Lock-In Funding Costs Ahead of Rising Rates

January 13, 2022

As we move into a new year, economic conditions remain volatile with heightened uncertainty in the air. However, what seems to be increasingly certain—at least from the market’s perspective—is that a low unemployment rate and rising inflation will pressure the Federal Reserve to begin tightening much sooner and potentially more rapidly than expected. Many of our members remain liquid, but as we approach the start of a new rate cycle, locking-in lower rates today ahead of the Fed’s actions, which could lead to higher net interest margins (NIMs) down the road, might make sense.

Market expectations for rate hikes from the Federal Reserve are changing rapidly. This is evident in the fact that in the last four weeks, market expectations for the first rate hike by the Fed have moved from September 2022 up to March of 2022. With better-than-even odds of the first rate hike now less than three months away, we have started to see upward movement in short-term advance rates for the first time in several years.

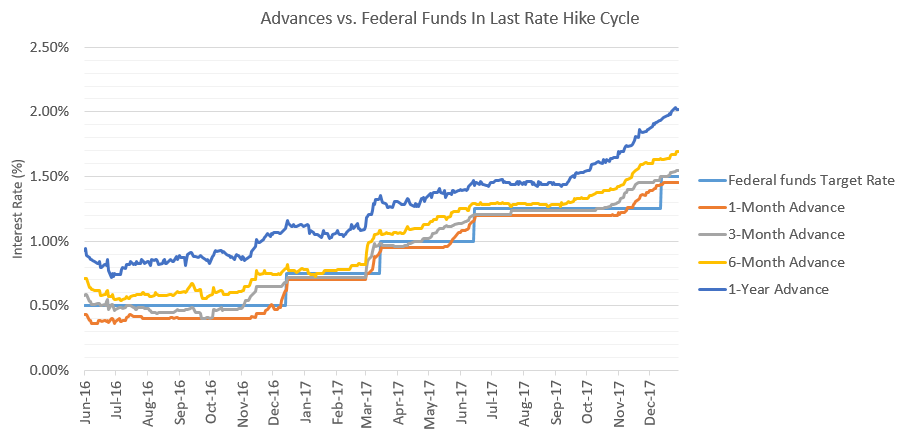

Looking back to the last rate hiking cycle can show the advantage of locking in term funding ahead of rate hikes. As the maturity of advances moves into the expected window of the next rate hike, advance rates start to climb ahead of rate hikes. The graph below shows advance rates compared to the federal funds rate from 2016-2017 when the FOMC announced hikes after the previous recession. Prior to rate hikes, longer-term advances priced in the adjustments sooner than shorter-term advances as is displayed with the 6-month advance consistently rising before 3-month and 1-month advances.

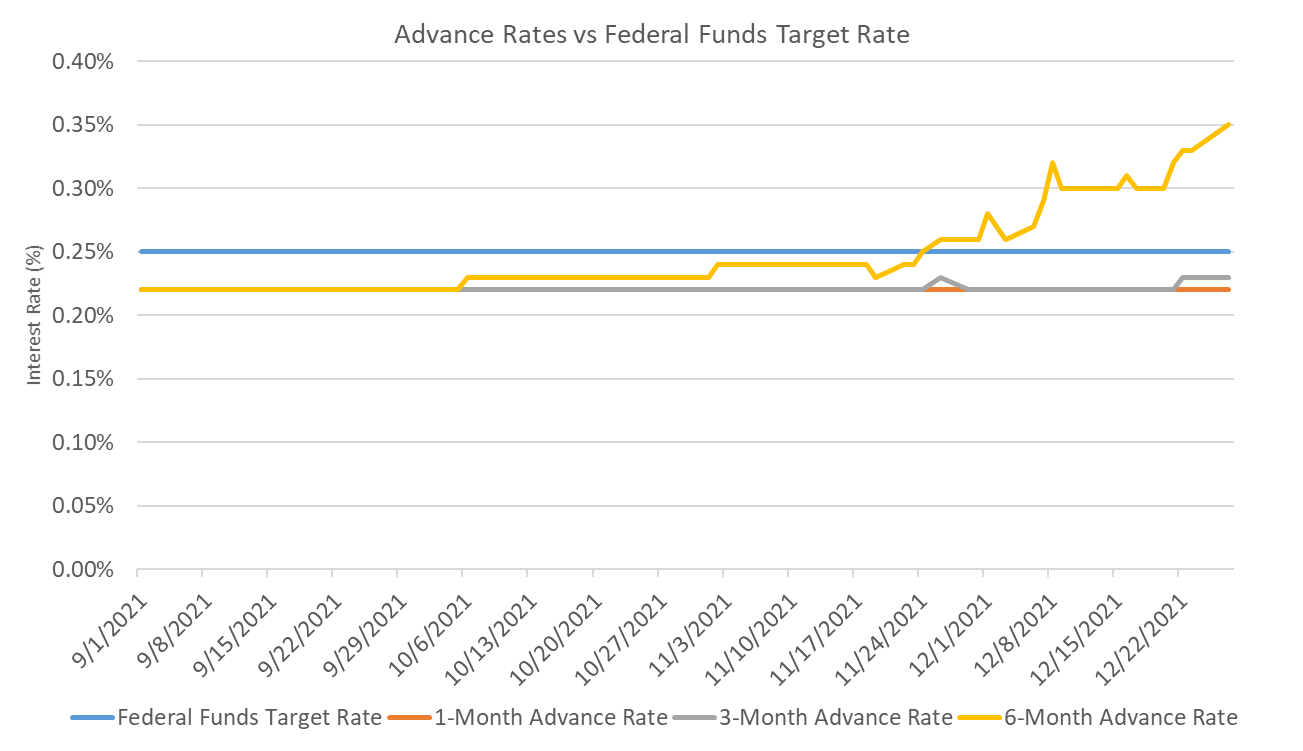

The graph below displays our recent advance rates compared to federal funds. Our 6-month advance rate has started to move higher for the first time since 2018 as the probability of an early 2022 rate hike rose at the end of 2021. According to the historical trend, we will see shorter-term rates follow suit as we move closer to upcoming FOMC meetings in March and June.

As rates begin to move higher, we present a funding tool that can be used to select optimal funding strategies. The inputs to this tool are the timing and number of rate hikes, current interest rates, and the historical relationship between advance rates and Fed rate hikes.

This concept can be extended over any time horizon and any amount of rate hikes. Below, we’ve provided examples for 6-month, 1-year, and 2-year horizons. The examples show a scenario that represents a more aggressive Fed action of four rate hikes in 2022 - one each in March, May, September, and December. Plus three additional hikes in 2023 - in March, June, and September.

The FED Hike Funding Tool, which was used to evaluate these scenarios, is available to members by contacting your Sales Director or our FHLBank Chicago Solutions team. The tool allows you to input today’s rates, select which FOMC meetings will have rate hikes or cuts, with the result showing which advance strategies are ideal in different rate scenarios.

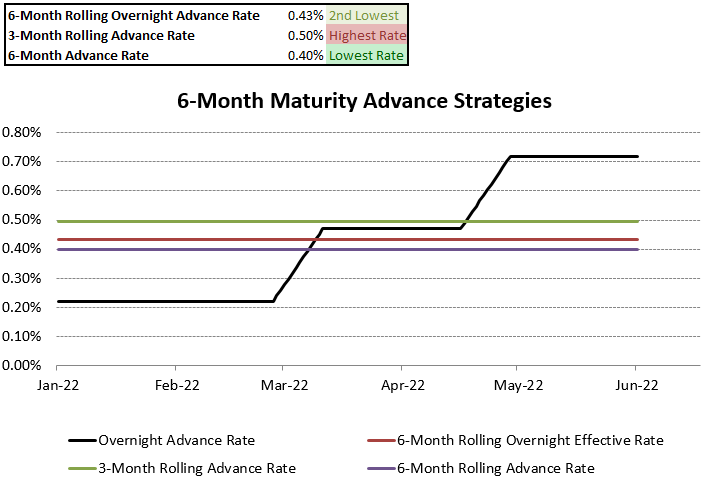

6-Month Funding Strategies

The graph below shows the Fed Funds rate as the FOMC hikes rates (black line) along with three advance strategies. In this scenario, the 6-month advance offers a locked in rate of 0.40%, saving the member 3 basis points (bps) over the expected cost of rolling an overnight advance for six months. With the market pricing-in more than three Fed hikes this year with an 80% probability of a hike in March, the overnight rate is expected to rise during the period above the 6-month advance rate.

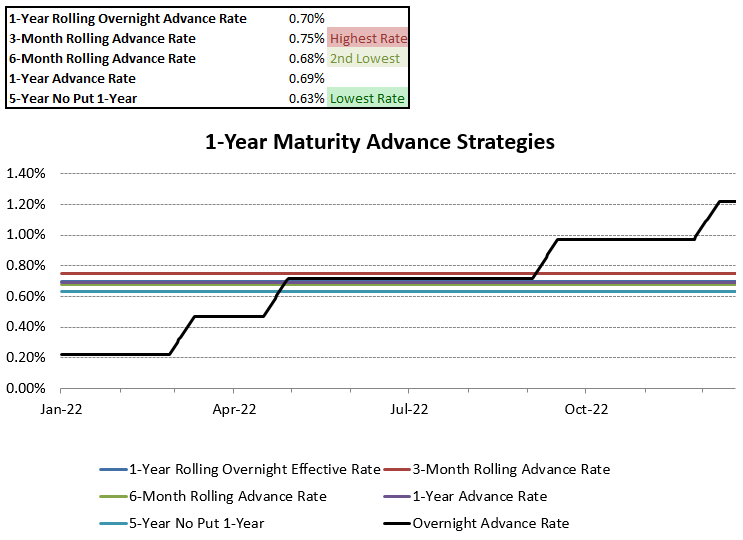

1-Year Advance Strategies

For those looking at funding for longer terms, this strategy can be extended to evaluate 1-year and 2-year terms. In the one year term, the lowest cost strategy would be to lock in one-year funding or roll a 6-month advance. Both strategies offer rates slightly lower than rolling an overnight advance. Costs can further be reduced by taking out a 5-Year No Put 1-Year European Putable Advance, which can reduce funding costs even more. However, this strategy comes with some duration risk as it is possible the advance would not be put.

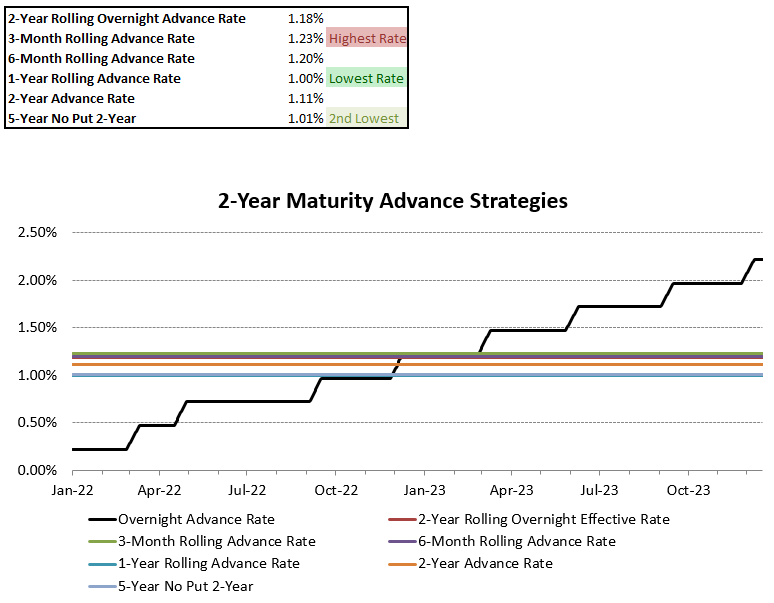

2-Year Advance Strategies

Looking at two year funding strategies, the best option would be to roll two 1-year advances over the period. The expected cost for this strategy and in this scenario would be 1.00%, saving 18 bps from rolling overnight funding for two years.

How to Transact

Please reach out to your Sales Director for quotes, other strategies, or for a copy of the Fed Hike Funding Tool used in this Notes From the Funding Desk. We’re happy to help you!

Other Pricing Special Reminders

The advance rates discussed above are based on our rate sheet advance rates for January 7, 2022. These do not include our current discount of 5 bps on longer-term fixed rate advances. You can find out more on this discount on eBanking or by contacting your Sales Director for more information. Additionally, these rates do not include the benefit of your activity stock dividend, which we estimate to reduce funding costs by a further 21 bps at the current level of dividend.