Fixed-Rate Securities and Funding Strategies

August 25, 2021

Overview

Members of the Federal Home Loan Bank of Chicago (FHLBank Chicago) continuously seek investment opportunities to help grow their balance sheets and bottom line. This is especially true in today’s environment, with many of our members still awash with liquidity. As financial institutions put that money to work, securities prices have risen to match the demand. The compounding effect has resulted in historically low yields and tight spreads in the market. However, despite the challenges, fixed-rate securities still serve a vital purpose on the balance sheet. Using a combination of different assets and funding options, you can optimize your balance sheet to help you meet asset liability management (ALM) goals.

Many institutions shy away from adding fixed-rate asset duration, pointing to the risk of rising interest rates in the future. However, the reward of locking-in long term, non-callable, fixed-rate assets if rates remain unchanged or fall will likely add a tremendous boost of performance in tough economic times. This is particularly true for a balance sheet profoundly weighted towards floating rate assets. The unprecedented COVID-19 pandemic is a reminder to be agnostic of future interest rate movements. Each piece of the balance sheet should serve a purpose. Skilled balance sheet managers will position the institution to perform well, or, be sustainable, in all interest rate scenarios.

FHLBank Chicago members’ portfolio managers have positioned their balance sheets to perform well in a rising rate environment. According to call report data for the second quarter of 2021, our members’ rate sensitive assets made up 46% of total assets. Conversely, only 10% of their total liabilities were considered rate sensitive. It indicates their assets will re-price faster than their liabilities. Said differently, portfolio managers have positioned their assets in anticipation of higher rates going forward. We encourage our members to hedge their bets and ensure their institution can provide sustainable earnings if interest rates do not rise. Adding longer-term fixed-rate securities is a wonderful solution.

Non-Callable Fixed-Rate Curve

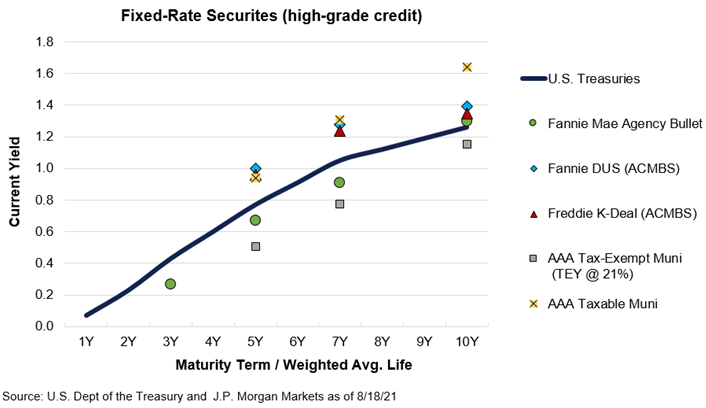

Fixed-rate non-callable security yields remain tight to treasuries in the current environment but offer protection from falling rates and provide income. The yields of sectors illustrated below exclude callable or option embedded securities, such as residential mortgage back securities (MBS), which may provide better yield but will not be of benefit if interest rates move.

Non-callable bullet cash flow securities shown in Figure 1 above include U.S. Treasury, government agency, and municipal bonds. The borrower will receive the full principal balance on the maturity date and no sooner. Agency commercial mortgage backed securities (ACMBS) cash flows are structured with a balloon amortization schedule with prepayment protections, thus pushing the vast majority of principal repayment closer to the maturity date as well. For example, Fannie Mae’s delegated underwriting servicing (DUS) program consists of an underlying multi-family balloon loan protected from borrower prepayment through yield maintenance. This feature stipulates a penalty paid by the borrower in the event of a prepayment. Freddie Mac’s K-deal series consists of underlying multi-family loans with defeasance, which require the borrowers replace the cash flows with treasury bonds in the event of prepaying principal early.

Funding Strategy

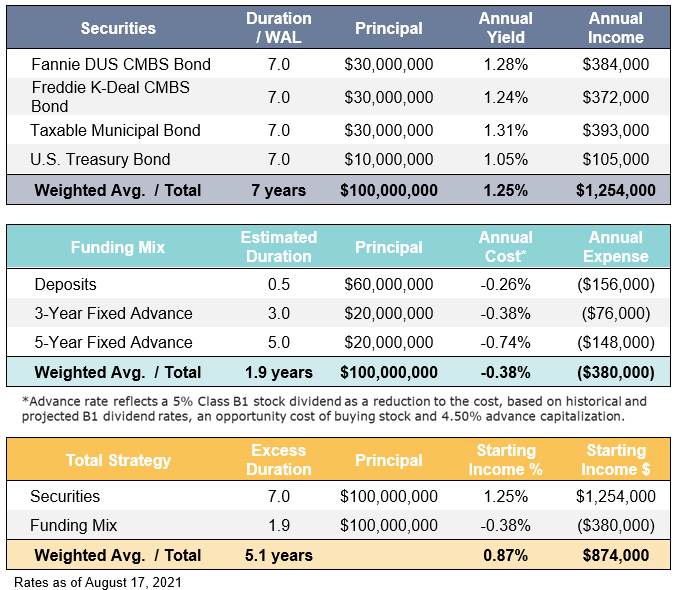

The cash flows of FHLBank Chicago’s fixed-rate advances match up well with the securities previously mentioned. Members can optimize their funding mix with deposits and advances to achieve income goals and add asset duration to the balance sheet. Deposits provide low interest rate duration as they will typically reprice to market interest rates in the short-term. Fixed-rate advances may be executed with longer maturities, providing a hedge against deposits. See the tables below in Figure 2 for an example asset funding strategy.

Figure 2:

The securities and funding mix example illustrated above is projected to provide 87 basis points (bps) of income per year, or $874,000 on a $100 million strategy. The call protected securities ensure the assets will remain on the balance sheet. The funding mix that includes some longer-term fixed-rate advances act as a partial hedge against the fixed-rate securities. The strategy produces a reasonable return and achieves the goal of adding asset duration.

Risks and Benefits

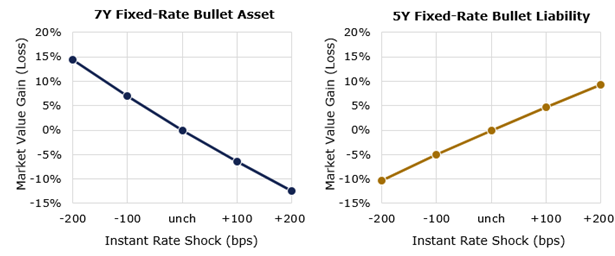

In the event of rising interest rates, adding fixed-rate securities with longer term duration could have a negative impact on the income statement. The net interest margin could be squeezed as the cost to fund shorter liabilities increases while the fixed-rate securities remain locked. Members may also experience this in unrealized gains or losses on the market value of the securities when marked on the books as available for sale or trading. Figure 3 below illustrates the market value gain (loss) of a 7-year fixed-rate asset compared to a 5-year fixed-rate liability.

Figure 3:

The market value loss on an asset in a rising rate environment is partially offset with a gain on the liability side of the balance sheet. The 5Y fixed-rate bullet liability illustrated above could represent an advance borrowing from FHLBank Chicago. If interest rates were to rise 100 bps instantly, the 7Y fixed-rate bullet asset would lose 6.5% of unrealized market value, offset by a 4.8% unrealized gain on the liability for a net of -1.7%. Conversely, the two cash flows would generate a net unrealized gain of 2% if interest rates fell by 100 bps.

While looking at the behavior of individual cash flows is important, it’s critical to consider the entire balance sheet when making ALM decisions. For example, if interest rates rise, would other cash flows such as loans offset any unrealized losses? Skilled balance sheet managers will use various combinations of cash flows on both sides of the balance sheet to achieve their goals. Many seek a sustainable portfolio that will perform as expected in all interest rate scenarios.

To Learn More

Please reach out to your Sales Director to help make cash flow decisions that are best for your institution.

Contributors

|

Nick Simoncelli AVP, Senior Analyst Sales, Strategy, and Solutions |

|

Travis Schroll Sales Director Sales, Strategy, and Solutions |

Disclaimer

The scenarios in this paper were prepared without any consideration of your institution’s balance sheet composition, hedging strategies, or financial assumptions and plans, any of which may affect the relevance of these scenarios to your own analysis. The Federal Home Loan Bank of Chicago (FHLBank Chicago) makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this paper. This paper is not intended to constitute legal, accounting, investment, or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind. You should consult with your accountants, counsels, financial representatives, consultants, and/or other advisors regarding the extent these scenarios may be useful to you and with respect to any legal, tax, business, and/or financial matters or questions. In addition, certain information included here speaks only as of the particular date or dates included, and the information may have become out of date. The FHLBank Chicago does not undertake an obligation, and disclaims any duty, to update any of the information in this paper. Moreover, this paper may include forward-looking statements, which are based upon the FHLBank Chicago’s current expectations and speak only as of the date(s) thereof. These forward-looking statements involve risks and uncertainties including, but not limited to, the risk factors set forth in the FHLBank Chicago’s periodic filings with the Securities and Exchange Commission, which are available on its website. The Bank makes no representations or warranties (express or implied) about the accuracy, currency, completeness, or suitability of any information in this presentation, and no warranties (express or implied) of non-infringement. The Bank does not guarantee, warrant, or endorse the advice, products, or services of Goldman Sachs Insurance Asset Management, CUNA Mutual Group, Equitable Financial, State Compensation Insurance Fund, Premera Blue Cross, J.P. Morgan Asset Management, Wellington Management, PIMCO, BlackRock Multi Asset Group, Principal Financial Group, AEGIS Insurance Services, Inc., and Liberty Mutual Investments. This presentation consists of materials prepared exclusively by Goldman Sachs Insurance Asset Management, CUNA Mutual Group, Equitable Financial, State Compensation Insurance Fund, Premera Blue Cross, J.P. Morgan Asset Management, Wellington Management, PIMCO, BlackRock Multi Asset Group, Principal Financial Group, AEGIS Insurance Services, Inc., and Liberty Mutual Investments and is provided during the 2021 FHLBank Insurance Conference solely for informational purposes to Bank members. By providing this information, the Bank does not imply that it is offering or selling any products, or that it endorses or concurs with any information provided. This presentation reflects the views of the author(s) and should not be construed to represent the Bank’s views or policies. This presentation is not intended to constitute legal, accounting, investment or financial advice or the rendering of legal, accounting, consulting, or other professional services of any kind.