Reminder: Advance Products with a LIBOR Component Changing July 1, 2020

As of July 1, 2020, advance products with a LIBOR component will be changing. Originally shared on September 27, 2019 and March 19, 2020, please see below for a helpful reminder on what is changing as part of our continuation of Federal Home Loan Bank System regulator LIBOR transition guidance.

What’s Changing:

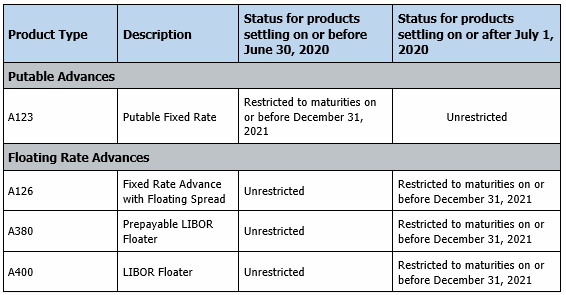

- On July 1, 2020, we are restarting the Fixed Rate Putable Advance (A123) for all maturities as we’ve found a successful Overnight Index Swap (OIS) based hedge.

- Members may execute certain Floating Rate Advances referenced to LIBOR with no tenor restriction as long as the transactions settle by June 30, 2020.

- Beginning July 1, 2020, members can still transact certain Floating Rate Advances referenced to LIBOR as long as they mature by December 31, 2021.

What’s Not Changing:

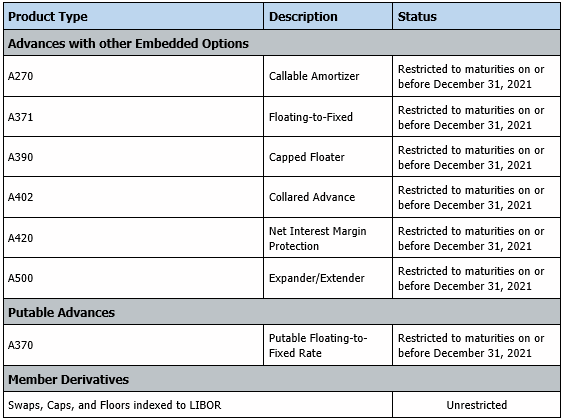

- As of April 1, 2020, members may transact the below advance products with embedded LIBOR options but maturities are restricted to December 31, 2021.

- The Floating-To-Fixed Rate Putable Advance (A370) remains suspended for all maturities after December 31, 2021 until we develop a successful hedge that is not based on LIBOR.

- Member derivatives, such as caps, floors, and vanilla LIBOR swaps, are unrestricted as to maturity.

As a reminder, if you are looking to replace these products, Discount Note-indexed floaters, Prime-indexed floaters, and SOFR-indexed floaters are good alternatives to LIBOR floaters and are not subject to these maturity restrictions. Visit our advances page for a complete list of our advance product offerings.

If you have questions regarding this communication or would like more details on the LIBOR transition, please contact your Sales Director.