Targeted Community Lending Plan

Our Targeted Community Lending Plan is designed to enhance financial support for underserved neighborhoods. By focusing on local needs, we aim to foster sustainable growth and development.

Our Mission

The Way We Build Program Focus

Methodology

We begin by identifying trends and disparities across our district through housing, demographic, and economic data. From there, we collaborate with members, community organizations, and stakeholders to validate findings and refine focus areas. This approach allows us to build strategies rooted in both evidence and lived experience.

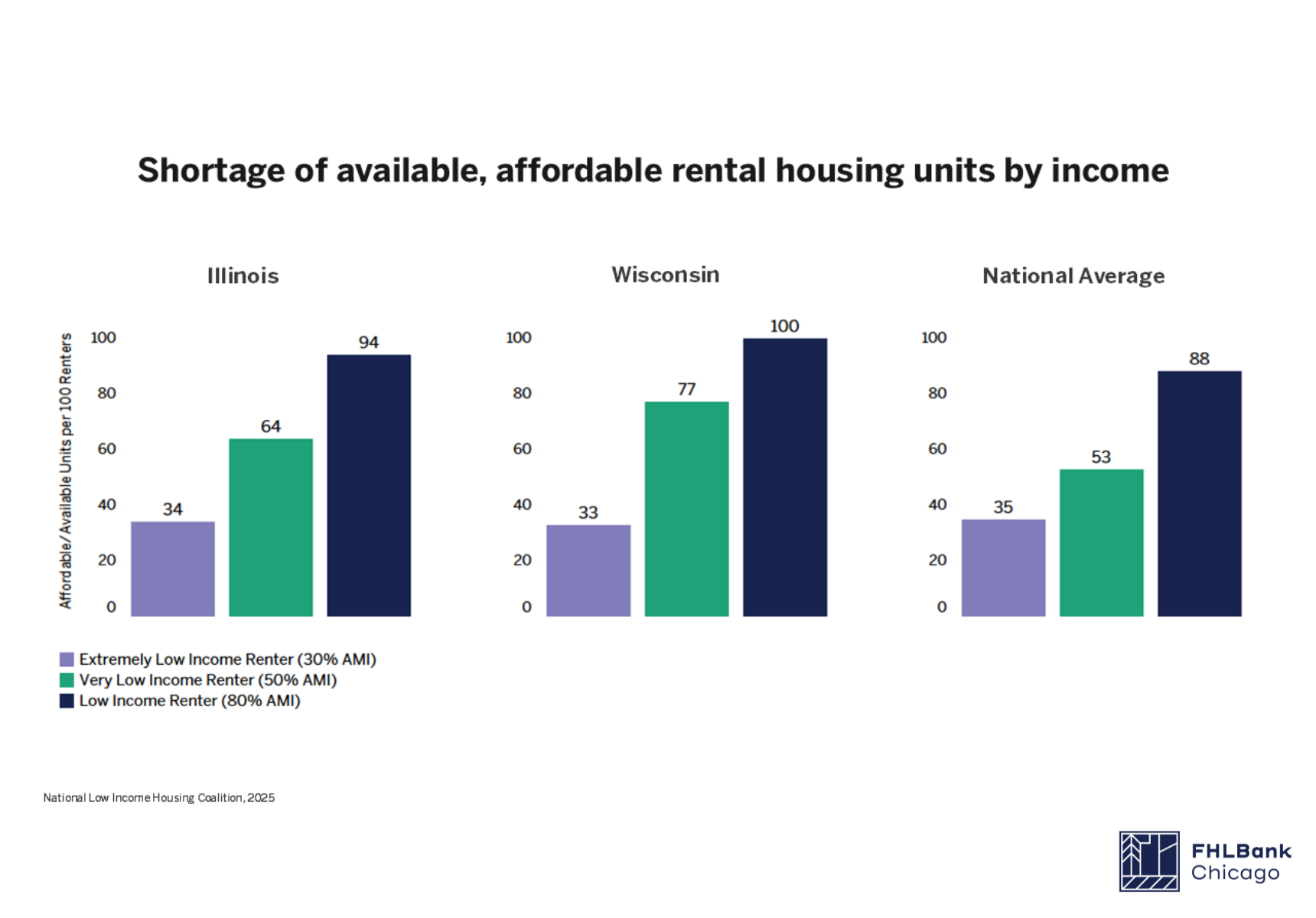

Affordable Housing Needs

Our analysis highlights where affordable housing gaps are most acute and where targeted investment can create the greatest impact. By listening to local partners and examining factors like cost burden, availability, and homeownership barriers, we tailor funding priorities that help individuals and families find stability through housing.Economic Development & Community Lending Needs

We examine regional economic indicators to understand where small businesses, infrastructure, and workforce development can most benefit from support. By strengthening access to capital and fostering collaboration among local lenders, we help communities build resilient, inclusive economies that sustain long-term growth.

Market Conditions Snapshot

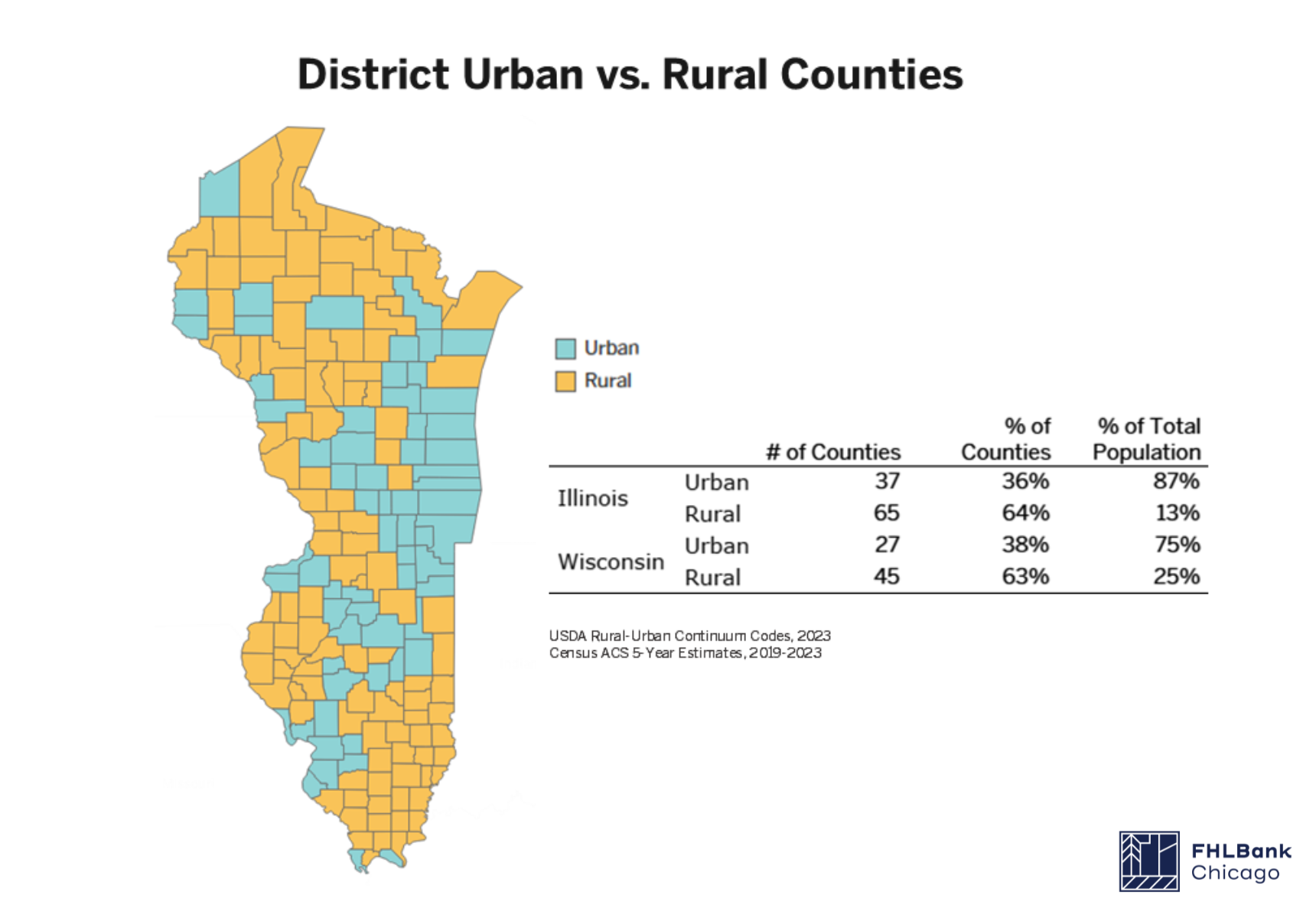

FHLBank Chicago monitors market conditions in the district and identifies unmet needs and opportunities to inform our housing leadership strategy, including our Mission Programs and other mission-oriented initiatives. District population, housing, and economic trends are highlighted in this section, read more by downloading the full Targeted Community Lending Plan report at top.

The Research in Action

Our Targeted Community Lending Plan is designed to address the unique needs of local communities. By focusing on strategic partnerships, we aim to enhance access to affordable housing and support economic development.

- Expand the supply of affordable housing in the district

- Build community capacity for affordable housing and economic development

- Catalyze economic opportunities for residents and communities

- Improve housing affordability and homeownership sustainability

- Expand access to capital for housing and economic development

.png?sfvrsn=a58d1912_1)