Notes From the Funding Desk: Long-Term Funding at Lower Costs

March 3, 2022

As inflation expectations have risen significantly and geopolitical risks are high, many members have asked about ways to lock-in longer-term funding. If your institution is in the market to lock-in long-term funding, can handle the accounting implications of using derivatives, and is looking to find the absolute lowest funding cost possible, the swap and rolling strategy offers very attractive funding levels in the current market.

By combining a long-term pay fixed-rate swap versus Secured Overnight Financing Rate (SOFR) with rolling short-term SOFR floating rate advances, your institution can lock in funding well below typical advance rates. And as swap rates have inverted, the longer the term, the larger the reduction in cost.

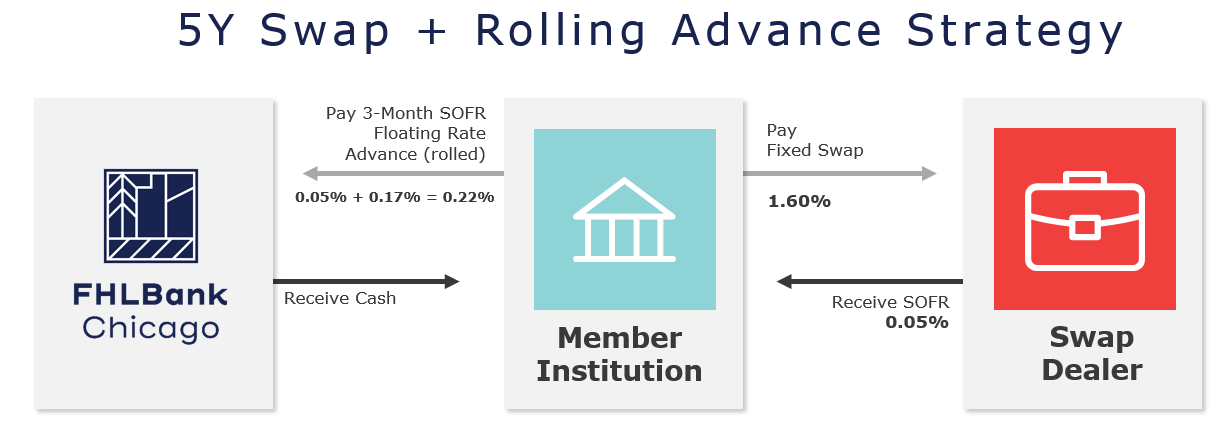

The strategy involves four steps:

- Execute a pay fixed swap and receive SOFR (monthly average SOFR payments) from a swaps dealer.

- Borrow a three-month SOFR floating rate advance (monthly average SOFR payments).

- Document the swap as a cash flow hedge* linked to the advance.

- Roll the three-month advance at maturity for the duration of the interest rate swap.

*Members should seek advice from their accountants, auditors, and consultants.

The illustration below shows the details of this strategy for a five-year duration. The swap and rolling advance would have an interest rate of 1.77% locked for the first three months, or 1.56% when accounting for FHLBank Chicago’s 5% activity stock dividend benefit as a discount to the three-month SOFR floating rate advance.

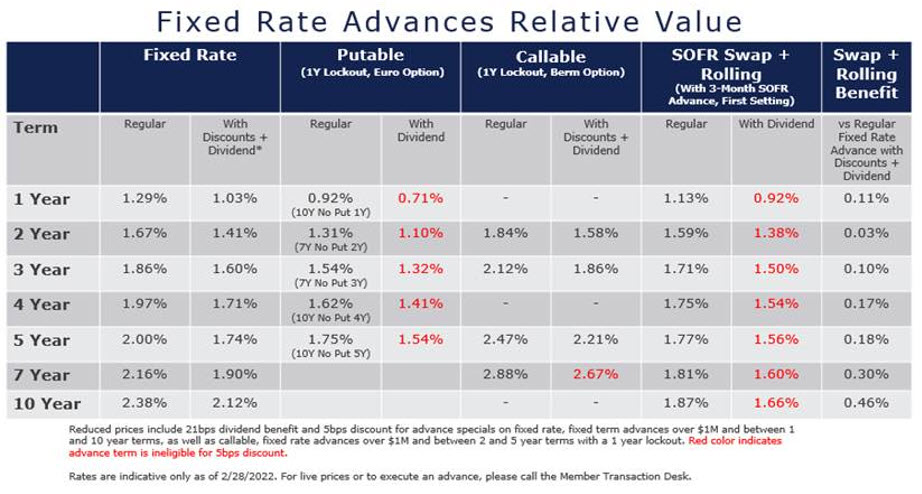

Compared to our regular five-year advance, this strategy reduces the effective borrow rate by 23 bps, from 2.00% to 1.77%, for the first three months.

The benefit increases on longer-term strategies as shown in the grid of rates below, which compares different advance strategies and includes our current discounts and stock dividend benefit on qualifying terms. As you can see, this strategy saves you 30 basis points (bps) at the seven-year point and over 45 bps at the ten-year point versus regular fixed rate advances! Other strategies including putable advances can also be used to reduce funding costs as putable rates have become more attractive in the last several weeks, especially in the medium terms.

How to Transact

Please call your Sales Director today for quotes and to execute this strategy.