Insurance Company Usage of FHLBank Chicago

Overview

The ongoing pandemic and associated financial market disruptions have led to increased usage of the Federal Home Loan Bank of Chicago (FHLBank Chicago) by our insurance members. Some of these uses have been more traditional, such as using an advance for a tactical asset purchase or a spread strategy, or using an advance to keep cash balances low in order to stay fully invested in this era of extremely low yields.

Some of the more interesting non-traditional uses of the FHLBank have centered around topics like funding a pension deficit with a low cost advance to save the member significant annual Pension Benefit Guaranty Corporation (PBGC) fees. We have also seen members use the Bank as an alternative to a public or private market debt financing - we are viewed as a reliable and low cost source of funding that is not subject to the significant financial market dislocations we experienced earlier in the year. Finally, an insurance member has used us to refinance a qualifying business loan with a low cost Community Investment advance. (We plan on publishing another whitepaper later this year addressing this topic.)

This whitepaper will focus on three of the most relevant topics for our members:

- Pension Funding Solutions

- Spread Investing Strategies

- Liquidity Management

- An Alternative To Debt Financing

Pension Funding Solutions

While many firms have moved away from defined benefit pension plans, some members continue to sponsor closed legacy plans or even active plans. In 1974, the Employee Retirement Income Security Act ("ERISA") was implemented establishing:

- Minimum funding requirements for pension plans

- The Pension Benefit Guaranty Corporation ("PBGC")

This regulation makes it expensive to maintain a pension deficit. In particular, there is an annual marginal fee of 4.5% charged by the PBGC on the deficit balance of sponsored pension plans. Interest rates are at or near record lows and FHLBank Chicago advances reflect this. Members can borrow from the FHLBank Chicago, fund the pension deficit and pay less in interest expense than they are currently required to pay in marginal fees to the PBGC.

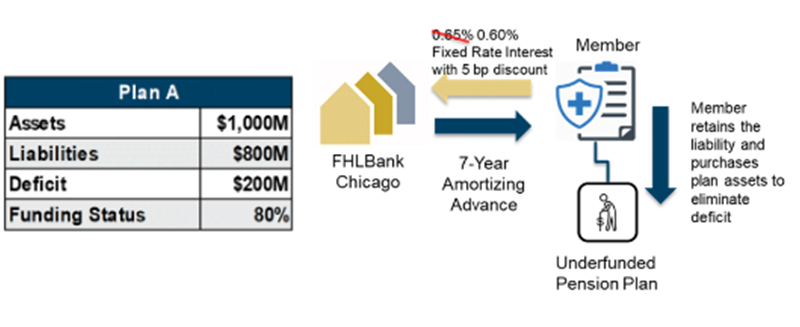

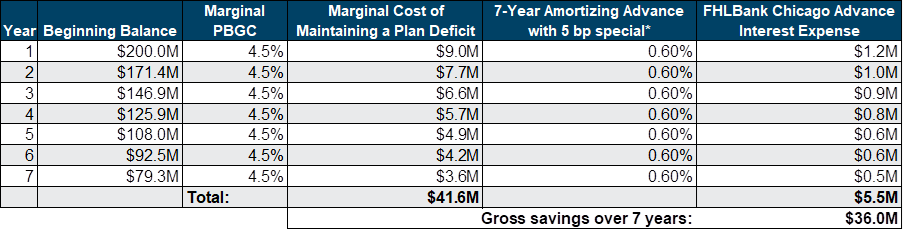

In a hypothetical scenario, Plan A shown below will be required to pay 4.5% incrementally on the $200M plan deficit, which is equal to a $9M annual expense. Alternatively, a member can use the FHLBank Chicago’s funding advantage to reduce this cost.

FHLBank Chicago offers competitive rates across various tenors and structures. For example,if the member sponsoring Plan A wants to amortize the $200M deficit over 7 years, they can borrow funds using an amortizing advance. Principal payments could be structured to match the planned pension fund contributions and instead of paying a 4.5% marginal fee to the PBGC, the member would fund the pension with the advance and pay a much lower rate of interest to the FHLBank Chicago. As of 10/26/2020, the 7 year amortizing advance was quoted at just 65bps. As shown in the graphic above, and the payment schedule below, Members can recognize significant savings while reducing their pension obligations. Additionally, using an amortizing advance between now and the end of the year allows members to take advantage of a 5 bp discount on all amortizing advances further reducing the all in advance rate to just 60bps.

*All Rates As of 10/26/2020

Spread Investing Strategies

With yields low and spreads tight, it has become increasingly difficult for insurance companies of all types to earn sufficient investment income. Over the last several months, we have seen a variety of insurance companies, but mainly our life members, pursue spread strategies to bolster investment income, at times as an adjunct to a securities lending program. Some of the most popular asset classes purchased have been CLOs, CMBS and corporate bonds. Whether or not the advance is imbedded in a funding agreement, spread trades should qualify for operating leverage treatment, assuming the cash flows of the asset and the advance are closely matched. The ability to tailor your advance to the exact specifications of the asset insure the cash flows mirror one another.

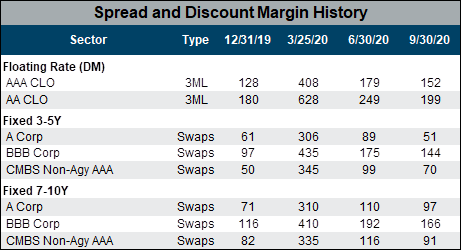

As spreads ballooned in the March/April time frame, some insurers were able to tactically identify attractive assets for purchase and utilize an FHLBank Chicago advance to fund the purchase. Municipal VRDNs, CLOs and CMBS were all purchased by our members as spreads hit all time wides in some cases. Indiscriminate selling led some high quality asset classes such as AAA CLOs to trade as wide as L+400, although trading volumes at these distressed levels was small. As can be seen in the table below, most asset classes have since recouped the majority of their COVID induced widening, but some are still trading at attractive levels and can be utilized effectively in a spread program.

Some examples of spread trades we have seen from our members:

- Using a 13week floating rate DN advance to fund the purchase of a AAA or AA CLO. With broadly syndicated CLOs trading around Libor + 130, you can take a 5 year 13week DN advance at today’s rate of 63 bps and match that versus the initial asset yield of 1.53% (L+130) and net 90 bps pre-tax. For those comfortable in the middle-market CLO space, a new AAA purchase could garner a yield of 2.30% (L+190), netting 167 bps pre-tax. For new issue CLOs, our flexible forward starting advances allow you to match the longer settlement period these typically have. In addition, a prepayable DN floater allows you to pay off the advance on the reset dates without a fee, giving you flexibility if the CLO is called or refinanced.

- Using a fixed rate advance to fund the purchase of CMBS. Currently, a AAA 5 year CMBS deal yields around 1.30%. Taking a fixed rate 5 year advance at 59 bps, match funded, nets 71 bps pre-tax. A $20mm investment would yield an additional $142,000 in pre-tax income for the member.

- Using an intermediate fixed rate advance which is then swapped to floating and used to match fund a floating rate asset. The attractive rates on our intermediate term fixed rate advances and on swaps have created the ability to formulate a synthetic floating rate advance that can be used to fund a floating rate asset. Assets purchased have included AAA CLOs.

- Using a 3 month O/N DN to fund the purchase of municipal VRDNs. Utilizing an O/N DN advance gave the member the flexibility to prepay at any time given the uncertain tenor of the assets.

- Using a callable fixed rate advance to fund the purchase of a fixed rate CLO. An intermediate term callable fixed rate advance was used by a member to purchase a fixed rate CLO. This allows the member to prepay the advance if the deal is refinanced after the initial lockout period.

Although not considered a spread trade, some members have taken advantage of our low short term fixed and floating advance rates to prefund a longer asset purchase, which we address in more detail in the next section. Members that know they have asset sales settling, or a cash infusion coming, can utilize an advance today to fund the purchase of an attractive asset.

Liquidity Management

The FHLBank Chicago offers reliable, low-cost funding for planned or unplanned operating and nonoperating liquidity needs. In situations such as the current pandemic, an advance can bridge cash-flow shortages or forestall the sale of investments at inopportune times or periods of market dislocation. Both our short term (out to 3 months) fixed and floating rate advances only cost around 25 bps, which when the dividend benefit is taken into account, means a cost of only 4 bps.

While most insurance companies have predictable ongoing liquidity, disruptions to normal cash flow patterns caused by events like the current pandemic can change that. Unexpected liquidity needs may be triggered when revenues are not received when expected, or larger-than-expected cash outflows occur due to many factors, including:

- Insurance claims following a catastrophe

- Tax payments

- Lawsuit settlements

- Equipment purchases

- Reinsurance obligations

- A change in acquisition payouts

Insurance companies may have a substantial portfolio of assets they can tap into to fund these needs; however, selling into a weak or illiquid market is often not the optimal solution. Utilizing an advance from FHLBank Chicago is a way to limit the need to sell into a weak market, avoiding potential losses and allowing assets to recover in value.

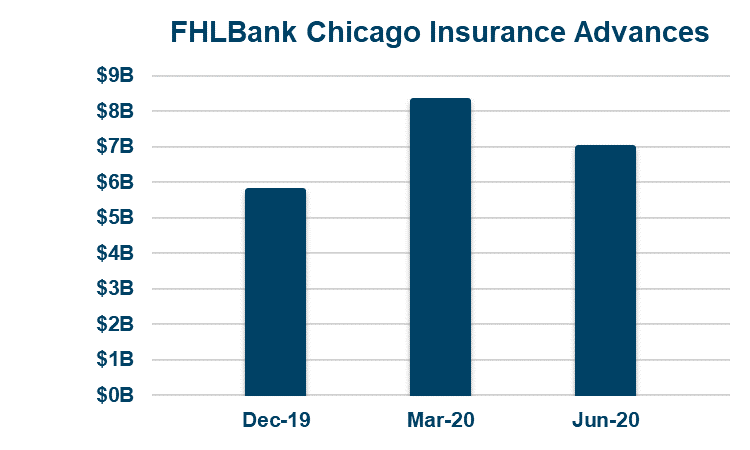

The chart below illustrates howinsurance companies have used the FHLBank Chicago for liquidity during the initial period of market disruption and claims uncertainty associated with the current pandemic. On March 31, 2020 advances among insurance companies increased $2.5 billion or 44% quarter over quarter, as companies wanted the assurance of having available cash on hand to help them manage the unknown. Once their liquidity needs became more predictable by June 30, 2020 these companies decreased advances to suit their needs. FHLBank Chicago was easily able to accommodate these needs and the liquidity needs of its other members as it did in the Financial Crisis of 2008.

Even in the best of times, FHLBank Chicago can be part of the overall liquidity planning of a company that provides a low-cost funding mechanism for a liquidity pool shared by an insurance company’s subsidiaries. The pool can help maintain a free flow of cash within the organization, and use of the FHLBank Chicago advance can help establish a market-determined rate for accounting purposes.

An Alternative To Public or Private Debt Financing

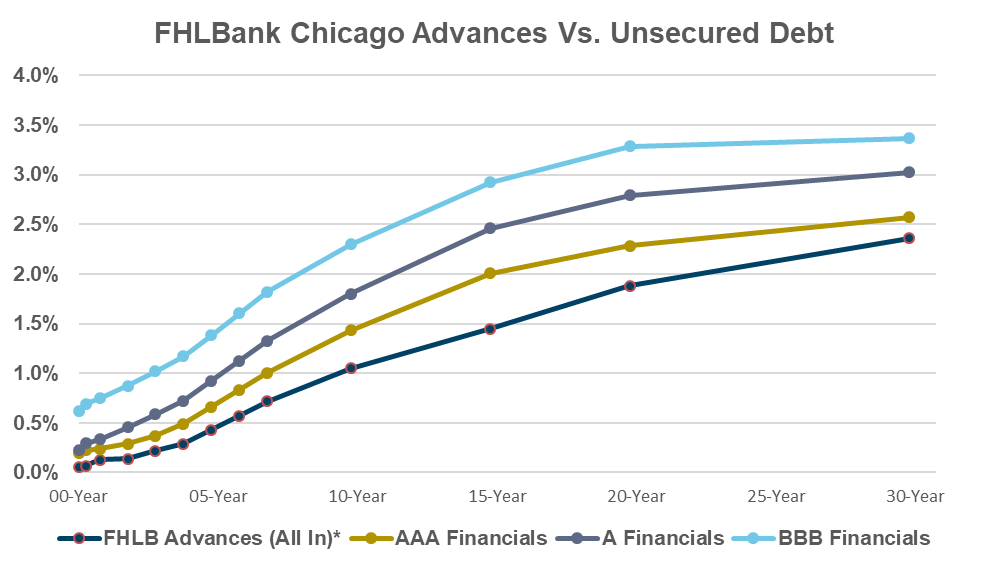

With corporate spreads having come in from the recent wides, and the investment grade corporate market seeing record issuance, some members may entertain going to the public or private debt markets for financing. While understandable, the other elements of a debt transaction (documentation, legal reviews, conference calls and roadshows) can be a hurdle that narrows the financing window. With FHLBank Chicago, you can be assured of financing in whatever size you’d like, in tenors out to 30 years, whenever you feel the timing is right. FHLBank Chicago can finance you even in the most challenged markets, when a public or private debt financing might not be possible.

As can be seen from the table below, a AAA rated issuer would need to pay a premium to fund in the public markets versus where they could borrow from the FHLBank Chicago. Granted, our borrowings are collateralized, but some members have found this an attractive alternative when pledging asset classes that typically don’t trade regularly. In the process, they can save quite a bit of money.

To Learn More

Contact your Sales Director or email membership@fhlbc.com for more information on this strategy or other tactics to assist your institution.

Contributors

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions.