Increased Access to the Community Development Advance Program for Paycheck Protection Program (PPP) Eligible Borrowers Renewed

In an on-going effort to meet the needs of our members and their communities during the COVID-19 pandemic, we continue to look for opportunities to support our members’ community lending to small businesses and economic development projects.

In June 2020, we announced that loans made by members to Paycheck Protection Program (PPP) eligible entities can qualify for our Community Development Advance program. This expanded program eligibility, which expired in December 2020, has been renewed. Between May 20 and December 24, 2021, members may access our discounted Community Advance rate to support qualifying community lending. All program and advance requirements apply.

Simple Process at a Very Low Rate

New and returning applicants can expect an effortless and streamlined application experience. The Community Development Advance is a subsidized advance approximately 10 bps lower as compared to fixed rate advances of the same maturity.

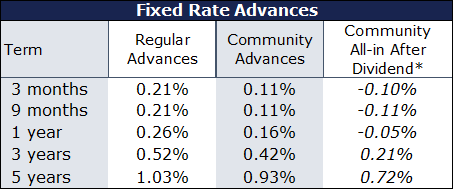

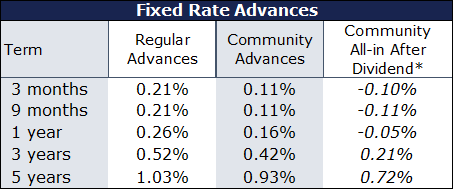

Our recent rate sheet from May 20, 2021, illustrating our Community Advance rate subsidy for fixed rate advances is below. As you can see, your dividend benefit further reduces your Community Advance rates by approximately 21 basis points.

In June 2020, we announced that loans made by members to Paycheck Protection Program (PPP) eligible entities can qualify for our Community Development Advance program. This expanded program eligibility, which expired in December 2020, has been renewed. Between May 20 and December 24, 2021, members may access our discounted Community Advance rate to support qualifying community lending. All program and advance requirements apply.

Simple Process at a Very Low Rate

New and returning applicants can expect an effortless and streamlined application experience. The Community Development Advance is a subsidized advance approximately 10 bps lower as compared to fixed rate advances of the same maturity.

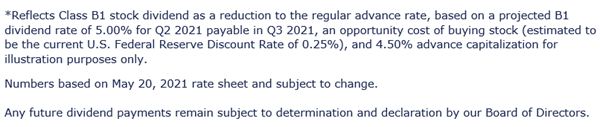

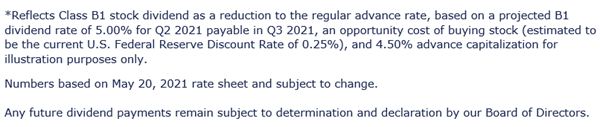

Our recent rate sheet from May 20, 2021, illustrating our Community Advance rate subsidy for fixed rate advances is below. As you can see, your dividend benefit further reduces your Community Advance rates by approximately 21 basis points.

What Are the PPP Parameters?

- A member’s borrower must be PPP-eligible; the underlying loan is not required to be a PPP loan.

- Members will certify as to the PPP eligibility of their borrower; additional documentation will not be required to support eligibility.

- Applications relying on borrowers’ PPP eligibility to qualify for the Community Development Advance will be accepted through December 24, 2021.

- The underlying borrower’s loan must be funded by a member no later than December 24, 2021, and must be less than 90 days old at the time of a member’s advance draw. Members must draw the advance no later than December 31, 2021.

- The existing per-member Community Advances limit applies: maximum advance amount is the greater of $250 million or 10% of a member’s non-Community Advance portfolio.

- Members may submit a portfolio of loans to PPP-eligible entities to be funded under a single Community Development Advance.

How to Participate

If you are interested in participating, please complete the Community Development Advance application. If you have any questions regarding the program or application, reach out to Community Investment at ci@fhlbc.com.