Take Advantage of Historically Low Spreads to Treasuries

Longer term borrowing rates on the Federal Home Loan Bank of Chicago’s (FHLBank Chicago) fixed rate advances fell to historically low spreads relative to U.S. treasury rates at the start of the year. High levels of general liquidity appear to be driving demand for agency securities, like FHLBank notes and bonds. Continued upward price pressure has tightened our debt levels closer and closer to treasury yields. While this is disadvantageous to the asset side of our member’s balance sheets, we identify it as an opportunity for the liability side.

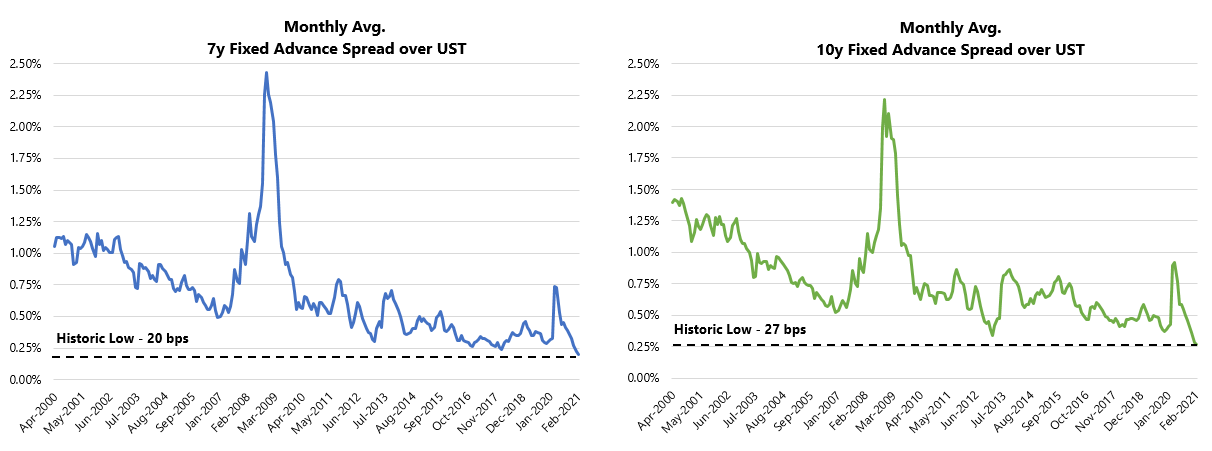

7-10 Year Fixed Term, Fixed Rate Advances Spread vs. U.S. Treasury Yields

The spread of 7-year fixed term, fixed rate advances over treasury yields reached a historically low level of 20 basis points (bps) in February 2021. The 10-year term hit a record low of 27 bps as well this month.

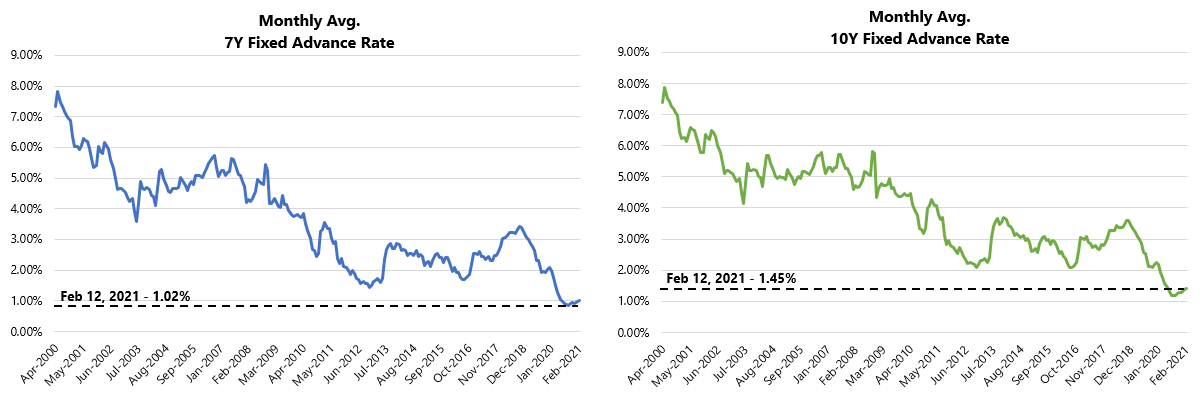

7-10 Year Fixed Term, Fixed Rate Advances Rates

FHLBank Chicago members can lock-in guaranteed advance funding just over 1% for seven years at a level that has never been closer to the borrowing rate of the U.S. Government. 7-10 year fixed advances rates reached historic lows at the end of last year but still remain close to those levels today.

Consider taking advantage, in the event that rates rise further. Members could use the funding to match as a hedge against longer-term assets like commercial real estate/multi-family loans or in strategic corporate bond sectors such as bank sub-debt issuance.

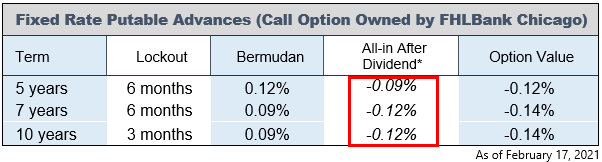

Members who are willing to embed put options into their advances, giving us the right to terminate the funding, can lock-in at even lower rates, which in some cases can be negative when including FHLBank Chicago’s 5% B1 dividend for borrowing!

Long-Term Advance Special Discount

We are offering a 5 bps discount on qualifying longer-term, fixed rate advances through Q1 2021. For example, fixed rate ladders of advances, amortizing advances with terms beyond five years, and single fixed rate advances beyond three years may qualify. We encourage members to take advantage of the discount with the given opportunity in the market.

You can find the details of this special here.

How to Transact

To execute, please call the Member Transaction Desk at 855-345-2244, option 1. Advances executed on eBanking are not eligible for the pricing discount.

Please reach out to your Sales Director with any questions.