MPF® Original Credit Enhancement Reset Changes

June 11, 2025

Overview

Learn how recent changes to the MPF Original product’s credit enhancement (often referred to as CE) reset schedule can help participating financial institutions (PFIs) reduce their risk exposure, lower capital requirements, and increase liquidity. This update is essential for PFIs looking to optimize their balance sheets and enhance compliance flexibility while continuing to participate in the MPF Traditional products.

Understanding Credit Enhancement

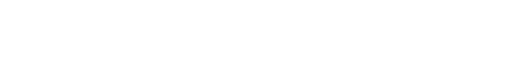

With the MPF Traditional products, PFIs transfer liquidity, interest rate, and prepayment risks and share in the credit risk of the mortgage loans they sell under the Mortgage Partnership Finance® (MPF) Program. In turn for sharing the credit risk, the PFI does not pay loan-level price adjustments and earns additional credit enhancement income.

The initial layer of protection in the credit risk sharing structure is the first loss account (FLA). The FLA is provided by the Federal Home Loan Bank (FHLBank) and acts as an initial buffer to protect against any losses on mortgage loans.

The next layer of protection is the PFI credit enhancement obligation. The PFI credit enhancement obligation is a contingent liability, used only when losses occur that are not covered by the borrower’s equity, private mortgage insurance (PMI) or the FLA. The PFI credit enhancement obligation amount is defined on the master commitment (MC) agreement and is the maximum amount of realized credit losses for which a PFI can reimburse the FHLBank. Typically, this amount is determined by the credit characteristics of the loans sold. It is worth noting that the FHLBank does not set aside amounts to fund the credit enhancement obligation, it is backed by pledged member collateral.

The visual below highlights the loss absorption profile for each product:

MPF Original Credit Enhancement Resets Enhancements

Each MPF Traditional products have scheduled CE obligation “resets” when the PFI credit enhancement obligation is recalculated. The scheduled recalculation benefits the PFI as it has the potential to reduce the amount of required collateral pledged and risk weighted assets the PFI is required to hold for a particular MC.

The MPF Original product previously had one scheduled credit enhancement reset 10 years after the MC was executed. However, effective May 1, 2025, any new MPF Original MC will reset five years after the MC’s “estimated completion date” and every five years thereafter.

Please note: MPF Original MCs executed prior to May 1, 2025, will continue to follow this ten-year reset schedule.

Benefits

As loan portfolios pay down, the updated methodology will lower the credit enhancement obligation, which will in turn reduce member exposure. Additionally, the changes can provide further benefits to PFIs:

- Reducing Risk-Based Capital: Reducing the credit enhancement obligation generally decreases the amount of capital PFIs are required to account for potential defaulted mortgages.

- Increased Liquidity: With less risk-based capital, funds can be invested in new opportunities.

- Greater Compliance Flexibility: Reducing the credit enhancement obligation can ease pressure on capital ratios PFIs are required by regulation to maintain.

Example

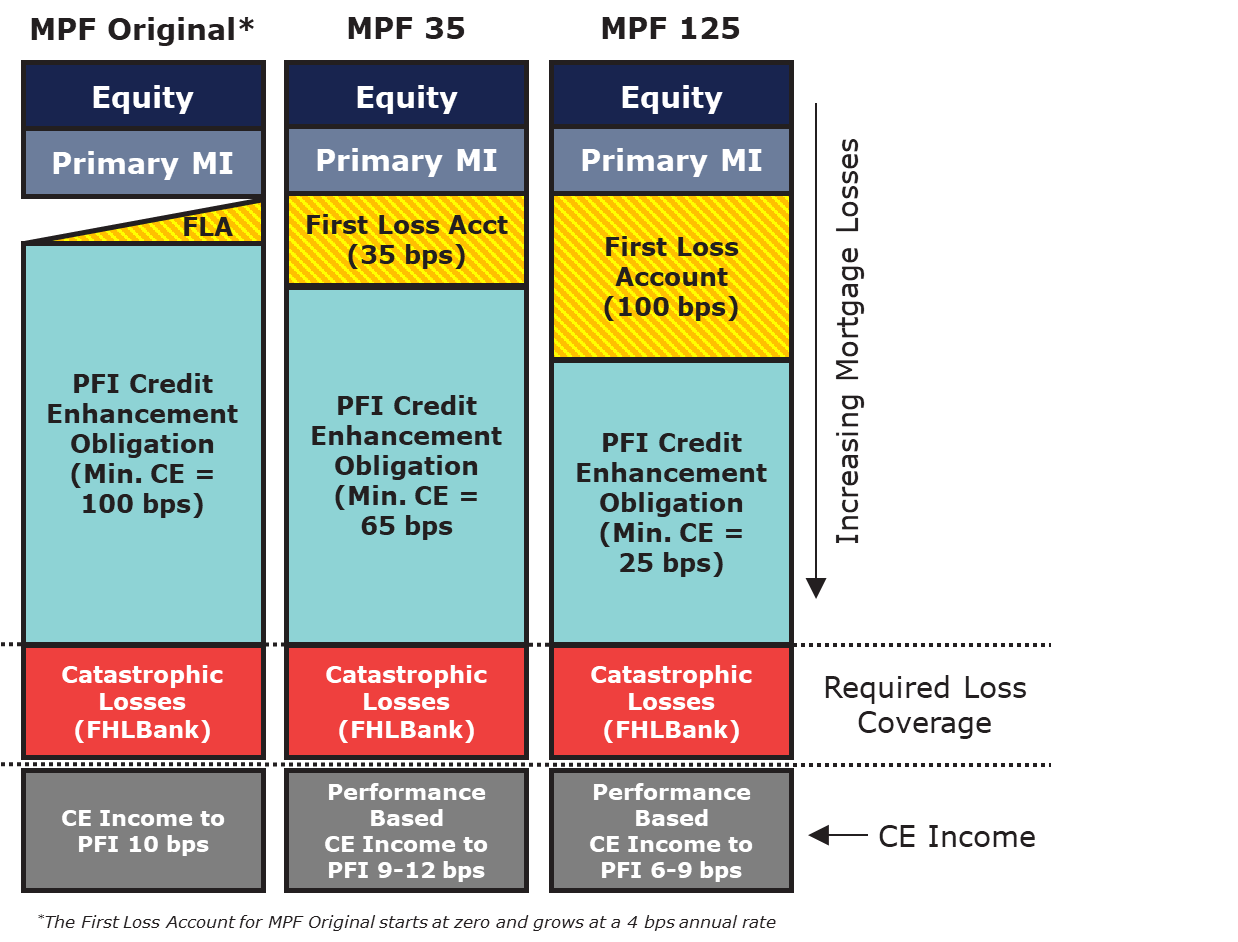

With the scheduled credit enhancement resets changing for the MPF Original product, the example below highlights what the changes would look like operating under the new reset cycle versus the old. In this example, we are assuming an MPF Original MC with $10 million in funding and a 3.5% credit enhancement obligation. The MC is filled/expired at the end of year one, so the first reset takes place at year six. As you can see in the graph below, following the prior methodology, there is one reset taking place at ten years, reducing the exposure only once. Following the new methodology, we see earlier and more frequent resets, which can reduce exposure at a much faster pace. Therefore, with shorter and more frequent resets, PFIs can more effectively manage credit risk while reducing both required collateral pledged and risk-based capital requirements.

MPF Traditional Products Credit Enhancement Resets

Below is a high-level comparison of the credit enhancement reset guidelines by product as they currently stand:

MPF Product | First CE Reset Timing | Subsequent CE Resets |

MPF Original | Five years after MC’s estimated completion date | Every five years |

MPF 125 | Ten years after MC agreement date | Every five years |

MPF 35 | Five years after MC expires or is filled (whichever is first) | Every year |

To learn more

Contact your Sales Director or MPF Sales at mpfsales@fhlbc.com to learn more about the credit enhancement structure between different MPF products.

Contributors

|

| |

| Will McGrath SVP, Director, MPF Product Development Sales, Strategy, and Solutions | |

| Eric Bidlo AVP, MPF Sales Enablement Senior Analyst Sales, Strategy, and Solutions |

Disclaimer