Letters of Credit for Insurance Companies

April 1, 2022

Overview

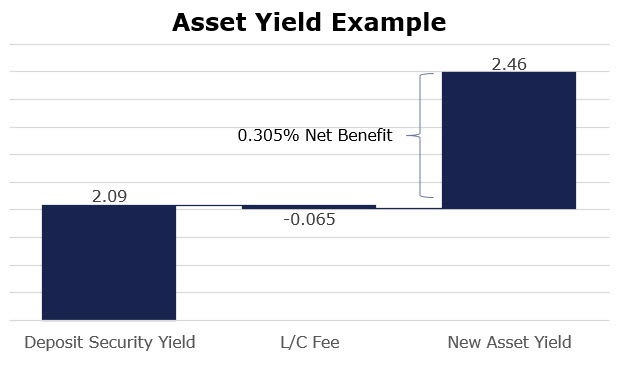

A letter of credit from the Federal Home Loan Bank of Chicago (FHLBank Chicago) may be issued to a third-party beneficiary on a member’s behalf as an independent guarantee of its obligation to a third-party beneficiary. Letters of credit are commonly used for guarantees of lease payments, insurance premiums, or legal judgment payment, or by counterparties under swap agreements.

Members frequently use FHLBank Chicago letters of credit as a substitute for collateral (e.g., securities or cash) they are required to pledge to a third-party regulatory beneficiary. For an insurance company member, the third-party beneficiary may be a federal or state regulatory authority (such as a state-specific department of insurance, a workers’ compensation board, or a federal agency).

Benefits of FHLBank Chicago Letters of Credit

- FHLBank Chicago’s Aa1 rating (as of May 19, 2025) makes its letters of credit product ideal for situations that require a letter of credit from a highly rated institution.

- FHLBank Chicago letters of credit are competitively priced.

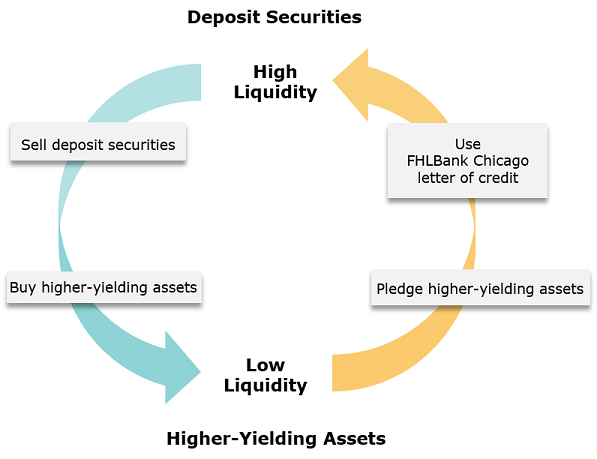

- FHLBank Chicago letters of credit are a cost-effective way to manage investment allocation—for example, by permitting reinvestment of low-yield securities that otherwise would have been posted as collateral to secure an obligation.

- FHLBank Chicago letters of credit are operationally convenient and offer easier access to underlying collateral than securities pledged directly to third-party beneficiaries.

- While letters of credit must be collateralized, FHLBank Chicago offers greater flexibility than third-party beneficiaries in the types of assets a member may use to collateralize its obligation. Example: Special Regulatory Deposit Replacement

Example: Special Regulatory Deposit Replacement

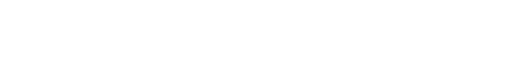

FHLBank Chicago provides greater flexibility to members in the collateral types that may be pledged to secure their letter-of-credit obligations. By substituting collateral pledged to third-party beneficiaries with collateral pledged to the FHLBank Chicago, members gain greater flexibility to reallocate the distribution of their investment portfolios and potentially earn income from higher-yielding assets, such as mortgage-backed securities.

For instance, suppose an insurer pledges 5-year U.S. Treasury securities for its state-specific statutory requirement to guarantee its performance of workers’ compensation insurance obligations. This collateral pledge requires the insurer to hold more Treasurys than it might otherwise desire. As an alternative, the insurer may substitute its 5-year Treasury securities with an FHLBank Chicago letter of credit. This substitution would provide the insurer flexibility in managing its investment portfolio according to its preferences—for example, by selling its Treasury assets and purchasing higher-yielding 5-year mortgage-backed securities, which in turn it might pledge to securitize the issuance of the FHLBank Chicago letter of credit.

To Learn More

Contact your Sales Director or email membership@fhlbc.com to learn more about how your insurance company may benefit from FHLBank Chicago letters of credit.

Contributors

| Bruce Cox Director, Client Strategy Sales, Strategy, and Solutions | |

| Ashish Tripathy Managing Director Sales, Strategy, and Solutions |

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content and offerings presented on its website. Mortgage Partnership Finance,” “MPF,” “MPF Xtra,” and “eMPF” are registered trademarks of the Federal Home Loan Bank of Chicago.