago owns the option to terminate the advance prior to final maturity, the actual duration of the advance may be significantly lower than the stated maturity of the advance. Likewise, the FHLBank Chicago may not execute the put option, and the advance will be held to maturity in the case of falling interest rates. Contact your own accountants and attorneys before executing an A123 Putable Fixed Rate Advance.

Not all advance types are suitable for all members. Members must be aware of and understand the market and operational risks that are associated with advances with embedded options. Contact your accountants and attorneys before executing an advance with embedded options. Certain advances such as those that contain call or put options, interest rate caps, collars or floors, or other rate, term, or payment variations may require the acknowledgement of or execution of disclosure statements in which a member represents that it understands the risks associated with a particular advance.