Notes from the Funding Desk: Three Opportunities for Discounted Advances

As your trusted advisor, the Federal Home Loan Bank of Chicago (FHLBank Chicago) is pleased to announce three distinct opportunities for discounted advances:

- Discounts on advance ladder special with revised terms and conditions are being extended from September 30, 2020 to December 31, 2020.

- New pricing special on certain single amortizing fixed-rate advance transactions from October 1, 2020 - December 31, 2020.

- New pricing special on certain single fixed-rate advance transactions from October 1, 2020 - December 31, 2020.

Taking advantage of these advance pricing specials could help you manage:

- Long-term, fixed-rate mortgages

- Long-term, fixed-rate farm/agricultural loans

- Long-term, fixed-rate commercial real estate loans, multi-family loans, and securities

Terms and Conditions Applicable to All Three Specials

- All advances must be fully capitalized and are not eligible for the Reduced Capitalization Advance Program (RCAP).

- Members may execute multiple specials in a day, but individual terms apply and discounts cannot be combined.

- Daily maximum of $50 million principal value inclusive of all three specials.

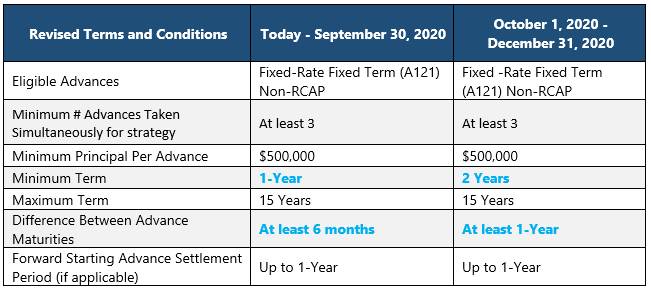

1. Extension of Advance Ladder Special: New Terms and Conditions

FHLBank Chicago is offering a 5 bps discount to execute three or more fixed-rate, fixed-term advance ladders.

To better understand the advance ladder strategy and its benefits, refer to the Solutions piece here.

Coupled with the B1 Activity Stock dividend of 5%, members can lock in very low and attractive funding through the advance ladder special. See the terms and conditions and sample below:

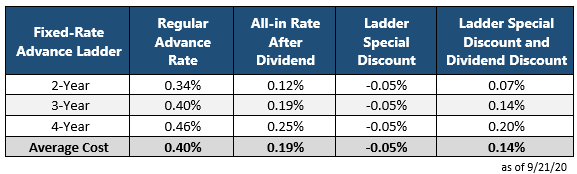

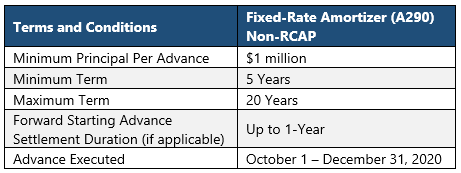

2. New Single Amortizing Advance Special: Terms and Conditions

FHLBank Chicago is offering a 5 bps discount to execute certain Fixed-Rate Amortizing Fixed-Term (A290) advances.

Coupled with the B1 Activity Stock dividend of 5%, members can lock in very low and attractive funding, which is especially useful when matched with amortizing assets such as fixed-rate farm, agricultural, or residential mortgage loans. You can customize the amortization schedule to fit your loan or needs, whether monthly pay, quarterly pay, annual pay, or amortize with a balloon payment (pricing for these may vary). See the terms and conditions and sample below:

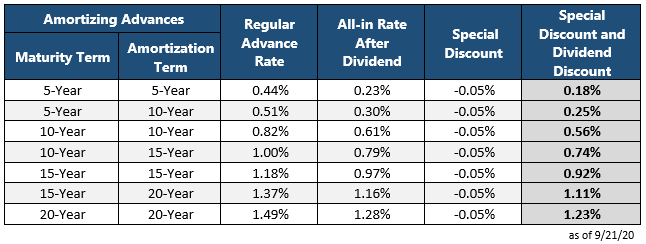

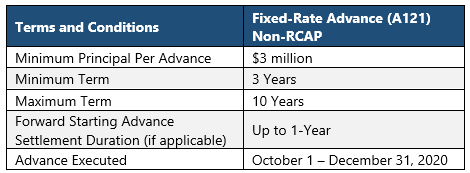

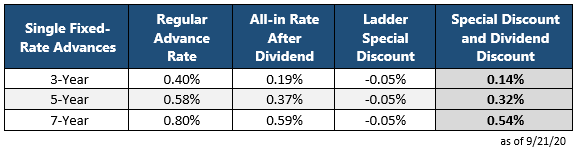

3. New Single Fixed-Term Advance Special: Terms and Conditions

FHLBank Chicago is offering a 5 bps discount to execute certain Fixed-Rate, Fixed-Term Advances (A121).

Coupled with the B1 Activity Stock dividend of 5%, members can lock in very low and attractive funding, which is especially useful for non-amortizing assets such as corporate or municipal bonds. See the terms and conditions and sample below:

How to Transact

Terms and conditions are subject to change and are updated here. These advance specials are not eligible for RCAP.

Current advance rates pre-discount can be found on the daily rate sheet. To execute, you must call the Member Transaction Desk at 855-345-2244, option 1. Advances executed on eBanking are not eligible for the pricing discount.

Members can also add the symmetrical prepay feature to the advances in the ladder, which allows them to prepay the advance and monetize their gains if rates rise by a sufficient amount.

Questions?

Please reach out to me with any questions on these specials.