2025 funding awarded to the Illinois Housing Development Authority will broaden access to housing counseling statewide

The Federal Home Loan Bank of Chicago (FHLBank Chicago) is providing $3,150,000 in 2025 funding to the Illinois Housing Development Authority (IHDA) through its

Community First® Housing Counseling Resource Program. This funding allows IHDA to strengthen support for its network of U.S. Department of Housing and Urban Development (HUD)-certified housing counseling agencies that deliver personalized, one-on-one guidance to individuals and families preparing for long-term homeownership across Illinois.

Launched in 2022, the Housing Counseling Resource Program expands access to financial education, credit preparation, and homebuyer support services for people working toward long-term housing stability. The program also empowers current homeowners in the maintenance of their homes through post-purchase education and, should they incur financial instability, foreclosure prevention counseling. The program is administered by IHDA in Illinois and by the Wisconsin Housing and Economic Development Authority in Wisconsin. Since its inception, FHLBank Chicago has awarded over $13 million to help strengthen these services throughout both states.

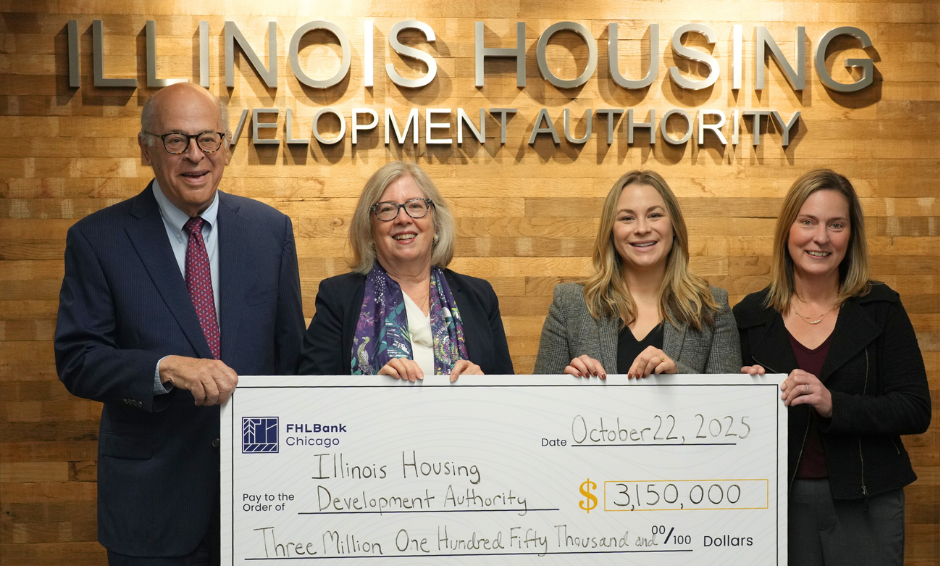

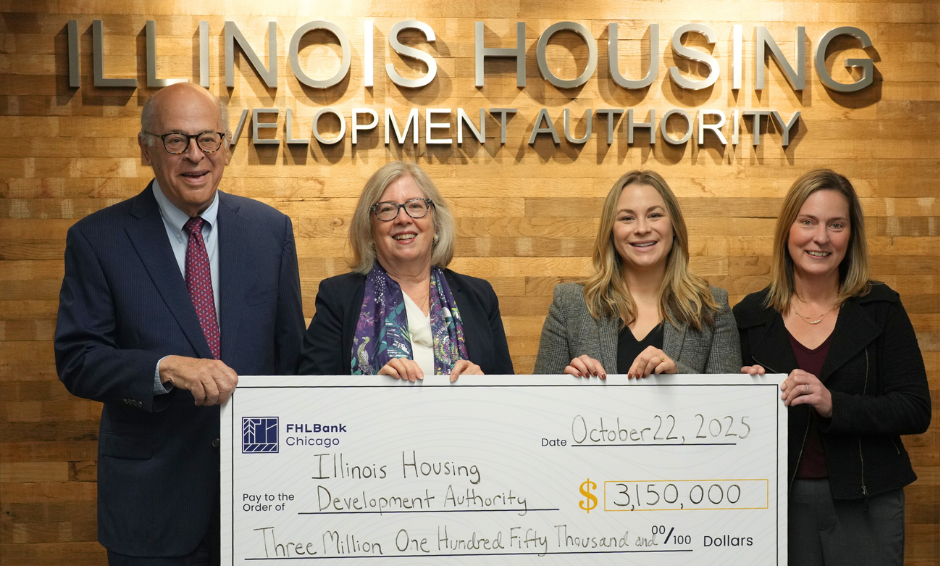

From left to right: King Harris, Chairman of the IHDA Board of Directors; Kristin Faust, Executive Director of IHDA; Abbey Delgadillo, Senior Community Investment Programs Specialist at FHLBank Chicago; and Katie Naftzger, Senior Vice President and Community Investment Officer at FHLBank Chicago, present a $3,150,000 check for 2025 funding to IHDA for the Community First® Housing Counseling Resource Program.

“Housing counseling lays the groundwork for successful, long-term homeownership,” said Katie Naftzger, Senior Vice President and Community Investment Officer, FHLBank Chicago. “Through IHDA’s leadership, these funds reach households across Illinois who benefit from trusted guidance during a critical time in their financial journey.”

To date, HUD-certified housing counseling agencies funded through the Housing Counseling Resource Program in Illinois have supported more than 49,000 households, including more than 3,800 that successfully purchased a new home. These services help participants build stronger financial foundations and take confident steps toward homeownership.

“Thanks to this support from FHLBank Chicago, IHDA is able to bring additional resources to households across Illinois who are preparing for one of the most important financial decisions of their lives,” said IHDA Executive Director Kristin Faust. “We’re here to help more Illinoisans, especially those traditionally left behind, secure a safe, stable home. Housing counseling helps people navigate that journey with greater confidence and clarity and we’re proud to continue supporting pathways that lead to lasting stability and stronger communities.”

About the Federal Home Loan Bank of Chicago

FHLBank Chicago is a regional bank in the Federal Home Loan Bank System. FHLBanks are government-sponsored enterprises created by Congress to ensure access to low-cost funding for their member financial institutions, with a focus on providing solutions that support the housing and community development needs of members’ customers. FHLBank Chicago is a self-capitalizing cooperative, owned by its Illinois and Wisconsin members, including commercial banks, credit unions, insurance companies, savings institutions and community development financial institutions. To learn more about FHLBank Chicago, please visit fhlbc.com.

About the Illinois Housing Development Authority

IHDA is a self-supporting and mission-driven state agency dedicated to financing the creation and preservation of affordable housing in Illinois. IHDA offers affordable mortgages and down payment assistance for homebuyers, provides financing for the development of affordable rental housing, and manages a variety of assistance programs to create communities where all Illinoisans can live, work, and thrive. Since it was established in 1967, IHDA has delivered more than $29 billion in state, federal, and leveraged financing to make possible the purchase, development, or rehabilitation of 335,750 homes and apartments for low- and middle-income households. For more information on IHDA programs, visit www.ihda.org.