Maximize Your Secondary Market Income

May 19, 2021

Key Takeaways

- As benchmark interest rates have sold off in 2021, institutions may be seeing a tighter spread on mortgage sales, creating new challenges for institutions looking to maximize non-interest income this year.

- Our Mortgage Partnership Finance® (MPF®) Traditional conventional/conforming products (MPF Original, MPF 125, and MPF 35) provide are an attractive secondary market option for members to recognize income both upfront at the time of sale and over the life of the loan in the form of Credit Enhancement (CE) Fee income and dividend income. MPF Traditional products have the added benefit of not charging Loan Level Price Adjustments (LLPAs).

- It is important to analyze the all-in prices of your secondary market outlets to find your best execution. FHLBank Chicago offers price comparison analyses to all members to assist in this decision making.

Overview

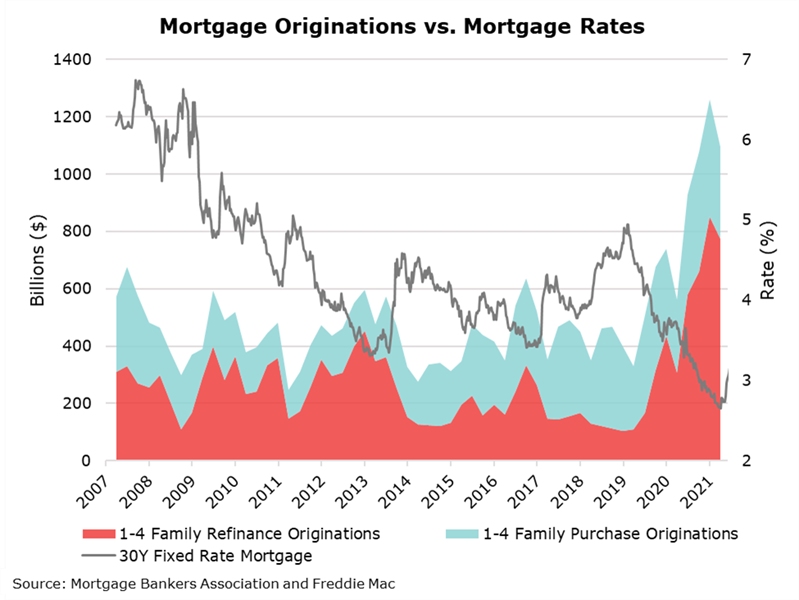

The housing market has been exceptionally resilient over the past year, despite challenges in other sectors of the economy. Mortgage rates fell to historic lows in the second half of 2020 and continued lower in the first weeks of 2021, reaching as low as 2.65% in early January. Prolonged, historically low mortgage rates have caused refinance activity to surge during this time. Data from the Mortgage Bankers Association (MBA) indicates the share of refinance activity in the fourth quarter jumped to nearly 70% of total mortgage originations, as seen in the figure below. Purchases have also fared well due to low mortgage rates, where an above-average pace of renters have converted to first-time homebuyers, according to data from Fannie Mae. Looking ahead to 2021, however, home purchases continue to be constrained by a lack of inventory, both in new construction and resales, and rapidly increasing home prices.

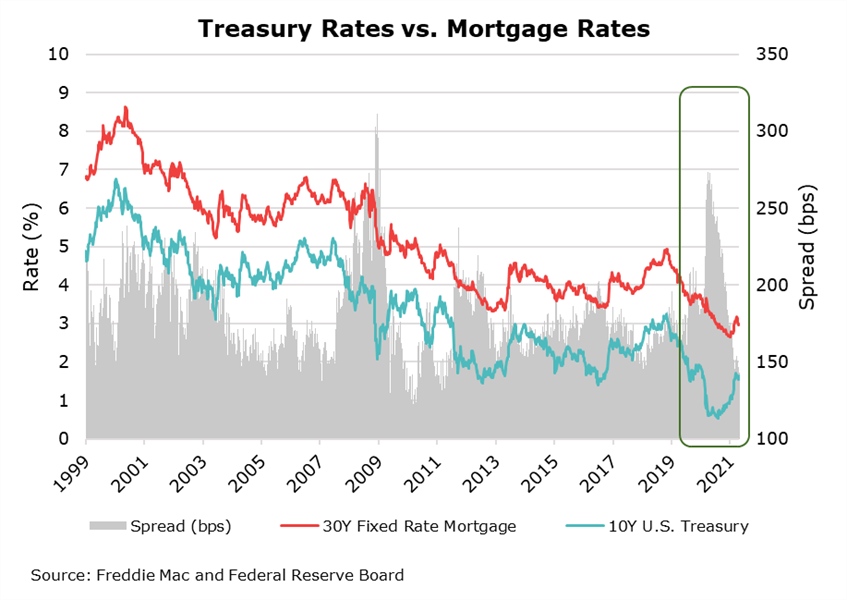

Because benchmark interest rates fell more rapidly in the spring of 2020 relative to mortgage rates, many secondary market sales were sold at very attractive spreads. As seen in the graph below, the spread between the 30-year fixed mortgage rate and the 10-year Treasury rate widened to nearly 275 basis points (bps). In 2021, however, both mortgage rates and Treasury rates have inched up, tightening the spread an institution may earn on a secondary market sale.

Competition has also contributed to lower margins for members. Some institutions have been choosing to leave newly originated mortgages on their balance sheets in order to soak up excess liquidity. The lack of housing inventory may also contribute to fewer purchase origination opportunities and more competition among lenders.

If spreads continue to tighten, non-interest income – of which mortgage banking fees constitute a significant portion for many institutions – is increasingly important. Consider reassessing your secondary market options today in order to maximize income in all future mortgage origination environments.

Through the MPF Traditional products, FHLBank Chicago can help your institution earn additional fee income, attract new customers, and obtain the best execution on selling loans into the secondary market.

Your Income Potential Through MPF Traditional Products

MPF Traditional products offer a competitive secondary mortgage market outlet for your conventional, conforming loans. The products offers attractive pricing for loans of good quality that may otherwise be penalized by LLPAs in other secondary market programs. Typically a secondary sale, regardless of the investor, requires LLPAs to cover the perceived risk of the loan being sold, compensating the investor for assuming that risk at sale.

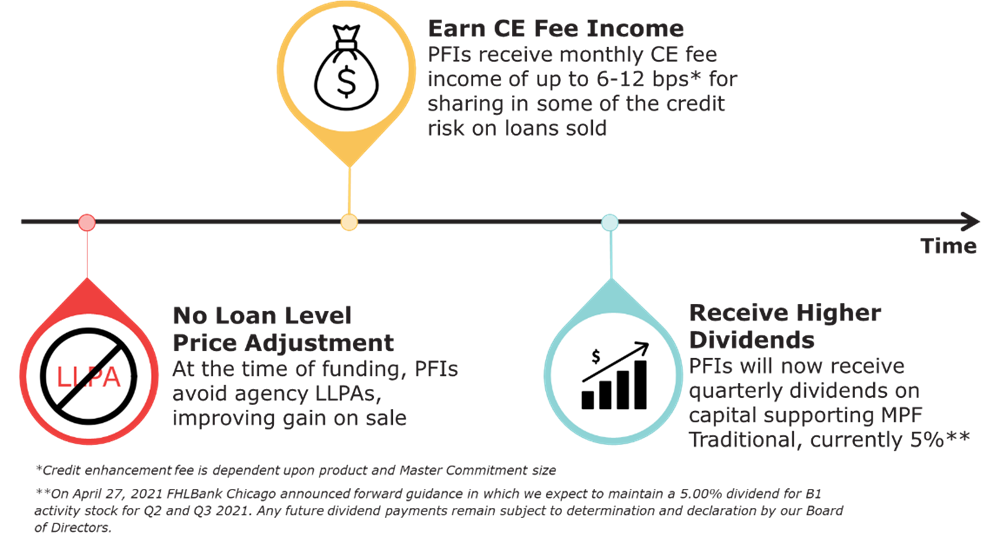

Because the MPF Traditional products charge no LLPAs, the member shares some of the credit risk for each loan sold into the MPF Traditional products. For sharing in this risk, your institution earns CE Fees of up to 6-12 bps* annualized, creating an additional income stream after the loan has been funded. This performance income continues through the life of the loan, as long as it remains on FHLBank Chicago’s balance sheet.

As FHLBank Chicago pays your institution CE Fee income and dividend income over time, MPF Traditional products can help your institution smooth earnings volatility over different economic cycles, especially during mortgage origination downturns. The graphic below illustrates the three sources of income members can earn through MPF Traditional products.

Beginning May 3, 2021, all new MPF Traditional products Master Commitments (MC) will require capital stock purchases. FHLBank Chicago will require capital stock of 2% of the Unpaid Principal Balance (UPB) of all loans sold into the MC at the time of funding. The required capital stock, however, will be reassessed as the principal balance of these loans declines over time.

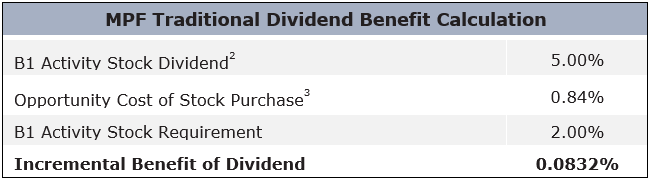

By holding additional B1 activity stock for MPF on-balance sheet products, members gain the added benefit of receiving quarterly dividend income on that stock. FHLBank Chicago pays a higher dividend per share on activity stock to reward members for using the Bank’s products and, thereby, supporting the entire cooperative. On April 27, 2021 FHLBank Chicago declared a dividend on B1 activity stock at an annualized rate of 5.00% and announced forward guidance in which we expect to maintain this rate through Q3 20211. The incremental benefit of the dividend paid on a loan sold into the MPF Traditional products is shown below.

Please visit our website for more information on our recent capital plan changes.

Consider the All-in Execution of Your Secondary Mortgage Sale

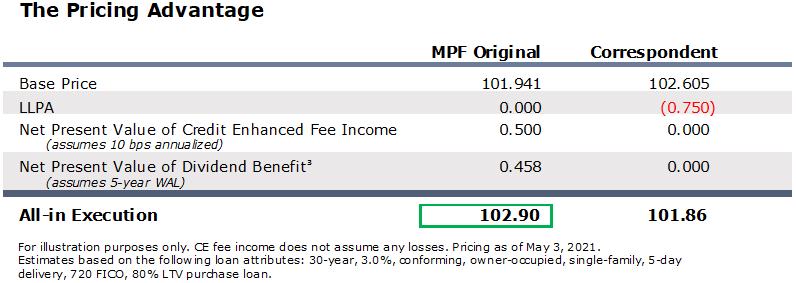

Although the dividend on your capital stock is paid out quarterly over the life of the loan, this benefit should be taken into consideration at the time of funding. Below we illustrate an example of the all-in execution on a loan members should consider when comparing programs. It is important to not only weigh the base price on programs, but also to look at the additional CE fee income and dividend income earned over the life of the loan.

When considering the additional ancillary CE fee income and dividend income earned on loans sold through the MPF Traditional products, the all-in execution can beat correspondents that charge LLPAs, even if offering a higher base price. FHLBank Chicago can provide the above pricing comparison for members to better compare your secondary market options.

Other features of the MPF Traditional products may also be attractive to your institution, such as same-day delivery and funding, low loan balance pricing grids, and a dedicated support staff. Reach out to your Sales Director to learn more about the benefits of the MPF Program.

How To Learn More

Contact your Sales Director to learn more about the benefits of the MPF Traditional products. If you would like a price comparison analysis completed on your mortgage volume either to an MPF product or to a non-FHLBank correspondent, contact your Sales Director to request one and learn more.

Contributors

|

Jessica Nick Senior Analyst Member Strategy and Solutions |

|

Ashish Tripathy SVP, Managing Director Member Strategy and Solutions |

1On April 27, 2021, FHLBank Chicago announced forward guidance in which we expect to maintain a 5.00% dividend for B1 activity stock for Q2 and Q3 2021. Any future dividend payments remain subject to determination and declaration by our Board of Directors.

2Assumes a B1 activity stock dividend of 5.00% (annualized). This analysis assumes the dividend remains constant through the life of the loan. Any future dividend payments remain subject to determination and declaration by the Board of Directors.

3Opportunity cost of stock purchase assumed at the published Treasury rate closest to the weighted average life of the loan; as of May 3, 2021

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. Mortgage Partnership Finance", "MPF", "eMPF", "MPF Xtra" and "eMAQCS" are registered trademarks of the Federal Home Loan Bank of Chicago. The "MPF Mortgage Partnership Finance" logo is a trademark of the Federal Home Loan Bank of Chicago.