Residential Lending Solutions: Funding Mortgages: Q1 2020

Overview

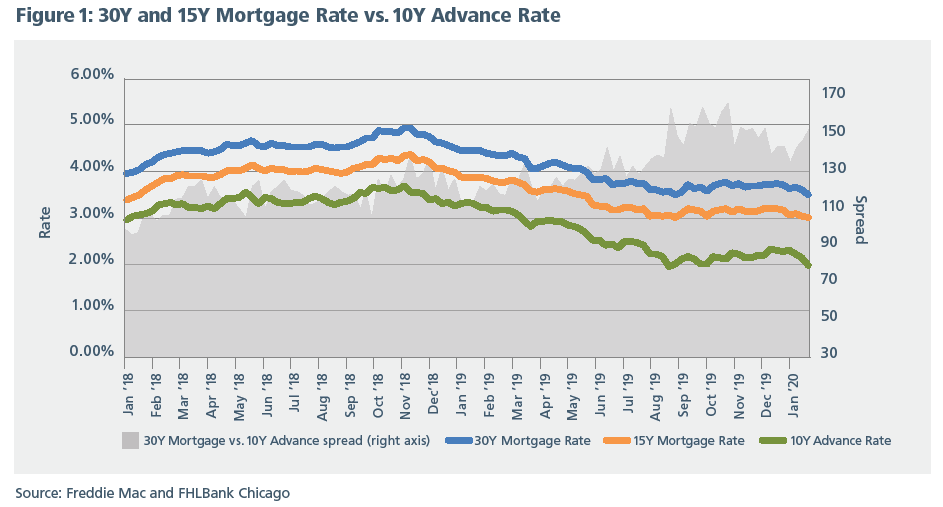

Thirty and fifteen year mortgage rates started dropping in 2019, according to Freddie Mac data. The Federal Home Loan Bank of Chicago’s (FHLBank Chicago’s) 10-year advance rate has fallen even more, and thus, the spread between the two has risen (see Figure 1). With this increased spread, it is a great time for members to evaluate holding mortgages funded with FHLBank Chicago advances.

In this paper, we will examine strategies for hedging both a 15-year and a 30-year mortgage portfolio with advances. Please note that our summaries on net interest margin (NIM) use forward rates in all scenarios, including the base case. All rates are as of February 5, 2020.

15-Year Mortgage Example

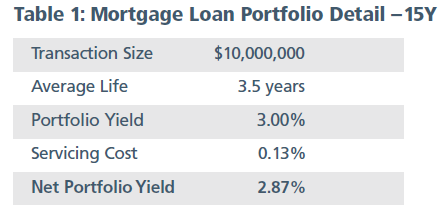

In this example, shown in Table 1 and 2, the portfolio consists of 15-year mortgage loans pooled together at a rate of 3% and reduced by 13 basis points for servicing costs. The average loan size ranges from $250,000 to $350,000. The funding solution includes a ladder of fixed rate advances, as well as some deposits to fill the gap. The deposits are assumed to have an average rate of 1.08%, based on 1% cost of funds adjusted by a forward 1-month LIBOR, a beta of 0.6, and a lag of 10 basis points per month in each rate shock scenario.

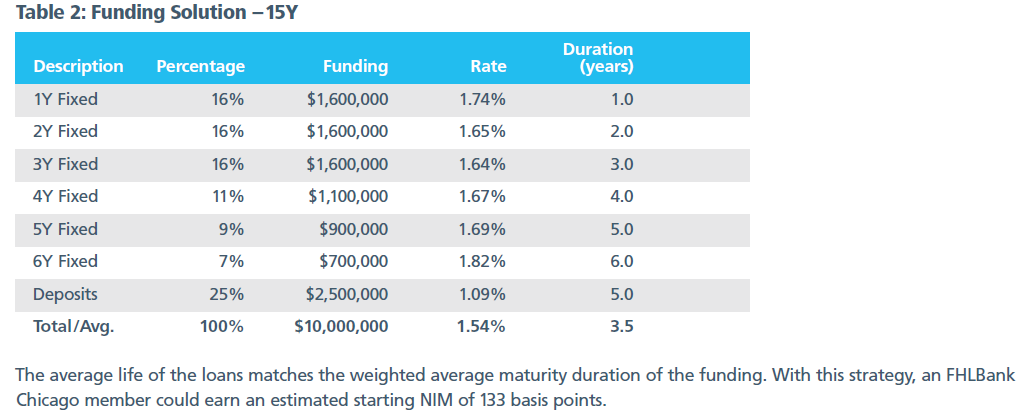

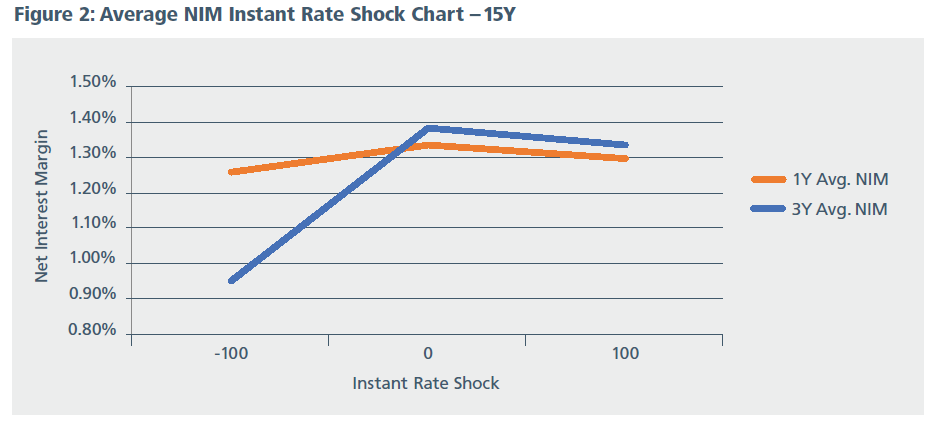

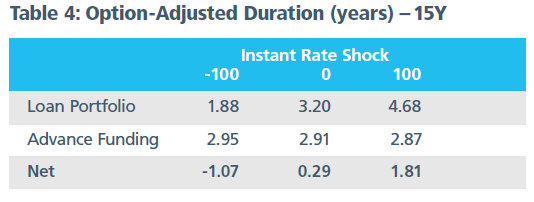

As described in Figure 2 and Tables 3 and 4, an FHLBank Chicago member could earn as much as 138 basis points in NIM over a 3-year horizon, assuming rates remain unchanged. Contraction risk could cause NIM compression in scenarios where interest rates fall on the horizon as prepayments of the loans increase. Table 4 shows that the option-adjusted duration of the loan portfolio would fall to 1.88 years, while the advance funding would be 2.95 years. In this scenario, new loans adjusted to a lower yield are assumed to replace the paid-down balance up to the excess advance balance.

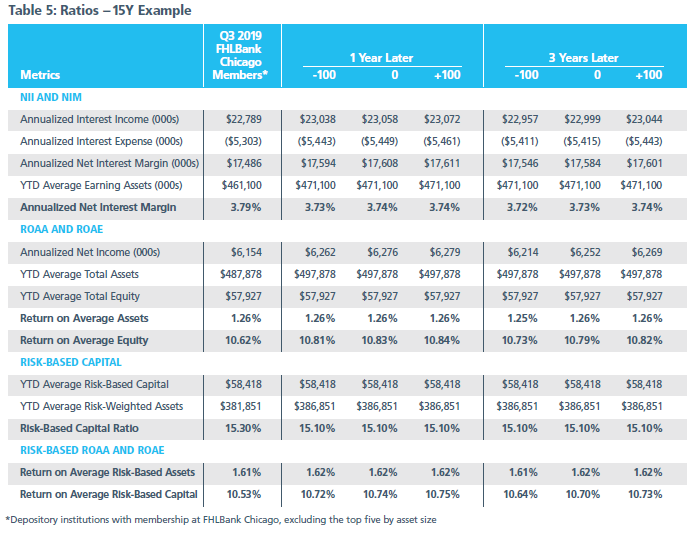

Leverage may change capital, asset, equity, and other ratios, such as return on average equity (ROAE), return on average assets (ROAA), and return on risk-based capital. Table 5 displays the impact on the balance sheet after the mortgage portfolio is added. FHLBank Chicago members had an average of $488 million in total assets as of Q3 2019, excluding non-depository institutions and the top five largest banks by asset size. The $10 million portfolio strategy proposed in this paper represents only 2% of those average assets. Yet, it can provide significant value to your institution.

As Table 5 shows, the sample FHLBank Chicago members have an ROAA ratio of 1.26% and a ROAE of 10.62%. This 15-year mortgage loan strategy would add an estimated 21 basis points of ROAE after 1 year, assuming all else remains constant. The figure remains mostly unchanged over a 3-year horizon.

Mortgages must be held at 50% weights for risk-based capital purposes, according to Basel III guidelines. In this example, the institution’s total risk-based capital ratio would take a 20 basis point reduction. However, after 1 year, the return on risk-based capital would have improved by 21 basis points in the base case. A member would earn an additional $97,000 per year over 3 years with this strategy.

30-Year Mortgage Example

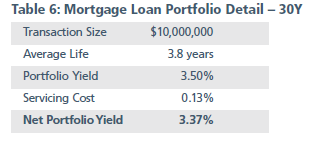

In this example, the portfolio consists of 30-year mortgage loans pooled together at a rate of 3.5%, and reduced by 13 basis points for servicing costs. The average loan size ranges from $250,000 to $350,000.

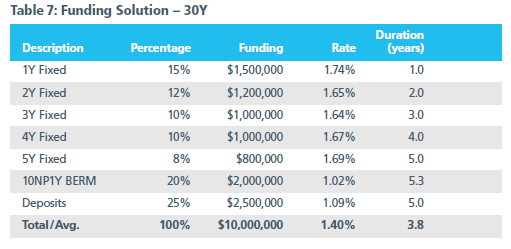

Tables 6 and 7 describe a pool of 30-year mortgage loans primarily funded with advances. The funding solution includes a ladder of fixed rate and fixed rate putable advances, as well as some deposits to fill the gap. Fixed rate putable advances give FHLBank Chicago the right to terminate the funding after a specified lockout period. For example, 10NP1Y BERM is a 10-year fixed advance that may not be put for 1 year, but then is putable every 3 months thereafter. The average life of the loans matches the weighted average maturity duration of the funding. Using this strategy, an FHLBank Chicago member could earn an estimated starting NIM of 197 basis points.

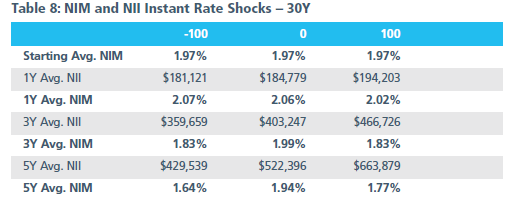

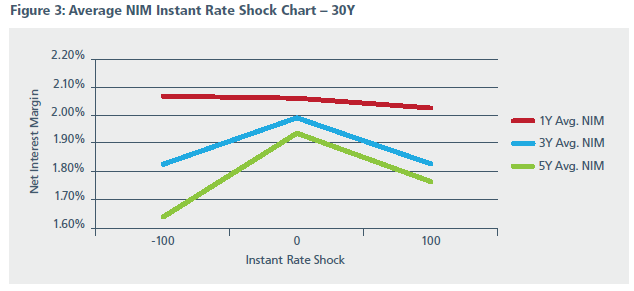

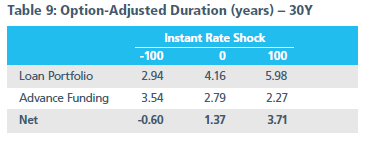

As shown in Figure 3 and Tables 8 and 9, an FHLBank Chicago member could earn as much as 194 basis points of NIM over a 5-year horizon, assuming rates remain unchanged. As in the pool of 15-year mortgage loans, contraction risk may cause NIM compression. Table 9 indicates that in the falling-rate scenario, the option-adjusted duration would fall to 2.94 years for the loan portfolio, and rise to 3.54 years for the advance funding. The option-adjusted duration of the advance funding would contract in a rising-rate scenario, as the probability of termination for the putable advances increased. Deposits with the same assumptions as in the 15-year funding strategy are assumed to fill the gaps.

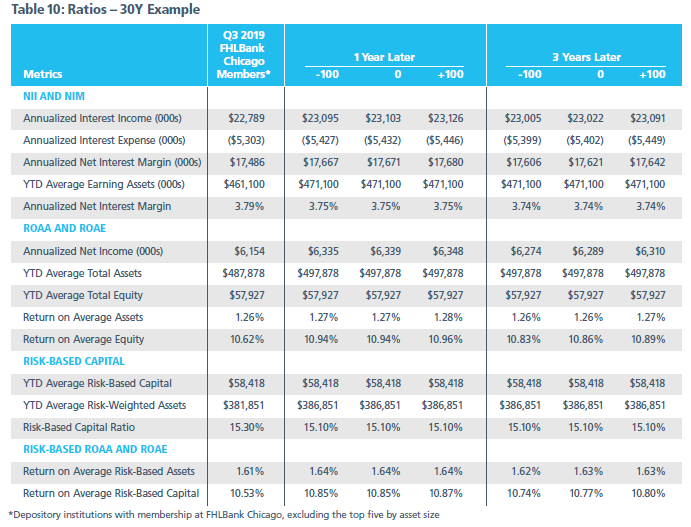

Leverage may change capital, asset, equity, and other ratios, such as ROAE, ROAA, and return on risk-based capital. The same sample FHLBank Chicago members used in the 15-year mortgage example are shown in Table 10.

As shown in Table 10, the hedging strategy for a $10 million portfolio of 30-year mortgage loans can provide even more value to your institution than the 15-year strategy. It would add an estimated 32 basis points of ROAE after 1 year, assuming all else remains constant. This figure moves slightly lower over a 3-year horizon as the strategy matures.

In this example, the institution’s total risk-based capital ratio would take a 20 basis point reduction, but after 1 year the return on risk-based capital would have improved by 32 basis points in the base case. The return on risk-based assets would improve by 3 basis points after 1 year. The member would earn an additional $134,000 per year over 3 years with this strategy.

While fixed rate mortgage loans are used in this strategy, members could use a variety of different assets, such as hybrid adjustable rate mortgages, commercial and industrial loans, commercial real estate loans, and consumer loans. Members can also use many different advance structures, with or without embedded options, to meet their needs.

To Learn More

If your institution would like more specific information about these strategies, please feel free to reach out to the Sales team or your Sales Director at membership@fhlbc.com.Contributors

Nick Simoncelli

Senior Analyst, Sales, Strategy, and Solutions

Ashish Tripathy

Managing Director, Sales, Strategy, and Solutions

Disclaimer

The risks of using leverage strategies should be reviewed by each financial institution to ensure they do not breach any regulatory requirements and understand the characteristics of any investments and borrowings they are making before engaging in such a strategy. The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago makes no representations or warranties about the accuracy or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsel, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions.

Federal Home Loan Bank of Chicago | Member owned. Member focused. | February 2020