Generating Income in an Uncertain Environment: Q1 2020

Overview

Since the financial crisis of 2007–2008, the banking sector has seen steadily high levels of profitability. According to the FDIC, community banks reported a net income of $6.9 billion in Q3 2019, up 7.2% from Q3 2018. However, as we enter a new decade, the last decade’s high level of profitability may be at risk. The flat and inverted yield curve has pressured net interest margins, and the Current Expected Credit Losses Methodology (CECL), while not yet fully implemented, is expected to cause a one-time reduction in book equity, as well as lower stated earnings during periods of portfolio growth for many institutions due to the “double counting” of credit risks for loan originations. With significant uncertainty afoot (stemming from the trade war, Brexit, the coronavirus outbreak, and the upcoming elections, to name a few), America’s economy seems tobe weathering the storm, but it is anyone’s guess whether interest rates will rise, drop, or stay the same in the near future.

Given these concerns, many of our members are asking: What are some income-generating strategies that I could implement today?

Strategy 1: Become Less Asset-Sensitive

The belly of the yield curve being inverted—again—provides some opportunities and strategies to deal with net interest margin (NIM) compression. The curve is currently flattest in its 2- to 5-year sector, so members may want to avoid purchasing assets with similar durations. Rather, look to add longer-duration fixed-rate loans or securities with durations greater than 7 years. Longer-term investments such as Fannie Mae Delegated Underwriting Service (DUS) bonds or 30-year fixed mortgage-backed securities/whole loans have attractive spreads and long durations. Members of the Federal Home Loan

Bank of Chicago (FHLBank Chicago) can also see historical trends of investment spreads and funding options for various investment classes in our new Investment Spreads Report (check out our “Highlights of the Investment Spreads Report” white paper for more information).

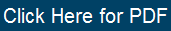

On the funding side, use the inverted belly to your advantage. Members can fund longer-term assets (7+ years duration) with medium-term advances in the 2- to 5-year sector to secure a greater NIM. Lock in fixed rate funding for 3 years with an all-in rate of 1.46%, which as of February 18, 2020, is the cheapest fixed rate advance available—approximately 12 basis points below short-term advance rates and nearly 20 basis points below equivalent-term brokered CD rates!

Strategy 2: Lower Funding Costs With Putable Advances

A flat yield curve can make the job of funding the balance sheet with a target NIM challenging. Financial institutions should be preparing to mitigate margin compression while still providing their customers with the loan products they demand.

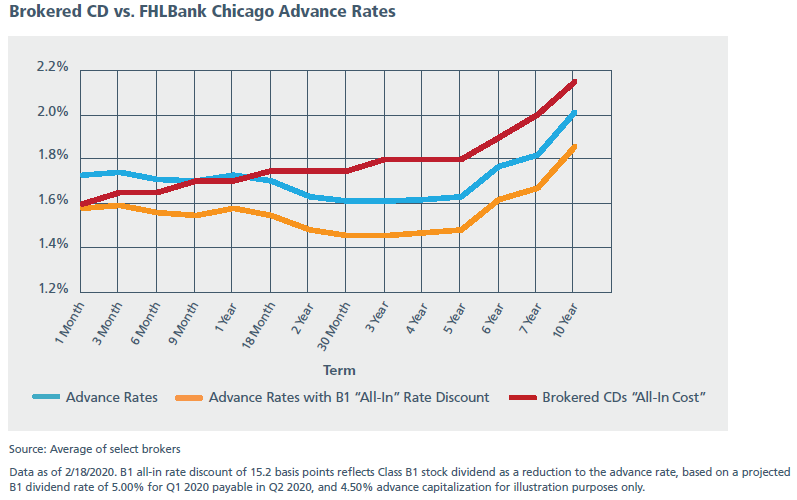

With rising volatility and the flatness of the curve, putable advance rates have moved well below the level of fixed rate advance funding. The putable advance is a non-amortizing advance with a lockout period, after which FHLBank Chicago owns the option to terminate the advance on a scheduled date. This allows members to borrow at lower rates than are typically available through regular fixed rate advances or other borrowing measures. Members can thus lock in below-market rates for longer-term funding, extend the duration of liabilities and reduce liability sensitivity, and match-fund loans or investments with an increased spread. Putable advances with lockout options as long as 2 years continue to be attractive and can help further reduce your cost of funding. Options come with risks, and in this case, the risk to your institution is that FHLBank Chicago may not terminate the advance if rates do not rise enough, and you would then hold the advance for the full term. Short-term putables such as the 3-year no-put 6-month can reduce your duration risk, but you should carefully consider the risk profile of putables relative to your funding needs.

Strategy 3: Lock in Low Rates With Forward-Starting Swaps

A more complex strategy utilizes a combination of other FHLBank Chicago strategies, including the swap-plus-rolling advance strategy, forward-starting swaps, and short-lockout putable advances.

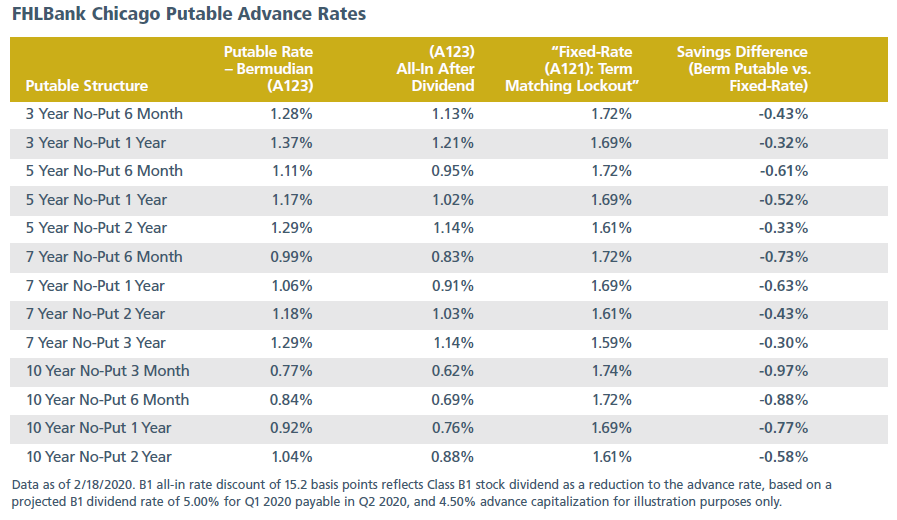

Swap spreads (the difference between the swap rate and the Treasury rate of the same term) remain tight. Members can benefit from these tight long-term swap spreads by utilizing a swap-plus-rolling advance strategy, in which a member takes out a 3-month advance from FHLBank Chicago and also enters into a pay-fixed swap with a broker/dealer or FHLBank Chicago. At the end of each three-month period, the member rolls the advance for another three months. This strategy can lower funding costs for members by giving them near (or even below) swap-rate funding for longer terms.

For interim funding, a member can take out a low-cost putable advance, such as the 10-year maturity, no-put 3-month advance. In this strategy, if rates rise in the following three months, the 10-year no-put 3-month advance will likely be put, but the member will have locked in low-cost funding via the forward-starting swap and can roll a 3-month advance

when the swap settles to create a fixed-rate-with-floating-spread strategy. Alternatively, if rates fall, the putable advance will extend in duration and will likely not be put. Note that this strategy requires setting up and using swap lines, as well as hedge accounting. For members who would like similar benefits without these requirements, FHLBank Chicago’s Fixed Rate With Floating Spread Advance (A126) is a single product that functions similarly to the swap-and-rolling advance strategy, and since no swap is involved, we believe it does not require hedge accounting.

Conclusion

While any of these strategies are good funding choices in the current environment, a relative value analysis will show that the optimal funding strategy depends not only on the environment, but also on the desired term of the funding.

Examining various strategies in an uncertain interest-rate environment should be part of a comprehensive and well-documented funding strategy aimed at NIM preservation and sound management of liquidity and interest-rate risk. A mix of FHLBank Chicago advances and core deposits provides our members with additional flexibility to implement a well-balanced strategy that optimizes funding portfolios.

To Learn More

Contact your Sales Director at membership@fhlbc.com to find out more about the products, strategies, and tools you can use to develop competitive lending solutions for your community and customers.

Contributors

James Hotchkiss

Director, Sales, Strategy, and Solutions

Ashish Tripathy

Managing Director, Sales, Strategy, and Solutions

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to

any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | March 2020