Public Policy and Advocacy

FHLBank Chicago works with our member financial institutions, their trade associations and other valued partners to influence laws and government actions to advance our mission, benefit our members, and improve the communities they serve.

FHLBanks: A Model That Works

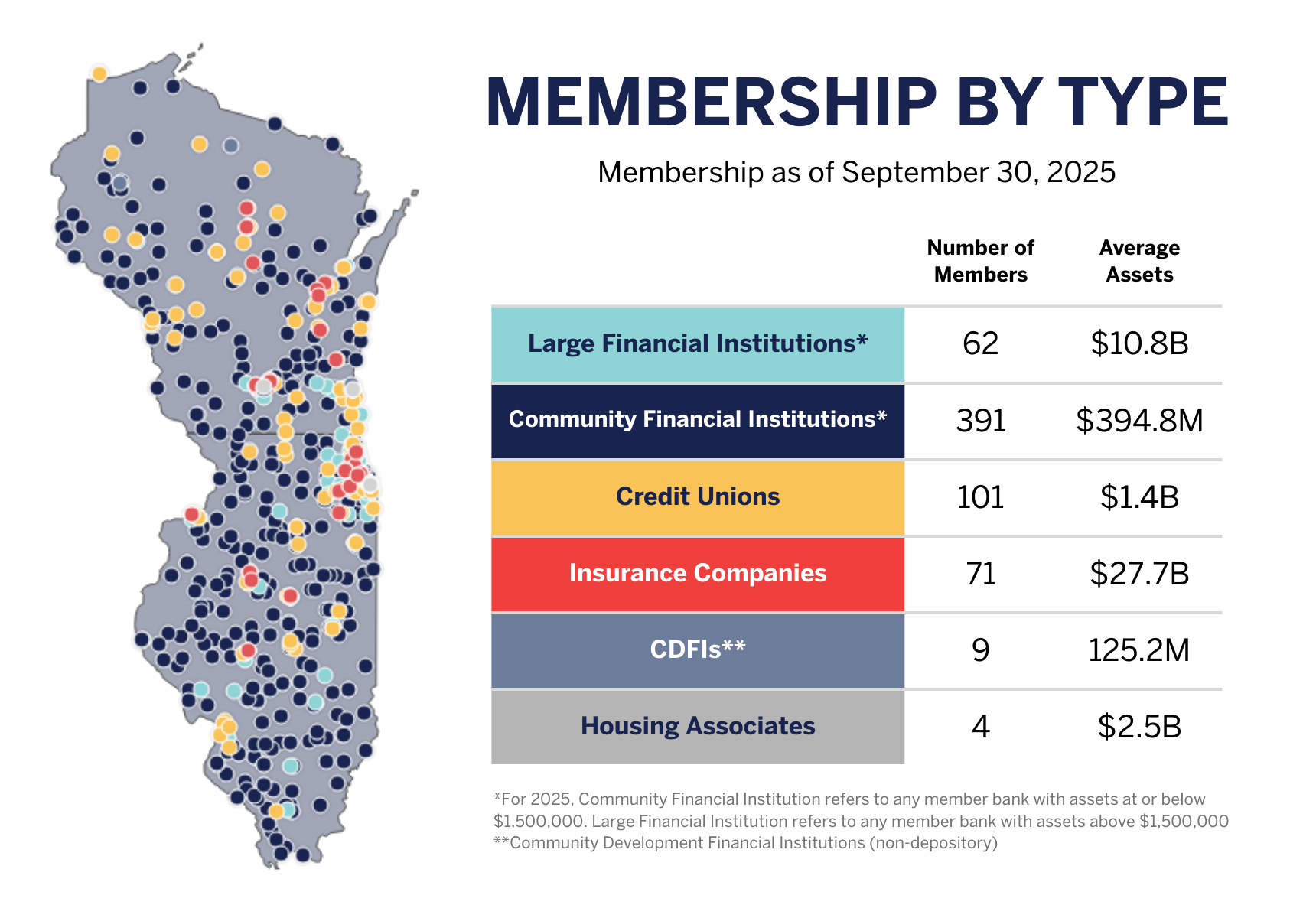

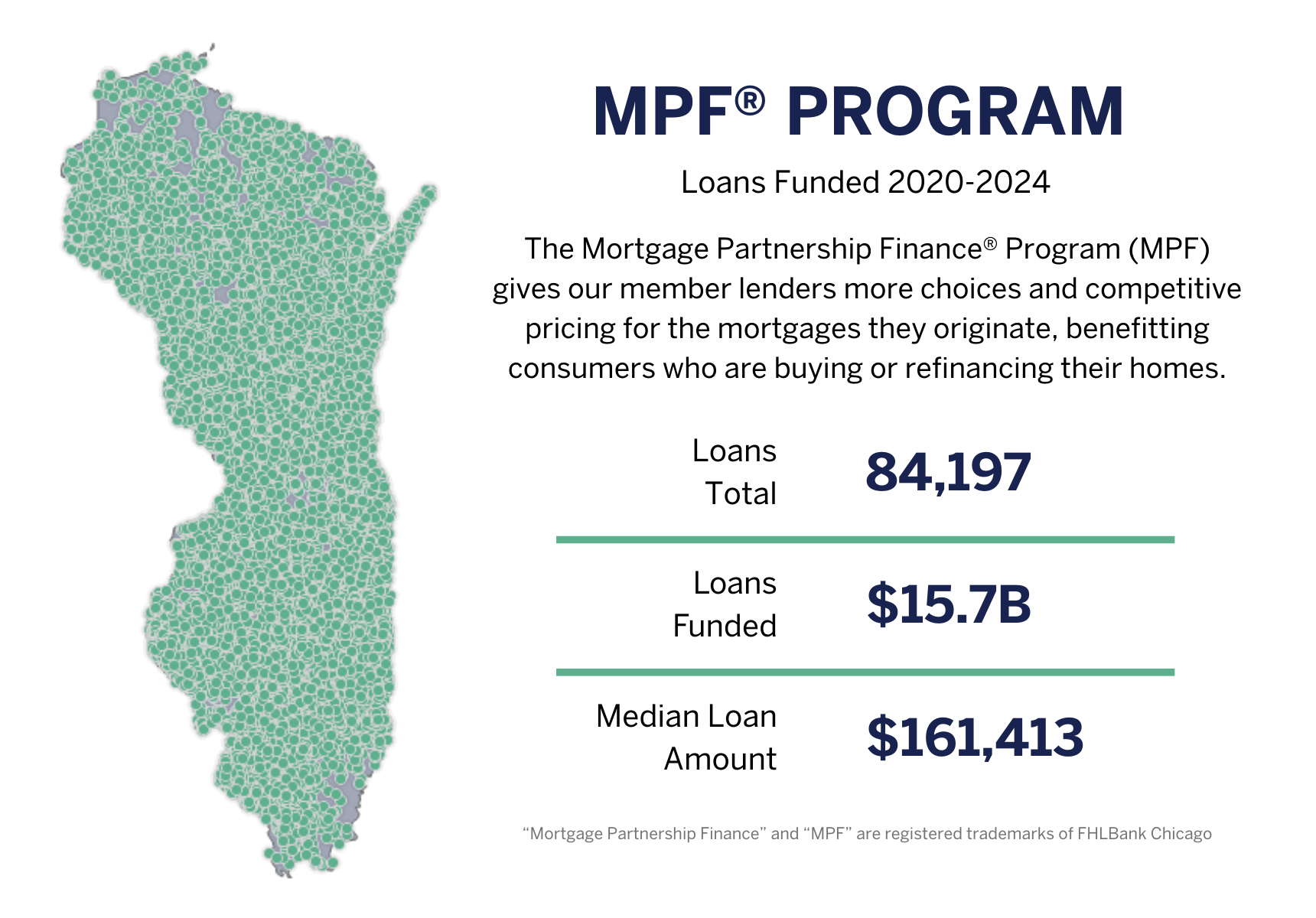

Every community in America needs capital and credit flowing to it. That is the money that keeps communities vibrant and growing. Nearly every insured depository institution in the U.S. relies on low-cost funding from a regional FHLBank to support their local customers and economies. Many insurance companies and community development financial institutions (CDFIs) also use FHLBank funding to support their housing and community activities. By harnessing the collective power of our members, the FHLBanks bring efficiencies and cost savings to every city, town and county in the Nation.

The FHLBanks are a Congressional success story and has been a great deal for taxpayers. Created during the Great Depression to stabilize the thrift industry and promote homeownership, today the FHLBanks are a source of steady, reliable funding for housing and economic development projects of all types. FHLBanks contribute to the resilience and stability of the U.S. financial markets, particularly in times of economic uncertainty. The FHLBanks have never lost a dollar on the loans they have made and do not receive appropriations from Congress. They are a model that works.

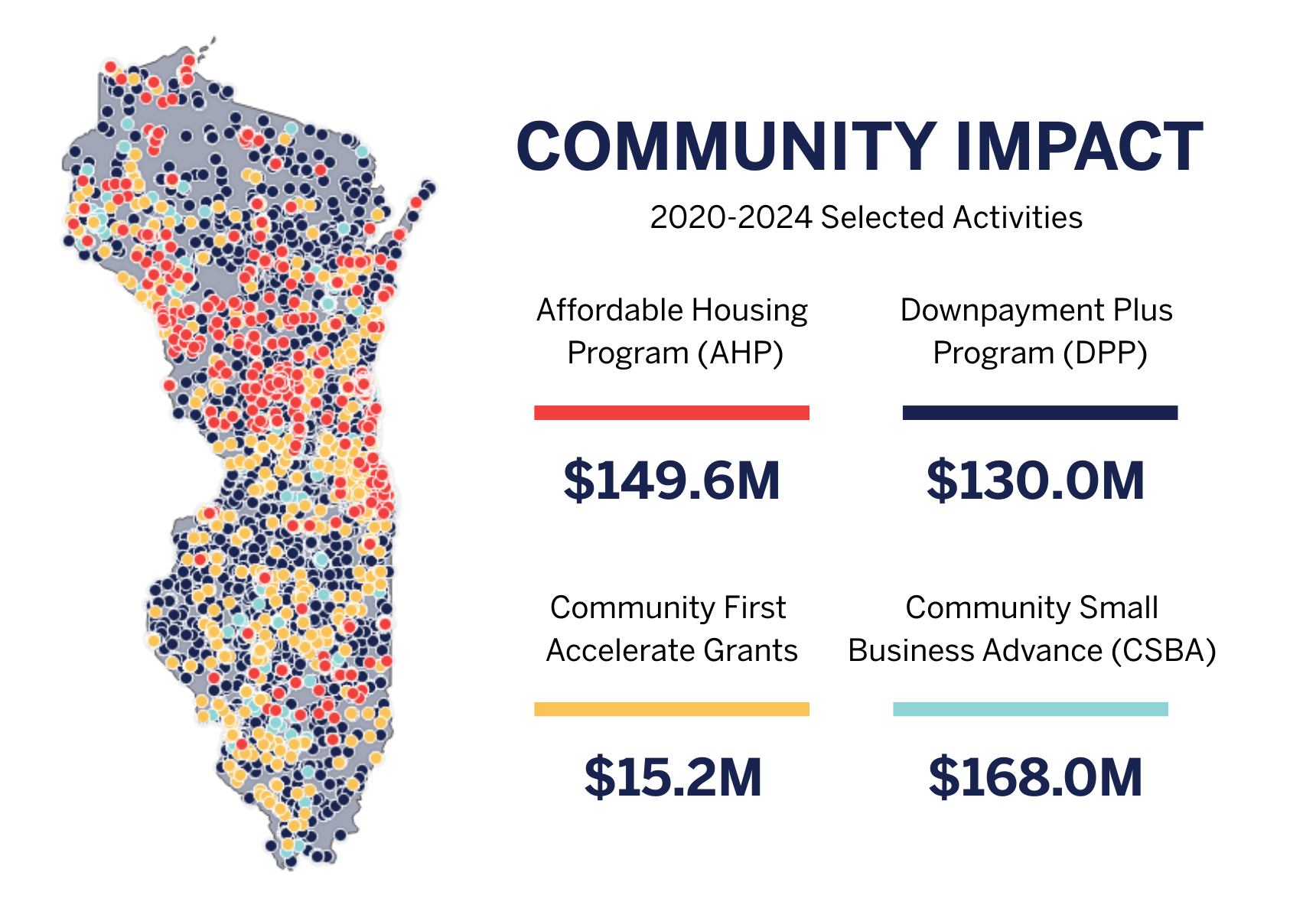

Impact Across Illinois and Wisconsin

Our key advocacy goal is to help Members of Congress and other policy makers understand the positive impact our activities have on their constituents in our district of Illinois and Wisconsin. We host a variety of events, often in collaboration with our members and other partners, to highlight our works through economic and housing roundtables and other policy conversations.

Illinois and Wisconsin Impact Reports

Advocacy in Action

Telling our story to policymakers is key to our advocacy efforts. Below are examples of our economic and housing roundtables, Affordable Housing Program project tours, and other events designed to demonstrate to policymakers how we work with our member institutions to impact families and communities in their Congressional districts.

- Advocacy

- 1 Min Read

Episode 3: Post-Election Analysis and Impact on the Banking Sector With Randy Hultgren

Partners in Advocacy

Effective advocacy requires a team effort. We can't do it alone, and we don't. To elevate our voice to policy makers and deliver consistent messages to Capitol Hill, we work closely with our members, their trade associations, the Council of FHLBanks in Washington, DC, and other industry partners to advocate for policies that support our housing and economic development mission.

Community Bankers Association of Illinois

Illinois Bankers Association

Wisconsin Bankers Association

Illinois Credit Union League

Wisconsin Credit Union League

Illinois REALTORS® Association

Home Builders and Remodelers Association of Illinois

Wisconsin REALTORS® Association

Wisconsin Builders Association

Council of FHLBanks

Meet Our Team

The team that leads our advocacy efforts have a long history of policy engagement and relationship building at all levels of government using a thoughtful and comprehensive approach.

We value your input and welcome your thoughts and questions. Please reach out to us.

.png?sfvrsn=7e74b1f9_1) David Feldhaus

David Feldhaus

In his role as Senior Vice President and Director of External Affairs, Dave leads all advocacy and government affairs efforts at the bank. His major focus is Congressional and Regulatory engagement in Washington DC and development of the banks advocacy strategy. He also serves as spokesman for public policy related issues on behalf of the bank. Previous to this role Dave served as Minority Counsel for the Committee on the Judiciary and Counsel and Legislative Assistant in the United States Senate. He studied at the U.S. Airforce Academy and is a graduate of the University of South Dakota and has his J.D. from the University of Kansas School of Law.

LinkedIn Profile Sharon Gorrell

Sharon Gorrell

In her role as Assistant Vice President and Senior Representative for External Affairs, Sharon’s key focuses are on in-district Congressional outreach in addition to managing the partnership effort with industry trade associations. Previously she was with Illinois REALTORS where she held several roles in policy and Government Affairs and served on key committees for housing and finance policy for the National Association of REALTORS. She is a graduate of Benedictine University and holds her Masters in Public Policy from Northwestern University Graduate School.

LinkedIn Profile

.png?sfvrsn=dcf91beb_1)

28a213af-4151-4dfe-8af5-228ca5478283.png?sfvrsn=5cee4a64_1)