The Federal Home Loan Bank of Chicago (FHLBank Chicago) today announced its preliminary and unaudited financial results for the second quarter of 2025.

“Our preliminary second quarter results reflect the continued strength of our cooperative and our ability to provide reliable liquidity to our members,” said Michael Ericson, President and Chief Executive Officer of FHLBank Chicago. “As market conditions evolve, we remain focused on delivering value through safe and sound financial management and strategic investments that support our members and the communities we serve.”

Second Quarter 2025 Financial Highlights

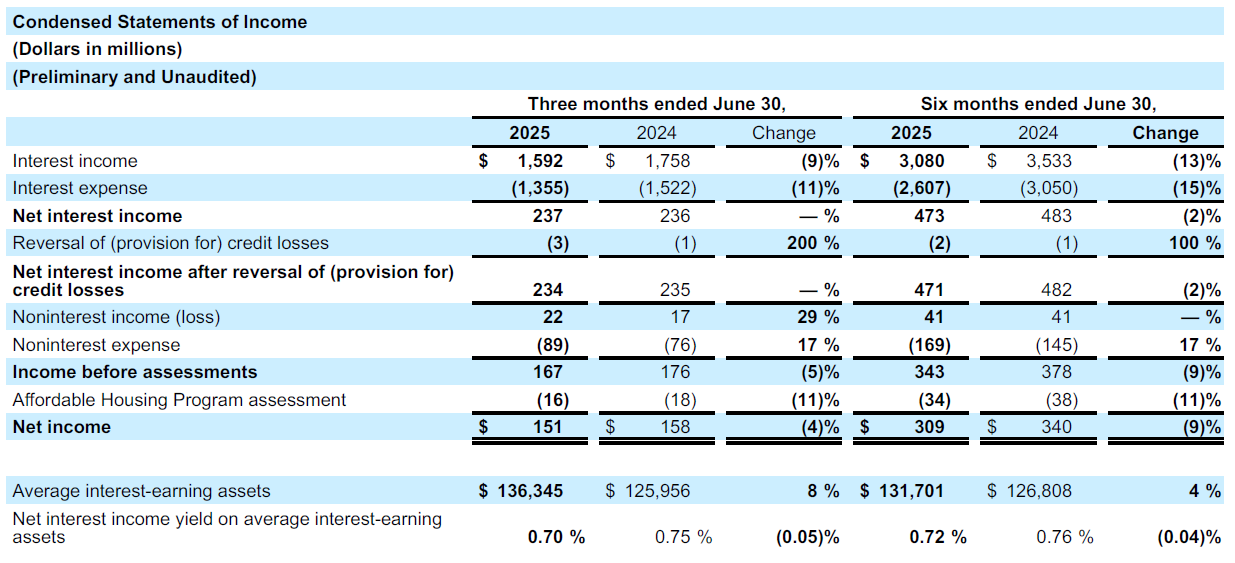

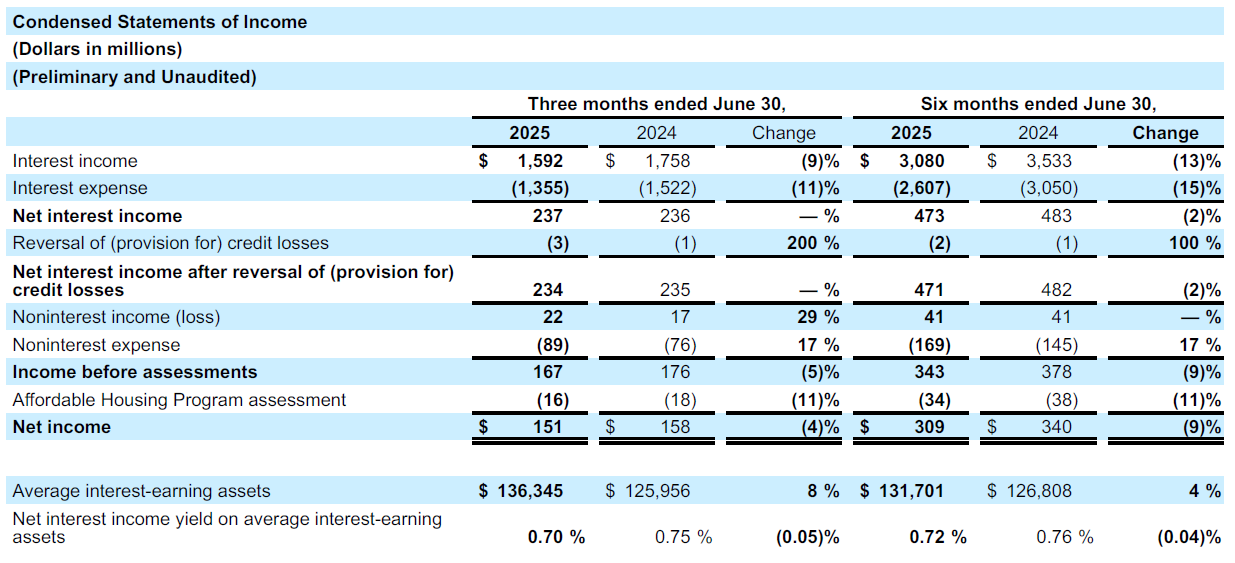

- Net income declined to $151 million, compared to $158 million for the second quarter of 2024. The decline was primarily driven by higher noninterest expense, largely due to increased contributions to support members’ housing and community development needs. This was partially offset by an increase in noninterest income from gains on trading securities.

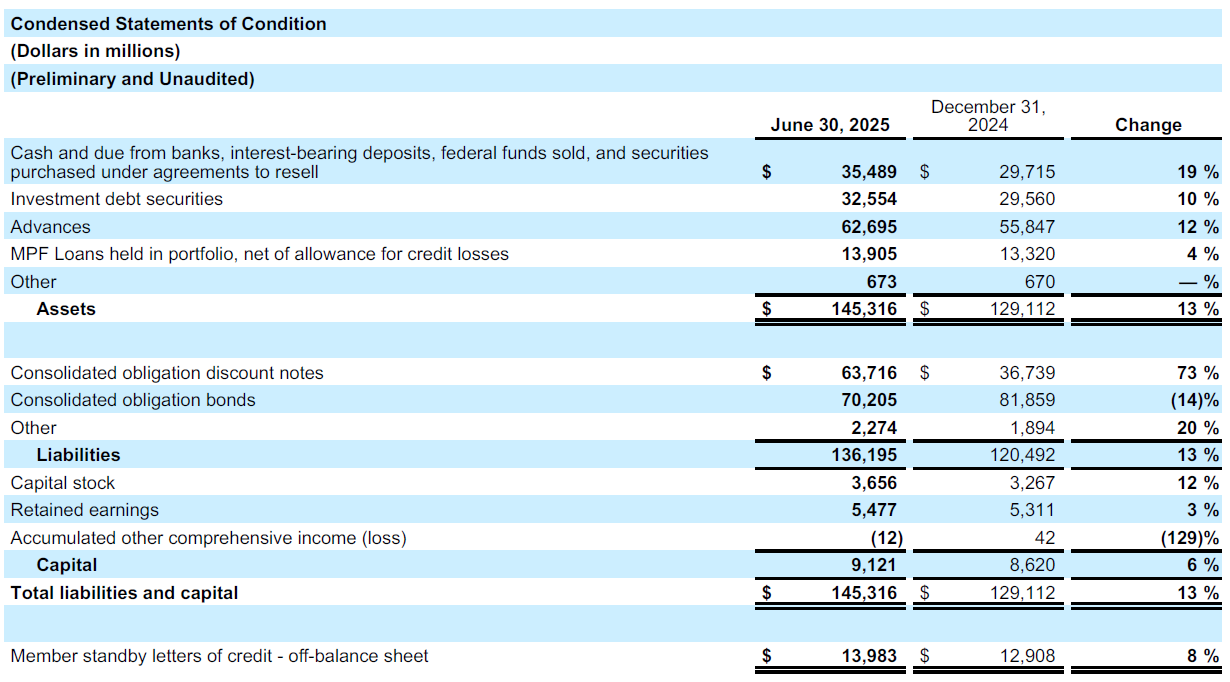

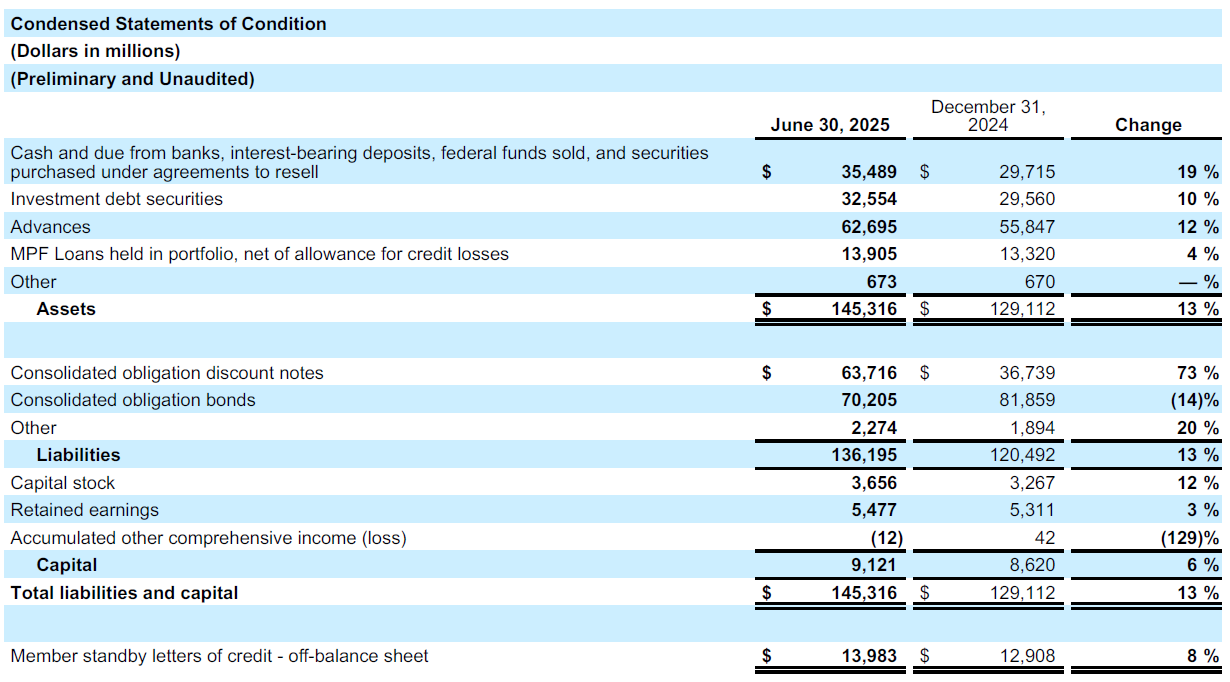

- Total assets rose to $145.3 billion, up from $129.1 billion at December 31, 2024. The growth was mainly due to increased volume in advances and liquidity.

- Advances outstanding increased to $62.7 billion, compared to $55.8 billion at December 31, 2024, primarily attributable to increased borrowings from insurance company and depository members.

- Mortgage loans held for portfolio through the Mortgage Partnership Finance® (MPF®) Program increased to $13.9 billion, compared to $13.3 billion at December 31, 2024, primarily attributable to new acquisition volume that outpaced paydown activity.

Housing and Community Development

- Statutory Affordable Housing Program (AHP) Assessments: FHLBank Chicago commits 10% of its income before assessments to support the affordable housing and community development needs of communities served by its members as required by regulation. As of June 30, 2025, FHLBank Chicago accrued $34 million to its AHP pool of funds.

- Voluntary Housing and Community Development Contributions : In addition to its statutory AHP assessments, the Board of Directors may elect to make voluntary contributions to the AHP or other housing and community investment activities to increase funding available to our members. During the first half of 2025, FHLBank Chicago contributed $8 million toward community investment grants and $25 million in subsidies supporting its Community Advances and loans.

For more financial details, please refer to the Condensed Statements of Income and Statements of Condition below. The Form 10-Q for the quarter ending June 30, 2025, is expected to be filed with the Securities and Exchange Commission (SEC) next month.

Forward-Looking Information: This announcement uses forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements other than statements of historical fact, including statements with respect to beliefs, plans, objectives, projections, estimates, or predictions. These statements are based on FHLBank Chicago’s expectations as of the date hereof. The words “believe”, “estimate”, “expect”, “preliminary”, “continue”, “remain”, “commit”, and similar statements and their plural and negative forms are used to identify some, but not all, of such forward-looking statements. For example, statements about future dividends and expectations for financial commitments are forward-looking statements. FHLBank Chicago cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to: legislative and regulatory developments that affect FHLBank Chicago, its members, or counterparties; instability in the credit and debt markets; economic conditions (including banking industry developments and liquidity in the financial system); prolonged inflation or recession; maintaining compliance with regulatory and statutory requirements (including relating to dividend payments and retained earnings); any decrease in levels of business which may negatively impact results of operations or financial condition; the reliability of projections, assumptions, and models on future financial performance and condition; political, national and world events; changes in demand for advances or consolidated obligations; membership changes; changes in mortgage interest rates and prepayment speeds on mortgage assets; FHLBank Chicago’s ability to execute its business model and pay future dividends (including enhanced dividends on activity stock);FHLBank Chicago’s ability to protect the security of information systems and manage any failures, interruptions, or breaches in its technology, controls or operating processes; and the risk factors set forth in FHLBank Chicago’s periodic filings with the Securities and Exchange Commission (SEC), which are available through the SEC’s reporting website. FHLBank Chicago assumes no obligation to update any forward-looking statements made herein. In addition, the FHLBank Chicago reserves the right to change its business plan or plans for any programs for any reason, including but not limited to, legislative or regulatory changes, changes in membership or member usage of programs, or changes at the discretion of the board of directors. Accordingly, FHLBank Chicago cautions that actual results could differ materially from those expressed or implied in these forward-looking statements or could impact the extent to which a particular plan, objective, projection, estimate or prediction is realized. New factors may emerge, and it is not possible to predict the nature of each new factor or assess its potential impact. Given these uncertainties, undue reliance should not be placed on forward-looking statements.