How the FHLBank Chicago Dividend Reduces Your Borrowing Costs: Q1 2020

The Dividend Effect

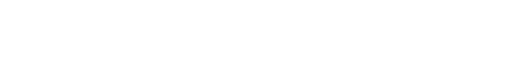

On April 28, 2020, the Federal Home Loan Bank of Chicago (FHLBank Chicago) declared a dividend on B1 activity stock at an annualized rate of 5.00% and on B2 membership stock at an annualized rate of 2.25%. The Bank pays a higher dividend per share on activity stock to reward members for using the Bank’s advances and, thereby, supporting the entire cooperative. The higher dividend received on Class B1 activity stock has the effect of lowering your borrowing costs.Key Takeaways:

- The FHLBank Chicago dividend reduces the "all-in" cost of borrowing an advance

- The FHLBank Chicago dividend represents a return on a member's investments

How Your Institution Gets More Savings from Advance Activity at the FHLBank Chicago

There are two types of capital stock— membership stock and activity stock. Members purchase membership stock to join and maintain membership in the FHLBank Chicago and receive the B2 dividend rate (which was 2.25% annualized for period ending Q1 2020) on that membership stock. As a member borrows in the form of advances, all but $10,000 of the B2 membership stock converts into B1 activity stock, which is required to support the advance borrowing. This B1 activity stock receives a higher dividend rate (which was 5.00% annualized for period ending Q1 2020). The dividend can be viewed as a discount on the advance rate— approximately 21 basis points (bps) based on dividends paid on May 14, 2020 by crediting your DID account. Based on current projections and assumptions about our financial condition and the economic outlook, we expect to maintain a 5.00% (annualized) level of dividend for Class B1 activity stock for the second quarter of 2020.

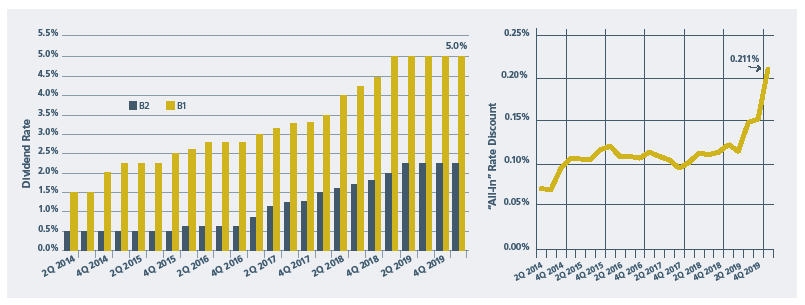

In Figure 2 below, the calculation behind the 21 bps savings is shown. As of April 28, 2020, the interest cost on a $5 million one-year advance with a fixed-rate of 0.47% is $23,826. The advance requires the purchase of activity stock equal to 4.5% of the advance, and the earnings on which are $11,250 when you take into account the 5.00% B1 activity stock dividend. Assuming a Primary Credit Rate of 0.25% as an alternative investment purchase, the net benefit from the activity stock is reduced. Overall, this reduces the interest cost of the advance from $23,826 to $13,147. Consequently, the “all-in” interest rate on a $5 million one-year, fixed- rate, fixed-term advance is reduced from 0.47% to 0.26%. This equates to the 21.1 basis point “discount” based on dividends payable in Q2 2020.

Other Considerations

Members who can earn significant alternate investment yields should consider our Reduced Capitalization Advance Program (RCAP), which requires a 2% activity stock investment instead of 4.5%, based on terms and conditions.

Summary

In summary, an FHLBank Chicago member receives savings on advance rates after taking the B1 dividend into consideration.

To Learn More

Visit the Solutions section of eBanking to read How the FHLBank Chicago Dividend Reduces Your Borrowing Costs white paper.

For further information, contact your Sales Director at membership@fhlbc.com to find out more about the FHLBank Chicago dividend rate and opportunities to lower your borrowing costs.

Contributors

Ashish Tripathy

Managing Director, Sales, Strategy, and Solutions

Jessica Nick

Senior Analyst, Sales, Strategy, and Solutions

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition,hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. Historical dividend rates provided for informational purposes only; future dividends at the Board’s discretion and subject to change.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | April 2020