Re-Introducing the Capped Floater Advance (A390)

December 9, 2022

As we continue to evolve our products to enhance their value to your business and transition into a post-LIBOR world, we are pleased to announce the reintroduction of the Capped Floater Advance (A390) for our members. The A390 is linked to the Secured Overnight Funding Rate (SOFR) and allows members to embed an interest rate cap and optionally, an interest rate floor into the advance. Interest rate caps are commonly used for asset liability management, allowing members to hedge interest rate risk of their variable rate liabilities in a rising rate environment or match-fund assets with embedded caps such as capped floating rate commercial loans. Members can select cap and floor strike rates to best fit their needs. The A390 is currently available under two structures:

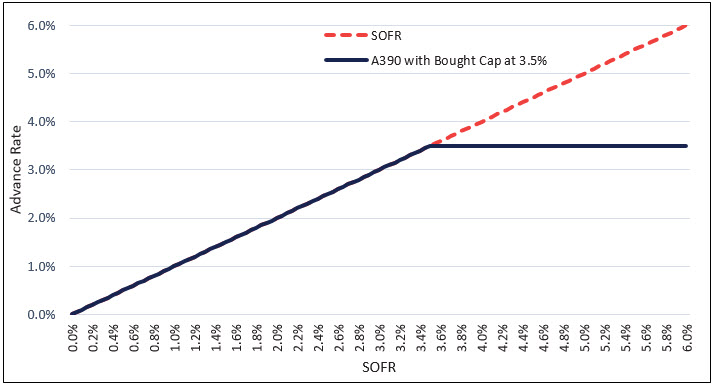

Structure 1: A floating rate advance with a member bought SOFR cap. Under this structure, during each accrual period (monthly or quarterly) the maximum average SOFR rate will not exceed the selected cap strike rate.*

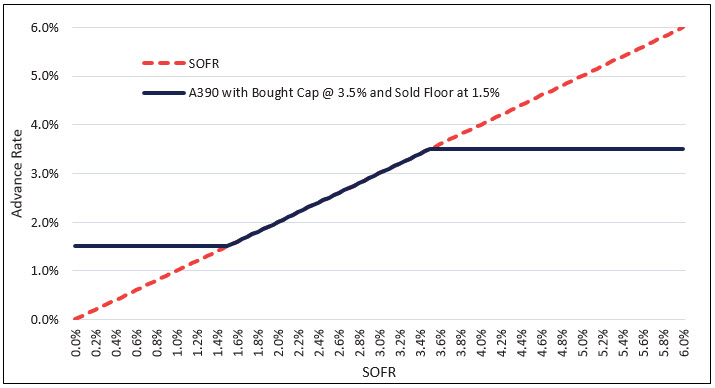

Structure 2: Commonly referred to as an interest rate collar, a floating rate advance with a member bought SOFR cap and sold SOFR floor. Under this structure, during each accrual period (monthly or quarterly) the maximum average SOFR rate will not exceed the selected cap strike rate and the minimum average SOFR rate will not fall below the selected floor strike rate.*

*Please reference the Advance Details section below for the calculation of the Interest Rate. Note that the all-in interest rate includes a fixed spread in addition to the capped or floored average SOFR index.

Advance Details

| Maturities | ▪ 180 days to ten years |

|---|---|

| Interest Rate | ▪ The interest rate may be comprised of up to four components depending on member request: (1) average overnight SOFR during the relevant Accrual Period, (2) a fixed spread, (3) the payout of an interest rate cap based on the average SOFR during the relevant Accrual Period, and (4) the payout of an interest rate floor based on the average SOFR during the relevant Accrual Period. ▪ The member may request at the time of application an Interest Rate comprised of components (1)-(3) or (1)-(4). |

| Floating Rate Index | ▪ Overnight SOFR, subject to an Interest Rate Cap and, if applicable, an Interest Rate Floor. ▪ Rate is reset daily on calendar days. |

| Interest Rate Cap | ▪ During the relevant Accrual Period, the average SOFR will not exceed the cap strike rate. |

| Interest Rate Floor | ▪ Optionally, a sold Interest Rate Floor can be embedded into the advance in addition to the bought Interest Rate Cap. ▪ During the relevant Accrual Period, the average SOFR will not fall below the floor strike. |

| Principal and Interest | ▪ Principal is due at maturity. ▪ Interest is due monthly, two New York business days at the end of the relevant Accrual Period. ▪ Final interest payment is due two New York business days after maturity. ▪ Quarterly or semi-monthly payment may be available upon request and as specified in the related application. |

| Accrual Period | ▪ Monthly or quarterly. |

| Day Count Fraction | ▪ Actual/360 using the daily compounding convention, with the last day of the Accrual Period adjusted to the following New York business day if it falls on a day that is not a New York business day. ▪ Alternatively, if requested and specified in the related application, the last day of the Accrual Period may be the unadjusted actual last day of the Accrual Period even if it falls on a day that is not a New York business day. ▪ Daily weighted average may be available upon request and as specified in the related application. |

| Prepayment Policy | ▪ Prepayable only at par plus accrued interest and a prepayment fee, if any, calculated in accordance with the prepayment policy in effect at the time the advance is prepaid |

| Reset Dates | ▪ Reset dates are daily on calendar days. ▪ For any date that is not a U.S Government securities business day, the interest date will be the same as the preceding U.S. Government Securities Business Day. ▪ Determination dates are the same as the reset dates. |

Example Advance

This advance can be used by members looking to limit net interest margin (NIM) compression due to increased funding costs in a rising rate environment while also benefitting if rates fall due to the floating rate nature of the advance. As loan to deposit ratios rise and you look to diversify your funding, using an advance with an embedded cap will prevent funding costs from increasing past the selected cap strike rate. Additionally, members can choose to sell an interest rate floor to help offset the cost of the cap, further improving NIM.

Risks and Rewards

The A390 can play an important part in the asset liability management of your institution, providing protection from adverse rate moves based on selected strike rates while allowing you to maintain a desired level of risk. Because the cap and floor are embedded in the advance members avoid mark-to-market derivative accounting. The premium for the cap is embedded in the spread paid over the life of the advance, increasing the cost vs. the A300 SOFR Floater advance. It is possible that rates may never rise sufficiently for the cap to be “in the money” depending on the selected strike. However, selling an interest rate floor can help offset some of the cost of the cap.

How to Transact

To execute this advance, you must call the Member Transaction Desk at 855.345.2244, option 1.

Questions?

Please reach out to your Sales Director with any questions.