LIBOR Transition Update

Overview

The heightened risk that LIBOR will no longer be available or representative beyond 2021 makes it critical that market participants prepare to transition to alternative rates. While progress continues in the Alternative Reference Rate Committee’s (ARRC) paced transition plan, ARRC and the Financial Conduct Authority (FCA), LIBOR administrator’s regulator, have stressed the importance for all institutions to be prepared to transition to alternative rates across areas impacted by the impending cessation of LIBOR. The Secured Overnight Financing Rate (SOFR) has been selected by ARRC as the preferred alternative to USD LIBOR. To date, the transition has focused on addressing new and legacy contracts referencing LIBOR through incorporation of fallback language; developing sufficient cash and volume in the SOFR-based derivatives markets; and operational requirements to successfully adopt SOFR without significant disruption to market stability.

This paper is part of a series of LIBOR-related papers from FHLBank Chicago. You may find it helpful to read the other papers before this one for sufficient background knowledge. The first is a primer and the second a whitepaper found on www.fhlbc.com/solutions/libor-transition.

Key Takeaways

- Recent Significant Transition Developments

- Developing a Market for SOFR

- FHLBank Chicago-related LIBOR and SOFR Developments

Key Transition Developments

The ARRC's transition plan has addressed three primary segments to date:- Cash Products (business loans, floating-rate notes, securitizations, and consumer products)

- Derivatives (interest rate swaps, forward-rate agreements, and cross-currency agreements)

- Supporting Functions (regulatory, legal, tax, accounting, and technology implications)

Considerable work has been done in each of three primary areas that members should be aware of and further consider how these developments may affect your institution. Significant transition developments in the fourth quarter of 2020, across these areas, are detailed below:

- On December 4, 2020, In response to the LIBOR administrator’s, Intercontinental Exchange (ICE) Benchmark Administration’s (IBA), announcement of its intent to seek consultation on LIBOR cessation, the Federal Reserve Board, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency (the Agencies), issued a joint statement regarding the transition from LIBOR. The statement encouraged banks to stop entering into new LIBOR contracts no later than December 31, 2021. However, the Agencies listed certain circumstances in which it would be appropriate to enter into LIBOR-linked contracts in the event USD LIBOR is published beyond December 31, 2021. In order to support the many outstanding legacy contracts still tied to LIBOR, regulators supported the continued publication of the overnight, 1M, 3M, 6M and 12M tenors through June 30, 2023. This date would allow most legacy contracts to mature while new issuances in 2021 should either utilize a different reference rate or have robust fallback language. The IBA subsequently released a consultation on this proposal to cease 1-week and 2-month USD LIBOR publications after December 31, 2021 and continue to publish the remaining tenors through June 30, 2023. The consultation is open for feedback until January 25, 2021, after which the IBA will release comments and a final consultation. The FCA also supported the proposed timeline, noting it would incentivize a quick transition, while also allowing time to address a significant portion of legacy contracts.

- On October 29, 2020, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) to clarify the scope of its reference rate reform guidance, intended to ease the potential accounting burden related to the transition. The amendments provide temporary, optional expedients and exceptions for applying generally accepted accounting principles (GAAP) to contract modifications and hedging relationships affected by the discounting transition on derivatives (see below event on October 16, 2020).

- On October 23, 2020, ISDA (International Swaps and Derivatives Association) launched its 2020 IBOR Fallbacks Protocol (Protocol) and Supplement to the ISDA 2006 Definitions (Supplement), which will take effect on January 25, 2021. The Protocol permits adhering market participants to incorporate LIBOR fallbacks in legacy non-cleared derivative contracts in the event of a LIBOR cessation or non-representativeness. The Supplement includes robust LIBOR fallback language for all new derivative transactions executed on or after January 25, 2021. All 11 of the FHLBanks adhered to the new Protocol in October 2020.

- On October 16, 2020, the Chicago Mercantile Exchange (CME) and London Clearing House (LCH) successfully converted discounting and price alignment interest (PAI) from Fed Funds (EFFR) to SOFR on all outstanding, cleared swaps, an event nicknamed the “Big Bang.” Over $80 trillion of notional swaps was estimated to be transitioned at the time. All new swaps executed since have used SOFR for discounting.

- On September 3, 2020, the ARRC released an updated version of its recommended Best Practices to help market participants prepare for the LIBOR transition. The release provides targeted timelines for the transition from LIBOR to SOFR for floating-rate notes, business loans, consumer loans, securitizations, and derivatives.

The SOFR Market

The market for SOFR continues to develop across daily transaction volume, floating rate debt instruments, and swaps and futures trading volume.

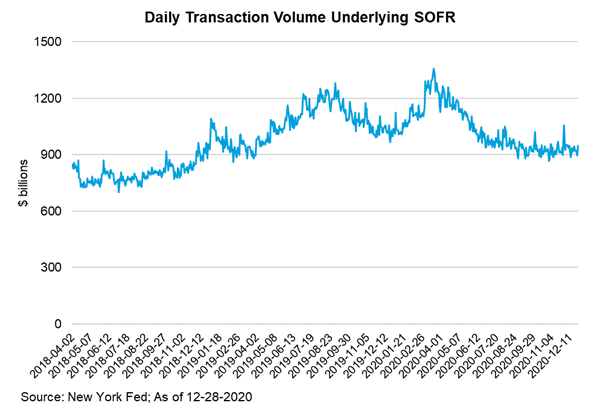

Since SOFR was first published in April 2018, daily transaction volume has averaged nearly $1 trillion with a wide range of market participants regularly transacting. These participants include asset managers, banks, insurance companies, money market funds, pension funds, government sponsored entities, and more. The breadth of the SOFR market, directly and indirectly, through the Treasury repo market, positions SOFR to reflect a deep, liquid, and broad market over time.

Source: ARRC FAQ

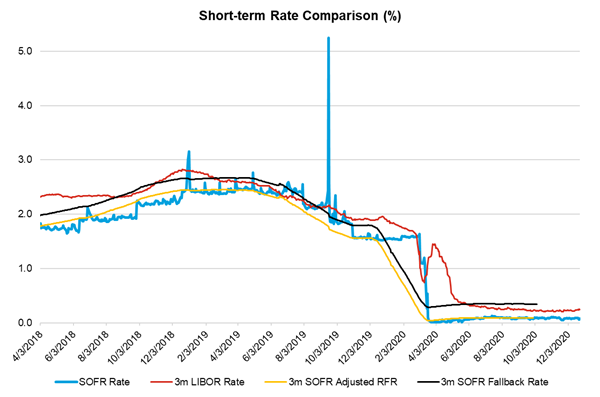

SOFR has generally been more volatile than other short-term interest rates on month- and quarter-ends due to fluctuations in demand in the repo market. SOFR is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities and is designed to capture this underlying market activity in its rate. While SOFR is inherently more volatile than other term rates on a day-to-day basis, this volatility has generally smoothed out on a 3-month rolling basis, in comparison with 3-month LIBOR.

Source: ARRC; as of 12/28/2020

Beginning in July 2020, Bloomberg began calculating and publishing fallback rates to LIBOR, consistent with ISDA’s fallback language in its Protocol and Supplement. The fallback rate is made up of two components: the adjusted risk-free reference rate (RFR) and a spread adjustment. Because LIBOR is available in multiple tenors, while SOFR is an overnight rate, SOFR is compounded daily in arrears over an accrual period corresponding to the LIBOR tenor. Second, because LIBOR incorporates a bank credit risk premium, while SOFR is secured by U.S. Treasury securities, a spread adjustment is added to the adjusted RFR. The spread adjustment is calculated as the median spread between the corresponding tenor of LIBOR and the adjusted RFR over the preceding five years from the date a cessation trigger (permanent discontinuation of LIBOR) or pre-cessation trigger (non-representativeness of LIBOR) event occurs.

The graph above shows the SOFR vs. 3-month LIBOR vs. Bloomberg’s 3-month SOFR adjusted RFR vs. Bloomberg’s 3-month SOFR fallback rate (adjusted RFR plus spread adjustment). For more information on these calculations, visit Bloomberg’s fact sheet.

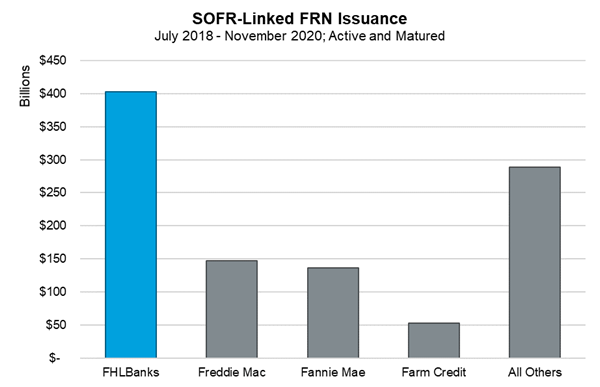

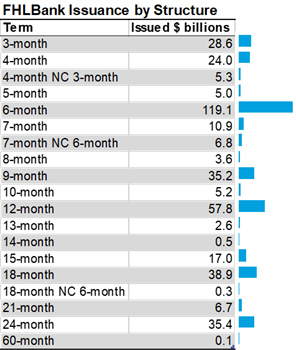

The FHLBank System continues to lead the market as the top issuer of SOFR-linked floating rate notes (FRNs), supporting the development of the SOFR-linked FRN market and its liquidity. In the 11 months ending November 30, 2020, the FHLBank System issued over $250 billion in SOFR FRNs. While issuance remains concentrated in the 6-month to 12-month terms, the FHLBank System issued its first five-year FRN in October. Across all issuers in the market to date, issuance of FRNs has also grown in longer maturities, with three 30-year FRNs issued in 2020 by large banks.

Source: Bloomberg; FHLBank Office of Finance as of 11/30/2020

Other areas of the SOFR market have also continued to develop. Fannie Mae and Freddie Mac have launched new SOFR-based products and stopped purchasing LIBOR-based loans as of December 31, 2020. Fannie Mae began accepting delivery of single-family SOFR-indexed adjustable rate mortgages (ARMs) in August 2020 and began accepting multifamily SOFR ARMs in October 2020. Fannie Mae then issued the market’s first-ever multifamily and single-family mortgage-backed securities backed by SOFR ARMs on September 10, 2020 and October 23, 2020, respectively. Freddie Mac priced its first Structured Pass-Through Certificates (K-Deals) with a class of floating rate bonds indexed to SOFR in December 2019. In the 20 K-Deals it has issued since, the bonds were backed by floating-rate multifamily mortgages indexed to LIBOR. In December 2020, Freddie Mac announced its latest offering would include floating rate bonds indexed to SOFR and be backed by underlying mortgages also indexed to SOFR.

Freddie Mac began issuing SOFR-indexed single-family credit risk transfer (SF-CRT) deals in October 2020. The first transaction was a $1.1 billion real estate mortgage investment conduit. These deals will initially use a 30-day average SOFR but will transition to a 1-month term SOFR when available. Finally, both firms began offering SOFR-indexed collateralized mortgage obligations in July 2020, where Freddie stated $1.2 billion had been issued to date as of December 17, 2020.

Following the “Big Bang” transition of swap discounting to SOFR in October 2020, there was a notable increase in SOFR swaps volume. Monthly volume in cleared SOFR swaps trading exceeded $700 billion in October 2020, above the prior peak of about $400 billion set in September 2020 according to LCH and CME data. SOFR futures open interest and volume has also grown since 2018, but they still lag behind Eurodollar and Fed Funds Futures. Trading currently exists for 1-month and 3-month SOFR futures.

FHLBank Chicago Developments

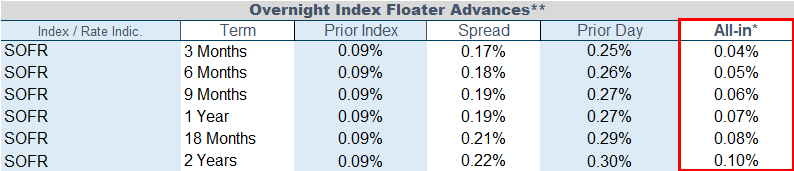

FHLBank Chicago continues to provide its members with attractive funding alternatives to LIBOR. For members looking to execute floating-rate advances linked to alternative reference rates, FHLBank Chicago developed the A300 SOFR Floater Advance, indexed to SOFR. Currently, you can find rates on our rate sheet with up to two years maturity, though advances with two to ten year maturity may be priced upon request:

Source: FHLBank Chicago rate sheet; as of December 29, 2020; indications only

The SOFR Floater Advance is a fixed term, floating rate advance indexed to SOFR plus a fixed spread. The rate is reset daily according to the published SOFR rate from the Federal Reserve Bank of New York. The all-in advance rate, which is the floating index plus a fixed spread minus the dividend benefit, has become very attractive in the current environment. As the Federal Reserve has indicated that it intends to keep interest rates lower for a prolonged period, looking to increase inflation above 2%, members may find it beneficial to lock in low, short- to medium-term floating rate funding. Members may also pair SOFR floating-rate advances with SOFR interest rate swaps in a cash flow hedge relationship. This can create long-term synthetic funding at lower costs and hedge other comprehensive income, or OCI, losses from available for sale securities if interest rates rise.

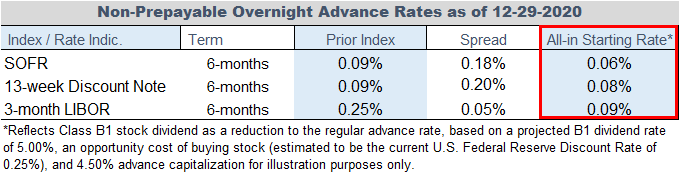

The SOFR Floater Advance gives members a competitive all-in rate, in line with other floating-rate advances offered, such as the LIBOR floater and Discount Note floater advances.

Source: FHLBank Chicago rate sheet; as of December 29, 2020; indications only

Refer to the Member Product Guide for full product terms and conditions of these advances.

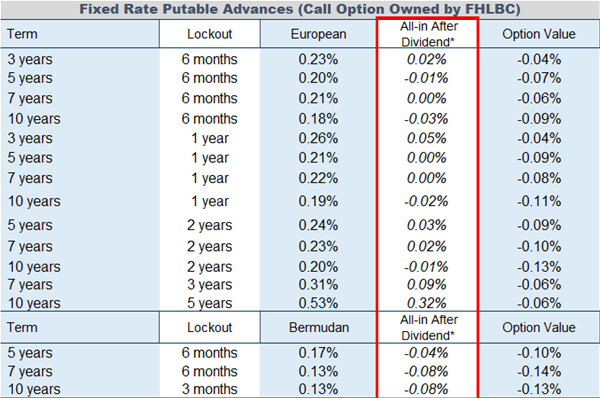

FHLBank Chicago has also taken steps to offer advances with embedded options that previously referenced LIBOR and/or were hedged using LIBOR. The A123 Putable Fixed Rate Advance is now available across maturities, as we have found a successful Overnight Index Swap based hedge. Many FHLBank Chicago members use putable fixed-rate advances in a blended funding strategy to achieve an overall lower cost of funding.

All-in advance rates, net the 5.00% activity stock dividend* benefit, are negative for many of these advance structures in the graphic to the right. Members may be able to lock-in negative, upfront funding for up to six months during the advance’s fixed lockout period. After the fixed lockout period, FHLBank Chicago may put, or terminate, the advance prior to maturity on predetermined option exercise dates.

*Reflects Class B1 stock dividend as a reduction to the regular advance rate, based on a projected B1 dividend rate of 5.00%, an opportunity cost of buying stock (estimated to be the current U.S. Federal Reserve Discount Rate of 0.25%), and 4.50% advance capitalization for illustration purposes only.

To Learn More

Contact your sales director or email membership@fhlbc.com if you want to learn more about the LIBOR transition or advance strategies using alternative reference rates to lower your all-in cost of borrowing.

Contributors

|

Jessica Nick Senior Analyst Sales, Strategy, and Solutions |

|

Ashish Tripathy Group Head Sales, Strategy, and Solutions |

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. This paper may provide relevant links to other outside web sites unrelated to FHLBank Chicago. FHLBank Chicago is not responsible for such linked sites nor the content of any of the linked sites. You understand that when going to a third-party web site, that site is governed by the third party’s privacy policy and terms of use, and the third party is solely responsible for the content and offerings presented on its website.

There are associated risks with options. Because the FHLBank Chicago owns the option to terminate the advance prior to final maturity, the actual duration of the advance may be significantly lower than the stated maturity of the advance. Likewise, the FHLBank Chicago may not execute the put option, and the advance will be held to maturity in the case of falling interest rates. Contact your own accountants and attorneys before executing an A123 Putable Fixed Rate Advance.

Not all advance types are suitable for all members. Members must be aware of and understand the market and operational risks that are associated with advances with embedded options. Contact your accountants and attorneys before executing an advance with embedded options. Certain advances such as those that contain call or put options, interest rate caps, collars or floors, or other rate, term, or payment variations may require the acknowledgement of or execution of disclosure statements in which a member represents that it understands the risks associated with a particular advance.